The possibility of the Federal Reserve slowing its bond purchasing program sent interest rates rocketing in May. Rate-sensitive assets — dividend stocks, REITs, MLPs, preferreds, muni bonds — all began to depreciate in value. By the end of the month even common stocks began to stammer.

Here on the first trading day of June, however, the Institute of Supply Management (ISM) offered up its assessment of U.S. manufacturers. Not only did the manufacturing sector shrink for the first time since November, the data point represented the worst reading in 4 years.

In the same manner that bad news continues to be good news, the Dow and the S&P 500 surged higher. Clearly, there isn’t a snowball’s chance in Death Valley that the Federal Reserve will taper its quantitative easing (QE). On the other hand, what should ETF investors take away from the clear evidence that economic output is waning?

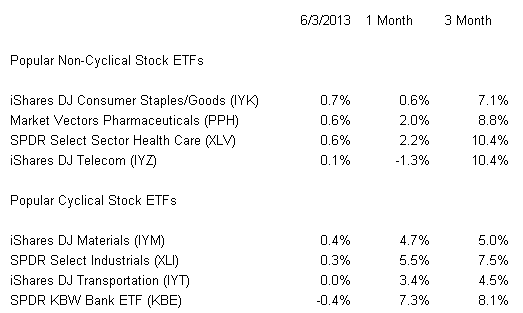

Less than a week ago, scores of commentators began discussing the best way to invest in the current environment. They advised shifting from non-cyclical stock assets to cyclical stocks like those in the banking and tech sectors. The reasoning? Not only did the month-over-month numbers show evidence of sector rotation, but rising rates were supposedly a sign of a strengthening U.S. economy.

Today, however, there will be less talk of a resilient economic backdrop and more talk of a summertime slowdown. And until the Fed fully commits to the same amount of QE, or perhaps a bump higher in its monthly bond purchasing, stock assets might struggle for definitive direction as well.

Granted, SPDR Industrials (XLI) and SPDR Materials (XLB) were phenomenal in May. Financial shares could do no wrong. And “”Risk On” was in complete control of the cockpit.

On the other hand, can high beta, higher risk assets prosper if the world economy continues to falter? The European Union entered its 6th consecutive recessionary quarter, India reported its slowest gross domestic product (GDP) in a decade, manufacturing in China is contracting and Japan’s rapid currency devaluation is creating sovereign debt concerns.

The solution remains the same as it has for most of 2013. Specifically, ETFs less tethered to economic uncertainty are better able to ride out increasing market volatility. Funds like SPDR Select Health Care (XLV) and iShares DJ Consumer Goods (Staples) are providing equal or better reward for less risk.

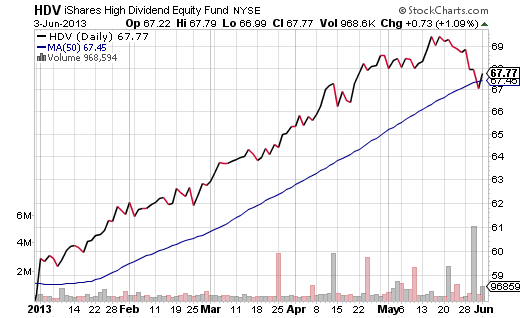

In addition, dividend investing did not die with its setback in May. As long as the Fed recommits to its QE (and let’s face it… tapering talk was little more than a trial balloon), high dividend equity payers from the non-cyclical sectors will remain desirable. For instance, iShares High Dividend Equity (HDV) focuses largely on health care corporations and telecom. Moreover, this exchange-traded tracker appears to have strong support at its 50-day trendline.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Should You Rethink Your Exposure To High Beta ETFs?

Published 06/04/2013, 04:21 AM

Updated 03/09/2019, 08:30 AM

Should You Rethink Your Exposure To High Beta ETFs?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.