Shares of Nvidia (NASDAQ:NVDA) opened about 2% higher on Thursday, just hours before the company is set to report its fourth-quarter financial results for fiscal 2018. This popular chipmaker has emerged as a favorite tech stock on Wall Street, and investors can expect its latest earnings report to attract significant attention.

Nvidia designs graphics processing units (GPUs) and system on a chip units (SoCs). The Santa Clara, California-based firm’s traditional business focuses on delivering GPUs to the gaming market and SoCs to the mobile computing market.

But Nvidia has exploded over the past two years thanks to the adoption of its technology in several booming new tech industries. In fact, Nvidia is now considered a leading supplier for “smart” vehicles, datacenters, cryptocurrency mining, artificial intelligence, and autonomous driving.

On the back of these major growth catalysts, Nvidia shares have skyrocketed more than 90% within the past 52 weeks. Of course, this share price explosion has also ushered in much bigger expectations for the company, and investors can bet that the pressure will be on Nvidia to deliver a solid report this afternoon.

Latest Outlook

Based on our latest Zacks Consensus Estimates, we expect Nvidia to report adjusted earnings of $1.16 per share and total revenues of $2.67 billion. These results would represent year-over-year growth rates of 17.2% and 22.8%, respectively.

But of course, earnings and revenue are just two of the many things investors will be concerned with when Nvidia reports on Thursday. Considering the interest in the company’s specific business segments, it is entirely possible that the stock’s post-earnings momentum is determined by Nvidia’s performance in key units.

To prepare for this, we can turn to our exclusive non-financial metrics consensus estimate file. The Zacks Consensus NFM file contains detailed estimate data for business segment metrics and non-financial metrics reported by companies. The data is acquired from digest and contributing broker models and includes the independent research of expert stock market analysts.

Nvidia investors are always interested in hearing about the firm’s exciting growth catalysts, but it is also important to track its core video gaming business. Our consensus estimate file is calling for Nvidia to report Gaming revenues of $1.581 billion, up about 17.3% from the year-ago period. Nvidia was able to notched 25.5% growth in this business last quarter, so investors will hope that management can prove a strong holiday shopping season by posting a positive surprise here.

Meanwhile, investors are going to want to pay special attention to Nvidia’s Datacenter business, which has been one of its fastest-growing units in recent quarters. In the previous fiscal period, Nvidia reported Datacenter revenues of $501 million, up 108.8% from the year-ago period.

Our current consensus estimates are projecting Datacenter revenues of $549 million for the fourth quarter. That result would represent 85.5% year-over-year growth. While that rate of expansion is certainly nothing to scoff at, investors have grown to expect triple-digit Datacenter growth recently. Look for this to be a catalyst for the stock if Nvidia can surpass estimates.

Earnings ESP

Investors will also want to anticipate the likelihood that Nvidia surprises investors with better-than-anticipated earnings results. For this, we turn to our Earnings ESP figure.

Zacks Earnings ESP (Expected Surprise Prediction) looks to find earnings surprises by focusing on the most recent analyst estimates. This is done because, generally speaking, when an analyst posts an estimate right before an earnings release, it means that they have fresh information which could potentially be more accurate than what analysts thought about a company two or three months ago.

A positive Earnings ESP paired with a Zacks Rank #3 (Hold) or better ranking helps us feel confident about the potential for an earnings beat. In fact, our 10-year backtest has revealed that this methodology has accurately produced a positive surprise 70% of the time.

Just hours ahead of its report, Nvidia is sporting a Zacks Rank #2 (Buy) and has an Earnings ESP of 4.23%. That is because the company’s Most Accurate Estimate for earnings sits at $1.21 per share, meaning that the most recent analyst estimates have been higher than the consensus. This improved outlook is a good sign heading into the report.

Price Performance and Surprise History

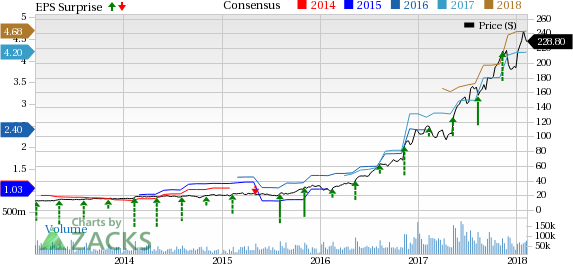

Another important thing to consider ahead of Nvidia’s report is the company’s history of earnings surprises and the effect that these surprises have had on share prices.

Nvidia clearly has an impeccable earnings surprise history. The company has only missed estimates once over the past five years, and a positive surprise tends to lead to nice surge for the stock. That has not always been the case, but the trend over the past two years of rising share prices has been pretty impressive during earnings season.

Nevertheless, Nvidia shares will likely trade in response to anything that company management says about forward-looking expectations and guidance. Another thing to remember is that Nvidia will likely be taking a huge one-time charge related to the recent U.S. tax reform bill. This will result in a significant difference between GAAP and non-GAAP results, but the overall impact of tax reform could lead to favorable earnings guidance for the next few quarters.

Want more analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research