U.S. markets kicked off October, and Q4, with modest gains. We have moved up from a string of recent losses as upbeat economic data cheered sentiment. Investors, for now, are ignoring the shutdown.

The markets, for now, are going to go about their business as politicians have always found a solution in the past. This closure of the U.S. Government, creates volatility and not a change in the direction of financial markets. However, we will see an impact on economic growth and sooner than later, the debt ceiling will come into play.

For now, on the economic front, U.S. manufacturing has expanded at its fastest pace in nearly two and a half years.

STOCKS

Overnight saw modest gains in the U.S. markets. The DJIA was up 62 points to close at 15,191.70. We are still hovering around a critical support at 15,100 which must hold to keep the bears hibernating. The S&P 500 was up 13.65 points to close at 1,695 and the tech heavy Nasdaq Composite finished at 3,817.98. The NASDAQ was up nearly 47 points for the day.

Asian markets were mixed today. A strengthening yen hurt the Japanese market and ongoing U.S. debt concerns made investors nervous.

The Nikkei 225 lost over 1 percent hitting its lowest level since September 2013. The yen fell below $98 versus the Dollar at one point. We saw a low of $98 on Monday. The Australian benchmark rose 0.2 percent as did the Kospi in South Korea. Emerging markets had a strong day as well. The Jakarta Index was 1.5 percent higher and the Philippine market jumped two percent.

European markets closed higher yesterday as the Italian Government neared an agreement to stick together.

For now, global equities markets are ignoring the first U.S. Government shutdown in 17 years.

CURRENCIES

Let us take a broad look at the Forex market today.

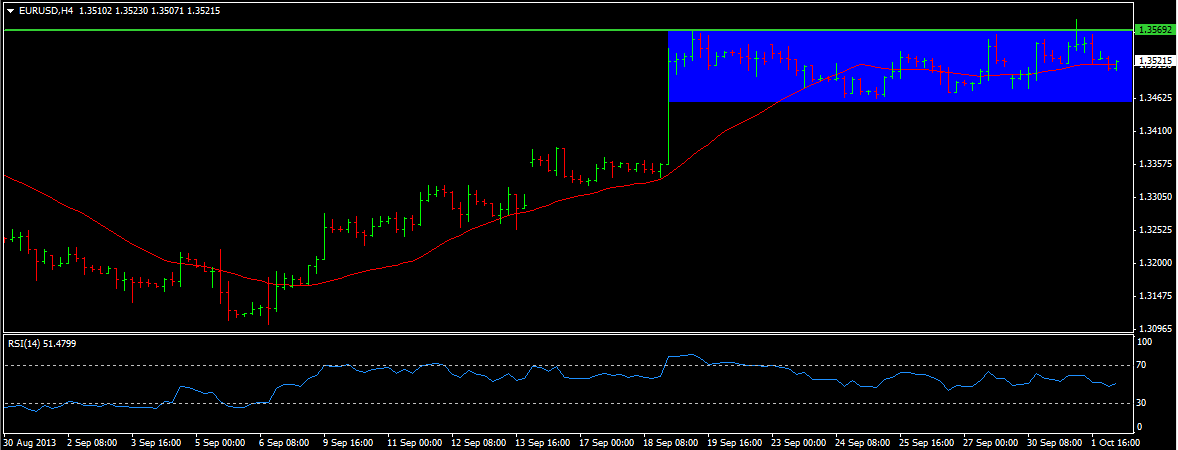

The U.S. Dollar recovered a bit overnight. However, this came after hitting an eight month low against the Euro. Please see the below chart.

The Dollar also moved lower against the other majors then recovered a bit. For now, Fx investors are shrugging the shutdown off. Nearly 800K government employees are jobless and this shutdown is costing the U.S. $300 million a day. As time goes on, Forex traders will focus on the U.S. debt ceiling. If it is not raised by Oct. 17 then the U.S. Treasury will run out of money somewhere between October 20 and October 31.

COMMODITIES

Let us look at Gold (1290.60). As it sold off sharply yesterday. The exact opposite of what we predicted.

The precious metal is near two month lows. We have seen the gold bullion losing almost 23 percent this year on taper fears but it lost 3 percent yesterday alone. We saw one massive Comex order which drove it down to below $1300. Why? Gold is a traditional safe haven where investors flee to on bad news. It would seem people are saving money and holding onto cash. We are not seeing bids on the yellow metal at this time.

TODAY’S OUTLOOK

Today we start testing the strength of the U.S. Economy. We get mortgage applications, and the ADP employment report which will forecast the NFP on Friday.

Investors will be gauging these numbers to get a better idea when the Federal Reserve will start to reduce its asset purchase program.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Shut Down? Who Cares? Markets Move Higher

Published 10/02/2013, 05:00 AM

Updated 05/14/2017, 06:45 AM

Shut Down? Who Cares? Markets Move Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.