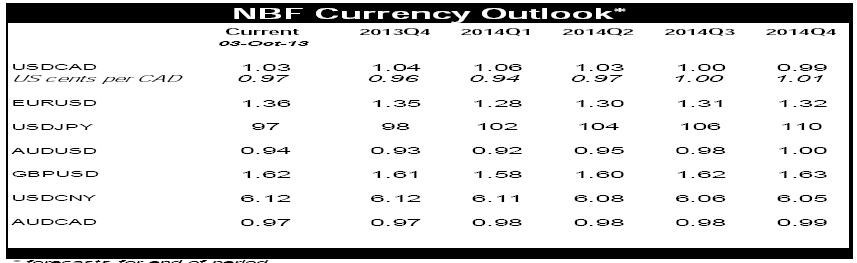

The Fed’s surprising decision to stand pat on monetary policy, despite having signalled to markets that it was about to taper its asset purchase program, changes the FX outlook quite a bit, at least over the short to medium term. The government shutdown and debt ceiling battle in Congress have already hurt US growth via uncertainty and lower confidence and that raises the odds the Fed will delay tapering until next year. With currency debasement policies lasting longer than expected, we have pushed by one quarter the timeline for when we see the US dollar regaining some vigour against the euro.

The euro is flying high, buoyed by the US dollar’s troubles, Chancellor Merkel’s decisive victory at the German elections and a return to growth on the old continent. While the common currency is now on an uptrend, we do not see that as lasting very long. True, the zone now seems to be on a path to recovery but significant hurdles remain, including politics as highlighted by recent events in Italy and Greece, and structural problems that remain largely unaddressed. The common currency could come back to earth early next year if, as we expect, the spotlight returns on the periphery and the European Central Bank finds itself compelled to inject more liquidity into the system at a time when the Fed will be winding down its QE program. So while the delay in the Fed’s tapering had us raise our end-of-Q4 euro target, we’re maintaining our 1.28 EURUSD target for 2014Q1.

The Canadian dollar hasn’t benefited from the US dollar’s problems, as investors correctly interpreted a US government shutdown as a negative for Canadian growth. And with the Bank of Canada signalling that it is about to downgrade its 2013 growth forecasts, the loonie is well on its way to reaching our 1.06 USDCAD target which we’ve now pushed to 2014Q1. But don’t rule out a return to parity with the greenback if projects for new energy infrastructure eventually get the go ahead and if, as we expect, the economic outlook improves along with FDI and portfolio inflows in the second half of 2014.

Fed plays it safe

Better safe than sorry. That was in essence the Fed’s explanation for leaving monetary policy unchanged at its September meeting despite having, for months, signalled to markets that it was about to taper its asset purchase program. Chairman Bernanke pointed out that the Fed’s decision to delay tapering was a “precautionary measure” in light of disappointing incoming data. But the precaution was also against political risks which ended up materializing in a big way a couple of weeks after the Fed’s decision, with the first government shutdown since 1995. And with the debt ceiling battle next on the agenda, the uncertainty surrounding Washington politics and policies won’t dissipate that quickly.

The stalemate on Capitol Hill will shave a few ticks from US GDP growth in Q4 not just via lower government outlays but also as the private sector turns more cautious in its investment and spending decisions. Weakness could persist if the sequester is allowed to enter its second year. Those raise the odds of the Fed continuing to play it safe and delaying tapering until next year. Little surprise then, that the US dollar has taken it on the chin, falling almost 2% in tradeweighted terms two weeks after the Fed’s decision. Speculators are also heading for the hills, taking net USD long positions to the lowest since February.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Shutdown, Slowdown And Currencies

Published 10/06/2013, 03:21 AM

Updated 05/14/2017, 06:45 AM

Shutdown, Slowdown And Currencies

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.