Shutterfly, Inc. (NASDAQ:SFLY) stock witnessed an upside after the company announced robust fourth-quarter 2017 results and the acquisition of leading online photography company, Lifetouch on Jan 31.

Shares of the online photo-based product retailer jumped to an all-time high of $68.28 the same day, before closing a tad lower at $68.15. The stock gained 27.8% on the day.

The turn of events is quite significant for the company as it has been grappling with a soft consumer spending environment due to considerable consumer debt levels, uncertainty in real estate markets and home values, fluctuating energy and commodity costs and limited credit availability.

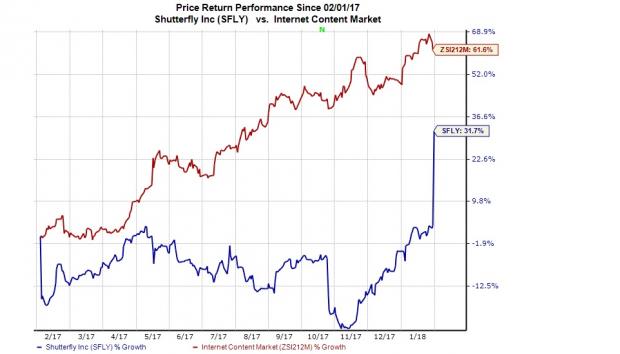

The stock has returned 31.7% in the past year, significantly underperforming the industry’s massive 61.6% rally.

Fourth Quarter Earnings and Revenues Beat

Owing to the seasonal nature of its business, Shutterfly usually incurs losses in the first three quarters followed by earnings in the last quarter of the year, which is good enough to make up for the three previous quarter losses and put up some notable yearly earnings.

Shutterfly, Inc. Net Income (TTM)

Adjusted EPS of $3.11 witnessed strong growth, beating the Zacks Consensus Estimate by 6.9% and increasing 18% year over year. Moreover, the figure came ahead of the company’s own guided range of $2.60 to $3.00. The improvement came on the back of a higher top line and expense control.

Net revenues of $593.8 million increased 6% year over year and surpassed the consensus mark of $557 million by 6.6%. The top line also came ahead of the guided range of $538 million to $568 million.

In fact, the fourth-quarter marked the 68th consecutive quarter of year-over-year net revenue growth. The solid growth was driven by strong performance across both consumer and Shutterfly Business Solutions (SBS) segments.

A Massive Strategic Acquisition

Concurrent with the earnings announcement, Shutterfly said that it has reached a deal to acquire Lifetouch, a privately held online photography company for $825 million cash. The deal is expected to close in the second quarter of 2018.

We believe that the buyout will help Shutterfly significantly expand customer base and boost its consumer segment revenues. On the strength of that deal, the company expects to add approximately $935 million to its net revenues and $100 million to its adjusted EBITDA over the 12 months following the closure of the deal. By 2020, the company targets a minimum $450 million of adjusted EBITDA.

Zacks Rank and Other Stocks to Consider

Shutterfly sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other top-ranked stocks in the broader technology sector include Micron Technology Inc. (NASDAQ:MU) , Lam Research Corporation (NASDAQ:LRCX) and The Trade Desk Inc. (NASDAQ:TTD) , all sporting a Zacks Rank #1.

Long-term earnings growth rate for Micron, Lam Research and The Trade Desk is projected to be 10%, 14.9% and 25%, respectively.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Shutterfly, Inc. (SFLY): Free Stock Analysis Report

The Trade Desk Inc. (TTD): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post

Zacks Investment Research