Should You Be Selling GBP Ahead Of The CPI Release?

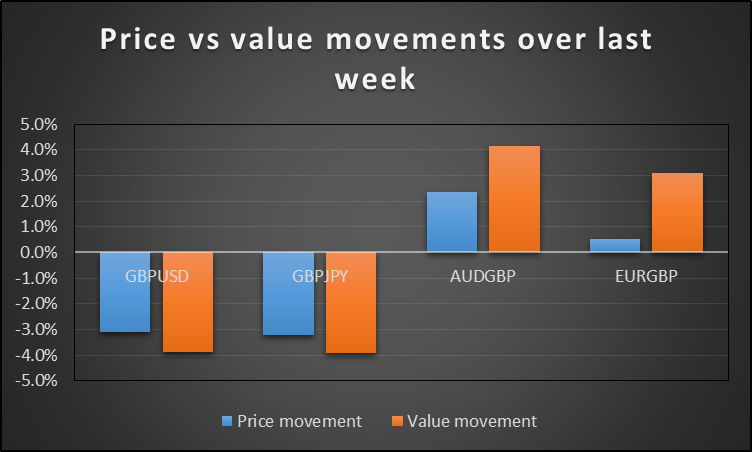

Our fair value monitor shows that the stars have aligned with sell signals on four major GBP pairs. For GBP/USD and GBP/JPY, over the last week the exchange rate movement has undershot the fair value decline; for AUD/GBP the exchange rate increase has undershot the fair value increase.

If the exchange rates move to close the gap to fair value movement, we get price targets of:

|

Currency pair |

Target |

Current |

| GBP/USD | 1.5030 | 1.5147 |

| GBP/JPY | 178.70 | 179.85 |

| AUD/GBP | .5510 | .5411 |

| EUR/GBP | .8010 | .7806 |

Of course, the fair value may change to reduce the gap or the gap may widen because of other factors not captured by the fair value model. However backtest performance for the GBP pairs as shown below does suggest that movement of the exchange rate to close the gap has been the predominant factor.

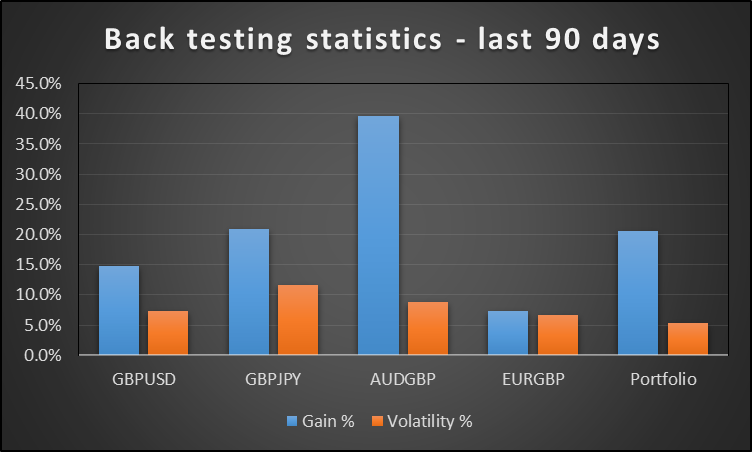

Although past performance should not be used to predict the future, following the monitor has backtested reasonably well for the GBP pairs, with strong performance for AUD/GBP. As would be expected, a portfolio of trades has a lower risk than any individual trade.

What could be the impact of the UK CPI release?

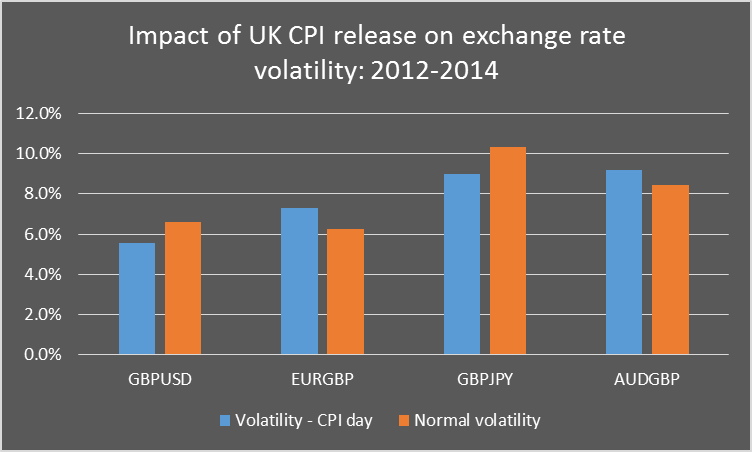

The UK CPI for December is due to be released at 9:30 GMT on Tuesday 13 January, with a consensus expectation of 0.1% increase (MOM). We looked back over the last three years to see how the four currency pairs above performed on the release date (close of trade that day vs close of trade the previous day).

The volatility impact has been somewhat mixed –

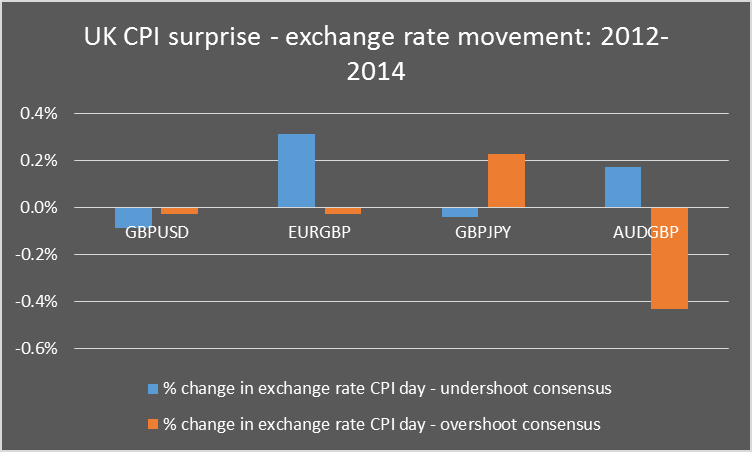

The impact of surprises has been pretty much as would be expected, with undershoots weakening the GBP on balance and overshoots strengthening the currency –

We estimate that statistically there is a slight bias towards an overshoot this month, so we would suggest caution in actioning the above recommendations from our monitor before the data is released.