On Thursday there was some big options action for Oasis Petroleum (OAS) which is a Zacks Rank #3 (Hold). The stock has seen quite a big run this week, but there was a player of size who thinks the move could only be getting started. Of course, with every options trade there are two sides so we will look at that as well.

The Trade

At 9:38 AM there were 5,000 October 20 Calls with a strike price of $10 traded at $0.20 each. At the time, the bid and ask were at $0.10 by $0.20 This trade cost $100,000, which isn't that much in the world of options, but for this stock, that is a pretty big bet.

Open interest was at 10, so that number will be much higher tomorrow. At the time of writing this article, another 1210 contracts were traded on that same strike price - most of them at the same amount.

Company

Oasis Petroleum (OAS)s an independent exploration and production company focused on the acquisition and development of oil and natural gas resources. The Company is currently focused on exploiting resource potential from the Bakken and Three Forks formations, which are present across a substantial majority of its acreage. Oasis Petroleum Inc. is based in Houston, Texas.

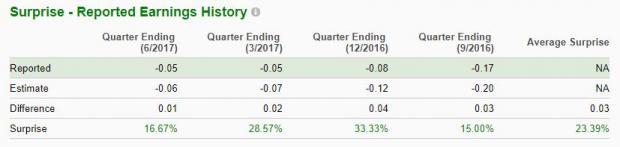

Recent Earnings

One quick look at the detailed estimates page on Zacks shows me what I need to know about the earnings history for this stock. The company has posted four straight beats of the Zacks Consensus Estimate and the average positive earnings surprise is more than 23%.

The Next Earnings

The stock currently has a negative earnings ESP number, with the next report due out in November. That makes this trade that much more interesting as an earnings report will not factor into it.

I see the Zacks Consensus Estimate is calling for $263M on top and a loss of $0.06 on bottom.

Recent Run

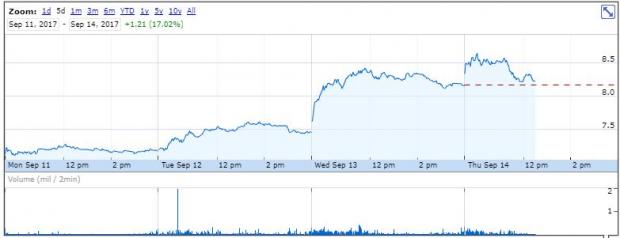

OAS has seen a significant move in the last few trading sessions. The stock started off the week at about $7.20 but is now around $8.20 and was $8.48 when the big options trade took place. The high for the day is $8.64.

To put this in a better perspective, the stock is up about 17% since the close on Friday.

Oil

Crude has been a bad trade all year. By that, I mean that the price has been trending lower. Recently, the price has jumped following the two big storms and there are other indications that we could get back to break even for the year.

The chart below tells a story of lower highs and lower lows through the first half of the year. Most investors were bearish on oil as OPEC moved to extend production cuts. After bottoming around $42 in late June, oil has come back over $50 thanks to the last few days of gains.

My Take

The option trade here is pretty aggressive, but I have been watching a lot of oil service names (FTK, BRS) moving higher of late. This smaller oil play could move big if the market rotates back into the oil patch and that is just what I see happening over the next few weeks. I am not so sure that I would want to follow this exact trade, but looking closer at oil stocks right now is a good move to make.

Free Tech Stock Newsletter

Let's face it, there is just too much data to keep track of. There are too many earnings reports and we all only have so much bandwidth to take it all in. Luckily, we have developed a tech stock newsletter that not only reviews the biggest ideas of the last week but also looks forward to the upcoming week as well. The best part about it is that it is totally free! I said FREE! To sign up, just click here: https://www.zacks.com/registration/newsletter/?type=TSN

Oasis Petroleum Inc. (OAS): Free Stock Analysis Report

Flotek Industries, Inc. (FTK): Free Stock Analysis Report

Bristow Group Inc (BRS): Free Stock Analysis Report

Original post

Zacks Investment Research