Weeks before Cloudera entered public markets, many Wall Street boys started calling it an "over-valued, money-losing unicorn." But Wall Street boys have a history of not truly understanding the tech side of public companies, and focusing only on the financial side. With that, I'm bringing my engineering background on the table to take the IDDA approach, and do a stock analysis to get to the bottom of this!

1- Fundamental Points

What the heck is Cloudera?

The modern platform for machine learning and advanced analytics. Cloudera Inc (NYSE:CLDR) is leading the industry that makes use of Hadoop. And Hadoop, is the revolutionary open-source tool that companies use for data management, machine learning, and advanced analytics.

Founded in 2008, with headquarters in Palo Alto, CA, Cloudera was the first company to build a business around the professional deployment and support of Hadoop. Since then, it has turned into an enterprise with offices in 28 countries and over 1,600 employees. According to its S-1 filing, Cloudera generated over $261M in 2016 and has a strong presence in the enterprise.

What’s their company structure?

Three engineers at Silicon Valley’s leading companies—including Google (NASDAQ:GOOGL) (Christophe Bisciglia), and Yahoo! (NASDAQ:YHOO) (Amr Awadallah), joined with a former Oracle (NYSE:ORCL) executive (Mike Olson) to form Cloudera.

Hadoop's co-creator himself, Doug Cutting, joined the company in 2009 as Chief Architect and remains in that role. He is kind of a big deal.

Who is Cloudera's competitor?

Hortonworks (NASDAQ:HDP). They were founded in 2011, when 24 engineers from the original Hadoop team at Yahoo! spun out to form the company. They operate in 17 counties with around 1,075 employees. Hortonworks generated $184.5 Million for 2016.

Fun Fact: Before Cloudera's IPO, we advised the Invest Diva members to consider adding the HDP stock to their portfolio, as the stock price bottomed out in 2016. We took profit on our medium-term position during the second week of May, 2017. We earned an average of 39% return.

What is Cloudera doing differently?

It is fundamentally about the people. Having Hadoop's co-founder, Doug Cutting on board is one of the key factors that has enabled Cloudera to offer a better product. With that, they have been able to attract more and "better" customers. They sponsor the biggest data conferences in Silicon Valley with O'Reilly Media and appear to be more innovative.

No wonder Intel (NASDAQ:INTC) decided to invest in the company before they went public.

How do they make money?

While you can get a free version of Cloudera, or even Hadoop, large enterprises prefer to go with the paid version, which comes with support. Investing in the paid version cuts a ton of human resource trouble and time for companies. They'd rather use their talent for matters more focused on their own core business. The more paid customers Cloudera gets, the more cash they make.

Who are their customers?

Real big companies like Cisco (NASDAQ:CSCO), Samsung (KS:005930), Barclays (LON:BARC), Sikorsy and the NYSE itself. Industries range from Financial Services, to Healthcare, Media and Entertainment, Manufacturing and Technology.

What's up with all the fuss around data analytics and machine learning anyway?

It's the future. Big data is rapidly growing and people must have tools to keep up with it. Hence, platforms like Cloudera are not going anywhere. Also, beware of Artificial Intelligence (AI) who's out to take your job. The robots are coming.

This brings us to the second point: Technicals.

2- Technical Points

The CLDR became available to trade publicly on April 28th, 2017. So basically a mere 9 business days ago. With that, we really don't have enough data to conduct a thorough technical analysis.

That is why instead of analyzing Cloudera, I analyzed other similar tech companies a few months after they did IPO.

The results?

Tech companies normally peak right after the IPO. Then they crash, and often even go below the IPO price within a few months. However, if the company's fundamentals are strong enough, the prices surpass the initial peak within a few quarters.

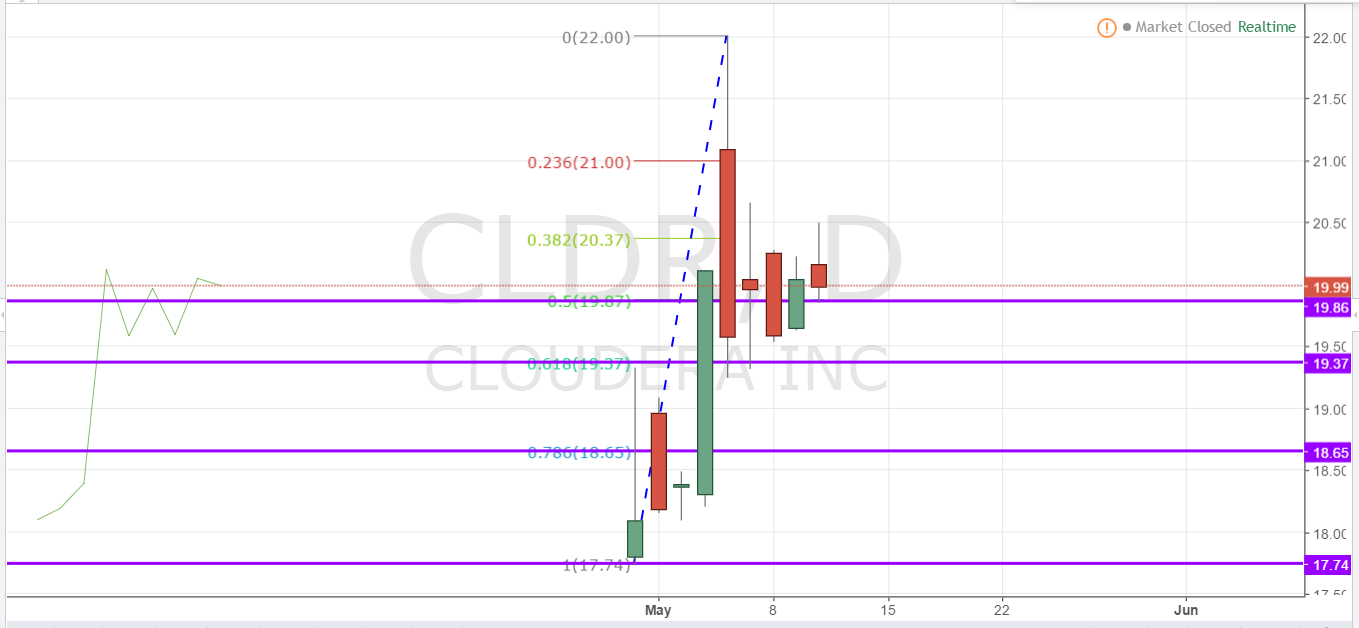

Now, we can't guarantee that this would happen to CLDR stock. That is why, I advised our Invest Diva members to set limit orders and buy CLDR stock shares as the price drops to key Fibonacci retracement levels as sited in the chart above.

3- Market Sentiment

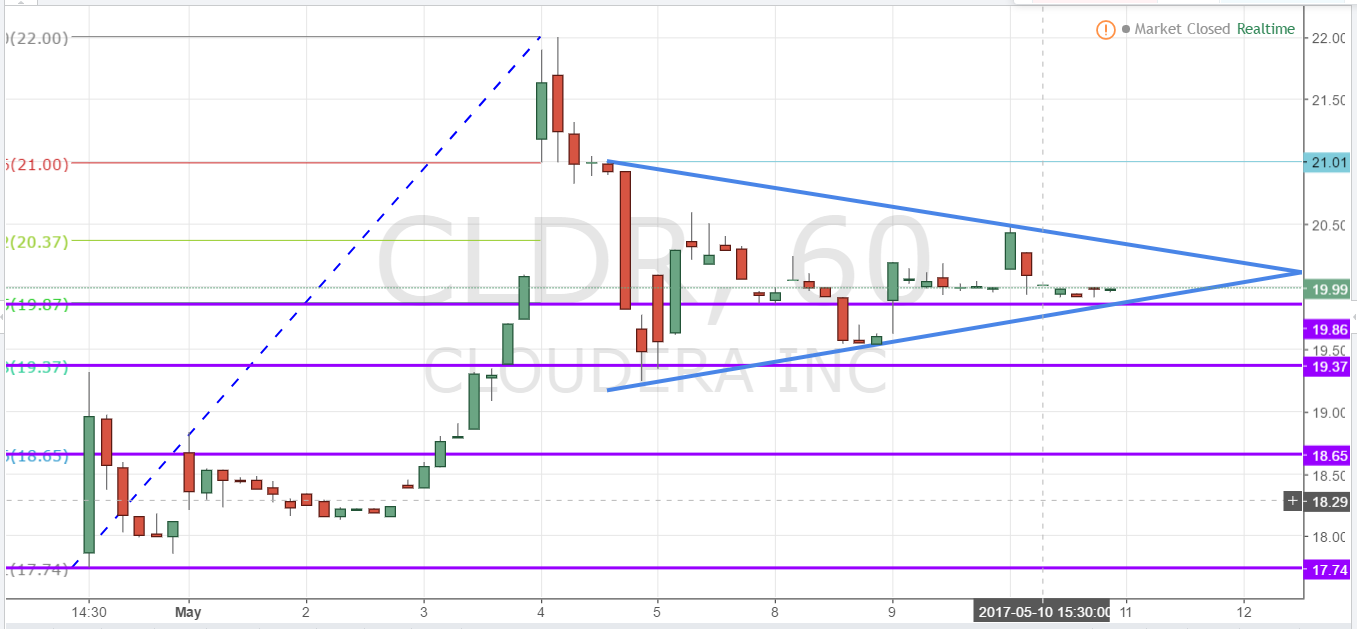

CLDR stock peaked to $22 per share on 5th day of its public trading on May 4th. However the force stopped being with them by the end of May the 4th. (P.S. I'm a Star Wars geek.) The stock dipped below the 61% Fibonacci level at 19.22, and it has been ranging within a symmetrical triangle ever since.

Market participants appear to be waiting for that big breakout. But which direction? Now that's the tricky part and we shall wait and see.

Investing Strategy

You must calculate your risk tolerance before deciding on which investing strategy is suitable for your portfolio.

Here are Invest Diva's calculations for important approximate levels.

Support LevelsTurning PointResistance Levels17.7419.87 21.0018.6520.3722.00