Shares of Wynn Resorts (NASDAQ:WYNN) experienced marginal gains on Monday, just one day before the company is scheduled to report its first quarter financial results. This climb is part of a larger 9% surge over the last four weeks, which might suggest that investors are expecting big things from the resort and casino giant in Q1.

Wynn looks like it could be set for even more changes on top after Elaine Wynn recently demanded that the company make changes to the board. She asked that one of Wynn’s directors overseeing the internal investigation into sexual misconduct allegations against Steve Wynn be removed, noting he is too closely allied to Mr. Wynn.

This move could go a long way in further distancing Wynn from its embattled former CEO. But beyond a positive public relations move, investors will want to understand what to expect from Wynn’s first quarter to see if the stock might be worth buying before the company reports its Q1 results on Tuesday afternoon.

Latest Outlook & Valuation

Our current Zacks Consensus Estimates are calling for Wynn’s revenues to climb by 15.5% to $1.70 billion. Investors might be even more pleased to note that the company’s earnings are projected to reach $1.96 per share, which would mark a 58% expansion from the year-ago period.

Of course, top and bottom line growth estimates are just two of the many things investors will be concerned with when Wynn reports its first quarter financial results. We can also turn to our exclusive non-financial metrics consensus estimate file to help prepare.

The Zacks Consensus NFM file contains detailed estimate data for business segment metrics and non-financial metrics reported by companies. The data is acquired from digest and contributing broker models and includes the independent research of expert stock market analysts.

According to these consensus estimates, Wynn is on track to report Macau revenues of $638 million in Q1. This would mark a roughly 34% climb from the year-ago period, in a unit that is quickly becoming one of the resort giant’s most important businesses. Last quarter, Wynn reported $618.6 million in Macau revenue, which marked a 24.1% jump.

Heading into Monday, Wynn was trading with a Forward P/E of 23.2, which marked a slight premium to the “Gaming” industry’s average of 21.3. With that said, the company is currently offering investors strong comparative value against its median Forward P/E of 25.1. Wynn also sits well below the 29.3x forward earnings it was trading at near the end of January.

Earnings ESP Whispers

Investors will also want to understand what chance Wynn has to surprise with better-than-expected earnings results. For this, we turn to our Earnings ESP figure.

Zacks Earnings ESP (Expected Surprise Prediction) looks to find earnings surprises by focusing on the most recent analyst estimates. This is done because, generally speaking, when an analyst posts an estimate right before an earnings release, it means that they have fresh information which could potentially be more accurate than what analysts thought about a company two or three months ago.

A positive Earnings ESP paired with a Zacks Rank #3 (Hold) or better ranking helps us feel confident about the potential for an earnings beat. In fact, our 10-year backtest has revealed that this methodology has accurately produced a positive surprise 70% of the time.

Wynn is currently a Zacks Rank #3 (Hold) and holds an Earnings ESP of 5.45%. The company’s Most Accurate Estimate—the representation of the most recent analyst sentiment—calls for earnings of $2.07 per share, which comes in 11 cents above our current consensus estimate. Therefore, Wynn is a stock that could be ready to top Q1 earnings estimates.

Surprise History

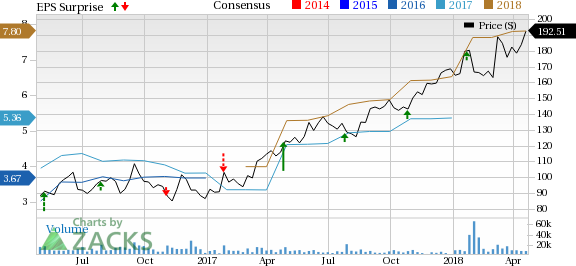

Wynn’s earnings surprise history and the effect that these surprises have had on its share prices are two other important factors to consider ahead of the casino power’s first quarter earnings report.

We can see that Wynn has posted strong earnings results over the last year, posting an average earnings surprise of 22.43% during this period. However, these beats haven’t always led to positive momentum immediately following Wynn’s quarterly earnings release.

We judge the price effect of these earnings beats by comparing the closing price of the stock two days before the report and two days after the report. Wynn stock has turned negative in two of these windows over the last four quarters.

Wynn is scheduled to report its first quarter financial results after market close on Tuesday, April 24. Investors will want to pay close attention to Wynn’s Q1 performance as other industry giants, including Las Vegas Sands (NYSE:LVS) and MGM Resorts (NYSE:MGM) , report their quarterly financial results later this week.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Las Vegas Sands Corp. (LVS): Free Stock Analysis Report

Wynn Resorts, Limited (WYNN): Free Stock Analysis Report

MGM Resorts International (MGM): Free Stock Analysis Report

Original post

Zacks Investment Research