- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Shutdown And Fear Could Equal Great Q3 Earnings Season

When the average American turns on their TV or opens their favorite news site only to see "SHUTDOWN" as the headline flashing across the screen, the last thing that comes to mind is running out and buying stocks; most would be inclined to sell.

In fact, I think it's safe to say that most people are right in their concern about the showdown in Washington and looming default. Investors are growing fearful and it's showing in the stock market.

The smart money knows this and is allowing most investors to play into their little game, while they set themselves up for big gains. Well I'm going to let you in on their little diversion and tell you why this might be one of the best earnings seasons yet.

What Have We Learned from the Past?

So many investors act without thinking and many experts speak without researching; it's part of what makes this game especially complicated and hard to interpret.

Power investors like Warren Buffett, Carl Icahn, Peter Lynch and others do their homework and have extreme discipline; this allows them to act calm and collective when the world seems to be crumbling. Moments of extreme fear and panic can produce profits for these investors that last for a generation.

What Are Today's Earnings Whispers Telling Us?

The government may have "shut down," but there are extraordinary opportunities for investors in-the-know. Especially with October earnings season getting underway.

I did a little homework for you on shutdowns to see if we can learn something from the past:

When you look back in time at past shutdowns (there have been 17 of them), the market actually fared rather well. Keep in mind that before 1981, government "shutdowns" weren't actually shutdowns at all, they were simply "spending gaps" that had little or no effect on day to day life in America, so they don’t really count. I’ll also exclude any shutdowns that were less than 2 days in length.

- Dec 17-21, 1982 – Dow went from 990-1,036 (continued higher after)

- Nov 10-14, 1983 – Dow went from 1,060-1,055 (was flat after)

- Oct 5-9, 1990 - Dow was 2,516 on Oct 5 to 2,515 (Dow was completely flat for the month of Oct then rallied to 2565 in November)

- Nov 13-19, 1995 - Dow went from 4,870-4,989 (rallied after)

- Dec 5th 1995 - Jan 6th, 1996 - Dow went from 5,182 to 5,187 (rallied after)

It's plain to see that shutdowns haven't been all that bad for stocks going back in time, and in fact have been bullish if you average all the occurrences together. There were of course down days as negative news spread, usually just before or sometimes during the shutdowns, but those proved to be profitable situations in all cases!

Compared to past shutdowns, this one is more show than go, relative to what most people think. 2.9 million people are employed by the Federal Government, but less than 500,000 are without jobs during this shutdown (the Post Office, DEA, TSA, Pentagon, parts of the FAA and others are still working) and all of those not working will receive retroactive pay once an agreement is made. As bad as it may seem (and I know it's tough for some), this is an unexpected, paid vacation for the majority of "furloughed" workers.

Perhaps the bigger story here is that all of this budget bickering is leading to a bigger problem in the debt ceiling. While some of the commentary may sound scary, I think there's a better chance of you getting struck by lightning on a sunny day then the U.S. Government defaulting on its debt.

A debt default (for the first time in 225 years) might just possibly be the dumbest thing the U.S. could do at one of the worst times. It also could undo years of government stimulus and completely counters the low rate policy the Fed has currently installed.

The headlines are scaring Americans, but the smart money sees right through this and are quietly buying the dips. More on that shortly.

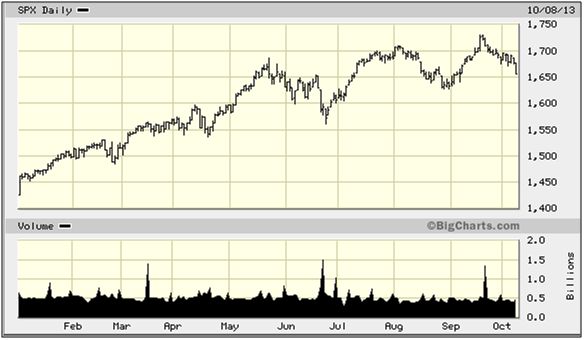

It makes sense because this time around. Stocks are down almost 4% from their highs just before the shutdown news started to really get going, and this comes after the Fed decided to keep stimulus in place and after economic data seems to have stabilized.

Hurdle Still Extremely Low for Earnings

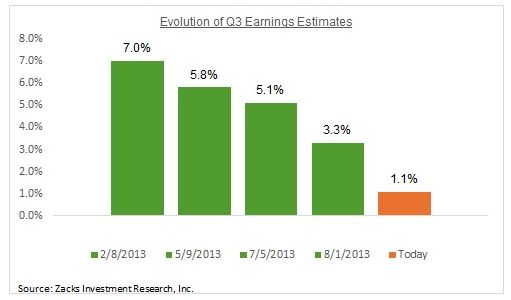

It's unfortunate that we have to start Q3 earnings with a shutdown, but it might be the perfect opportunity. One stumbling point for would-be earnings investors is the fact that earnings growth estimates have come down dramatically for Q3.

While this looks like a really bad chart and trend, consider the fact that the S&P 500 is up over 11% in that same time frame, even with the current correction. This tells me that despite slowing growth, investors have not only accepted it, but embraced it. It also means the expectations are but a mere speed bump for most stocks to traverse.

Q2 delivered 2.5% year over year growth (expectations were for roughly 1.9%), with 62.6% beating earnings expectations and a median surprise of +2.9%. The Q2 growth rate of +2.5% compares to +2.3% earnings growth rate in Q1 and the 4-quarter average growth pace of +3.9% for the S&P.

While I would give last earnings season a C- grade overall, the market saw tremendous gains during Q2 results, and we came into the season not too far off from where we are today in terms of the S&P's value.

So, if the S&P index was around 1,640 at the start of last earnings season and is now less than 1% higher, I think it's safe to say that we have some unlocked value thanks in large part to our friends in Washington.

So What Are the Pros Doing?

Volume has been rather light since stocks have been moving lower. This is one indicator that it's mostly retail selling that's taking place and not smart money panic, as the market makers let stocks drift lower, nibbling at them slowly on the way down.

Another indicator that stands out to me is that the options markets have been revealing more large bullish trades than bearish ones. In fact, the option markets are taking this whole shutdown/debt ceiling correction in stride! I have been noticing a flow of big money traders buying out of the money calls in many stocks and indexes, which indicate that they expect a sharp recovery once all this blows over.

The chart below shows the implied volatility of the S&P 500 options going out in time. Don't worry if you don't know options; simply think of this as a predictor for where the VIX (the fear index) will be in the future. If the pros really thought a catastrophe or meltdown was eminent, that little black horizontal line would be moving UP out in time, not DOWN.

So What Should You Do?

We have seen what history has revealed about past shutdowns and I've proven that even though estimates have come down dramatically, stocks have still rallied. This gives us both a low earnings hurdle to clear and shows us that U.S. stocks are still one of, if not the best, bet in town.

The recent fears that have swept over the markets have created some great opportunities, flushing out some of the junk stocks and lowering the price of many quality stocks.

If the pros are taking an overall bullish position now (they have been spot on before previous corrections this year), I wouldn't mind riding their coattails...and neither should you.

That doesn't mean you should go out and buy any old stock. In fact, I would be lying if I didn't warn you that around 40% of the companies reporting will probably miss or report inline earnings, which could hurt those shares.

But for the 60% or so that beat, the rewards can be tremendous. The key is to target those quality companies that have a high probability of beating estimates and be extremely selective with your investments...

I have a feeling this earnings season will be one of the best that we have seen in a while.

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.