Shares of Shutterfly, Inc. (NASDAQ:SFLY) have declined 2.3% in afterhours trading on Jul 25 as the company posted mixed second-quarter 2017 results. Herein, the loss incurred by the company was narrower than expected but revenues missed estimates.

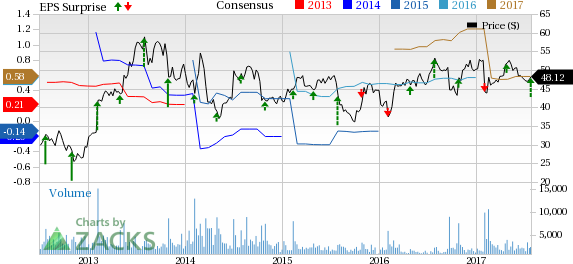

Shutterfly, Inc. Price, Consensus and EPS Surprise

Quarter in Detail

Generally, this personalized products and service provider’s business is highly seasonal and incurs losses in the first three quarters of the year.

Shutterfly incurred a loss of 44 cents per share in the second quarter, narrower than the Zacks Consensus Estimate of a loss of 54 cents and the company’s projected loss in range of 55 to 50 cents. The reported figure was also slightly narrower than the prior-year quarter loss of 48 cents per share. The improvement came on the back of a higher top line and expense control.

Net revenue increased 2% year over year to $209.0 million and was within the guided range of $205.0 million to $212.0 million. In fact, the second-quarter earnings season marked the 66th consecutive quarter of year-over-year net revenue growth. However, revenues lagged the Zacks Consensus Estimate of $210.3 million by 0.6%.

Notably, the top line benefited from the strong performance of the company’s flagship Shutterfly brand, which was driven by the home décor and personalized gift categories, supported by the company’s strategy of expanding range of products. Additionally, revenues were bolstered by the growth seen in the Shutterfly Business Solutions (SBS) segment, partially offset by weaker performances at the non-Shutterfly.

Revenues from the Consumers category were up 1% year over year to $179.1 million, backed by mid single-digits growth at the Shutterfly flagship brand. Meanwhile, SBS segment revenues jumped 10% to $29.9 million.

In fact, both total number of unique customers and total orders grew 3% year over year to 3.4 million and 5.5 million, respectively. However, average order value was $32.75, down 2% from the year-ago quarter, primarily due to a higher level of promotions and a greater mobile mix.

Gross margin (excluding restructuring charges) decreased 280 basis points (bps) to 43.5%.

Normalized operating expenses totaled $109.9 million (excluding restructuring charges of about $4.5 million), decreasing 4.8% year over year. This was because rise in general and administrative expenses were partially offset by a decline in technology and development costs as well as sales and marketing expenses.

Adjusted EBITDA (Earnings before interest, tax, depreciation and amortization) was $17.4 million, down 4.7% year over year. This reported figure was at the high end of the guided range of $14.0 million to $17.5 million backed by careful expense control.

Third-Quarter Earnings Outlook

For the third quarter of 2017, the company expects to incur loss per share in the range of 80 cents to 76 cents. The Zacks Consensus Estimate of a loss of 82 cents is wider than the guided range.

Net revenue is expected in the range of $187.0 million to $193.0 million, a year-over-year growth in the band of -0.2% to 5.3%.

Gross profit margin is expected within 35.0% to 35.5% of net revenue. Adjusted EBITDA is expected in the range of $0.0 million to $3.0 million.

2017 Guidance

The company reaffirmed its previously issued guidance for 2017.

The company continues to expect earnings of 45 to 80 cents per share in 2017. The Zacks Consensus Estimate of 58 cents falls within the guided range.

Net revenue is still expected in the range of $1.135 billion to $1.165 billion, a year-over-year increase of 0.4% to 3.1%. Adjusted EBITDA is anticipated to be in the band of $210.0 to $230.0 million, as expected earlier.

Gross profit margin is projected in the range of 49.0% to 50.0% of net revenue, in line with the previous expectation.

Zacks Rank and Upcoming Peer Releases

Shutterfly currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other firms in the same space, Bankrate, Inc. (NYSE:RATE) and Yelp Inc. (NYSE:YELP) are expected to release their second-quarter numbers on Aug 3. The Zacks Consensus Estimate for the quarter is pegged at 11 cents for Bankrate and at a loss of 3 cents for Yelp.

XO Group, Inc. (NYSE:XOXO) is scheduled to report its quarterly numbers on Aug 7. The Zacks Consensus Estimate for the quarter’s bottom line is pegged at 11 cents.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Shutterfly, Inc. (SFLY): Free Stock Analysis Report

Bankrate, Inc. (RATE): Free Stock Analysis Report

Yelp Inc. (YELP): Free Stock Analysis Report

XO Group, Inc. (XOXO): Free Stock Analysis Report

Original post

Zacks Investment Research