Semiconductor ETFs had a great 2016, having returned in the range of 35-46%. Areas like autonomous cars, 3D printers, fitness devices and IoT fueled growth in the sector, offsetting otherwise-saturating businesses like PCs and smartphones.

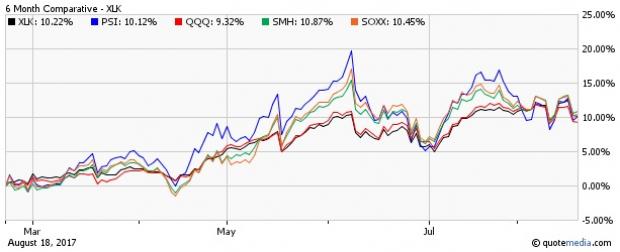

Though things moderated for the space in early 2017, semiconductor ETFs gathered steam from mid-May. In the last six months (as of August 18, 2017), semiconductor ETFs kept pace with the soaring broader technology sector (read: Will Semiconductor ETFs Repeat This Year's Success in 2017?).

Let’s find out which factors may drive the semiconductor rally ahead.

Usage of Semiconductor in Cryptocurrencies

Bitcoin is on a tear this year. The digital currency has now more than quadrupled in value from around $997 at the start of the year. Bitcoins are ‘mined’ by using a greater amount of computer processing power. Creation and transactions in bitcoin are controlled through cryptography to keep transactions secure (read: Bitcoin Skyrockets, Race to First Cryptocurrency ETF Heats Up).

Like bitcoin, Ether or etherum is also quite popular this year. Now, mining of cryptocurrencies needs the usage of semiconductors. A hardware known as an ASIC (Application-Specific Integrated Circuit) is designed explicitly for mining bitcoin (read: Ethereum ETF? The Bitcoin Crushing Digital Currency Explained).

This where semiconductor companies can gain traction. As per Bloomberg, there was a 10-fold rise from April to June in the Ethereum market which helped shares of Nvidia Corp. (NVDA) and Advanced Micro Devices Inc. (NASDAQ:AMD) substantially.

Barclays (LON:BARC) recently added that Nvidia is better placed than its competitors to cash in on the cryptocurrency rally.

Rise of 4G LTE

Though shipment of smartphones has cooled down lately, the continued shift toward 4G LTE in high-end smartphones has given a boost to wafer demand for advanced process technologies, as per research agency Gartner. Plus, the rapid deployment of fingerprint sensors and active-matrix dynamic light-emitting diodes (AMOLEDs) by Chinese smartphones should also give the space a boost, as per several research agencies including Gartner. Recently, the agency indicated that consumer applications will likely make up for about 63% of the overall IoT applications in 2017.

Value-Centric Area

In any case, semiconductor is the value-centric traditional tech area that is likely to have an upper hand in an edgy investing environment. Moreover, the semiconductor space is consolidating rapidly with a number of deals announced lately.

Market Trends Favorable

Investors should note that there was a gathering ofshort sellers in the semiconductor sector only to acknowledge defeat. As per an article published on Investopedia, out of the 10 biggest semiconductor shorts in the U.S. market only two, Xilinx Inc. (NASDAQ:XLNX) and Qualcomm Inc. (NASDAQ:QCOM), were in favor of short sellers. The rest eight punished them with over $3.5 billion.

ETF Picks

Against this backdrop, investors can take a look at ETFs like VanEck Vectors Semiconductor ETF SMH, PowerShares Dynamic Semiconductors Portfolio ETF (TO:PSI) and iShares PHLX Semiconductor ETF SOXX.

Stock Picks

We also highlight a few semiconductor stocks with a Zacks Rank #1 (Strong Buy) and a value score of A. These are:

Micron Technology Inc. (NASDAQ:MU)

This is one of the leading worldwide providers of semiconductor memory solutions. It belongs to the Zacks Industry Rank of top 1% and Sector Rank of top 44%.

IEC Electronics Corp. (NYSE:IEC)

It is a full-service contract manufacturer employing state-of-the-art production utilizing both surface mount and pin-through-hole technology. The Zacks Industry Rank is in the top 13%.

Stoneridge Inc. (NYSE:SRI)

It is a designer and manufacturer of highly engineered electrical and electronic components, modules and systems for the automotive, medium and heavy-duty truck, and agricultural vehicle markets. The Zacks Industry Rank is in the top 13%.

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

Stoneridge, Inc. (SRI): Free Stock Analysis Report

IEC Electronics Corp. (IEC): Free Stock Analysis Report

ISHARS-PHLX SEM (SOXX): ETF Research Reports

PWRSH-DYN SEMI (PSI): ETF Research Reports

VANECK-SEMICON (SMH): ETF Research Reports

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post

Zacks Investment Research