Kohl's Corporation (NYSE:KSS) has been in investors’ good books of late. Shares of the company have been gaining momentum since the past year. Should investors retain this stock in their portfolio? Let’s find out.

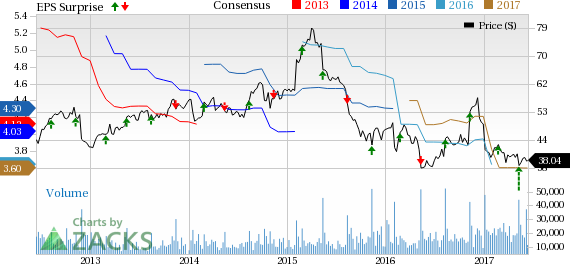

Estimates Moving North

The company’s estimates for second quarter and fiscal 2017 have moved north in the past 30 days, reflecting the positive outlook of analysts. While estimates for the second quarter grew 0.9% to $1.16 per share, for fiscal 2017, the same increased 0.3% to $3.60 per share.

Positive Surprise History

Kohl's has an impressive earnings history. The company delivered positive earnings surprised in the trailing four quarters, with an average surprise of 21.3%. In fact, the bottom line outpaced estimates in eight of the past 10 quarters. Sales have also exceeded the Zacks Consensus Estimate in three of the past four quarters.

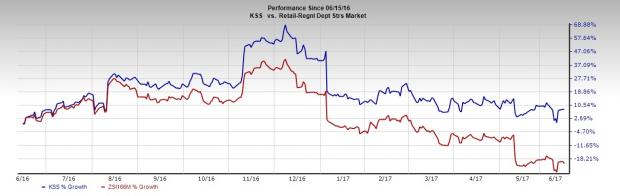

Price Performance

The company’s shares have jumped 8.1% over the past year compared with the Zacks categorized Retail – Regional Department Stores industry’s decline of 20.5%.

Favorable Zacks Rank & Score

Kohl’s currently carries a Zacks Rank #3 (Hold) and a VGM Score of ‘A.’ Here 'V' stands for Value, 'G' for Growth and 'M' for Momentum. Kohl’s score is a weighted combination of these three scores (Value - A, Growth - B, Momentum - B). A score of ‘A’ or ‘B’ is generally considered favorable and allow investors to rule out the negative aspects of stocks and select the valuable picks.

Impressive Q1 Earnings, Despite Concerns

The company delivered better-than-expected earnings of 39 cents per share that not only beat the Zacks Consensus Estimate by 39.3%, but also grew 26% from the prior-year quarter, driven by margin improvement initiatives, strong inventory and expense management.

However, revenues missed the consensus mark and declined 3.2% from the year-ago quarter due to a challenging sales environment and a 2.7% decline in comparable store sales. This signals that the company’s strategic initiative ‘Greatness Agenda’ is failing to deliver results.

Though the plan has helped the company to deliver positive comps in all the four quarters of fiscal 2015, the quarterly growth rates moderated gradually, thus posing a concern. In fact, both sales and comps have been declining since first-quarter fiscal 2016.

In addition, lower spending on apparel and accessories as well as a general slowdown in consumer spending are hurting sales at department stores. A highly competitive market from online retailers also seems to hinder sales of Kohl's. Consequently, management continues to expect sluggish comps amid a difficult sales scenario, going further.

Nevertheless, Kohl’s boasts a robust brand portfolio and a solid e-Commerce business. Also, it has been trying hard to attract more shoppers and improve sales. Lately, the company has started offering more outside famous brands and cutting down on the number of in-house clothing brands it sells.

The addition of Under Armour workout tights, sneakers and other gear in March was a great success, and very well accepted among customers. It also helped to boost sales of the entire active apparel department in the fiscal first quarter, despite decline in women's, children's and accessories units.

Kohl's currently carries a Zacks Rank #3 (Hold).

Key Picks from the Sector

Investors may consider better-ranked stocks such as Best Buy Co., Inc. (NYSE:BBY) , Burlington Stores, Inc. (NYSE:BURL) and The Children's Place, Inc. (NASDAQ:PLCE) .

While Best Buy and Children’s Place flaunt a Zacks Rank #1 (Strong Buy), Burlington holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Best Buy delivered an average positive earnings surprise of 33.8% in the trailing four quarters and has a long-term earnings growth rate of 11.8%.

Children's Place delivered an average positive earnings surprise of 36.6% in the trailing four quarters and has a long-term earnings growth rate of 8%.

Burlington Stores delivered an average positive earnings surprise of 22.6% in the trailing four quarters and has a long-term earnings growth rate of 15.9%.

Zacks' 2017 IPO Watch List

Before looking into the stocks mentioned above, you may want to get a head start on potential tech IPOs that are popping up on Zacks' radar. Imagine being in the first wave of investors to jump on a company with almost unlimited growth potential? This Special Report gives you the current scoop on 5 that may go public at any time.

One has driven from 0 to a $68 billion valuation in 8 years. Four others are a little less obvious but already show jaw-dropping growth. Download this IPO Watch List today for free >>

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Kohl's Corporation (KSS): Free Stock Analysis Report

Original post

Zacks Investment Research