Genesis Energy LP (NYSE:GEL) has succeeded in transforming itself into a heavily diversified midstream energy Master Limited Partnership (MLP). In the last quarter, the company posted strong topline and bottom-line growths. But the issue of crude oil price rout has just refused to go away in any discussion of oil stock. How is Genesis Energy dealing with it?

This Genesis Energy analysis article brings out what existing investors and aspiring investors need to know about this MLP so as make more informed investment selection. But first is a quick recap of Genesis Energy’s last quarter financial scorecard.

Q4 2015 highlight

Genesis Energy, L.P. (NYSE:GEL) posted equivalent of net income of $102.3 million in Q4 2015 . That indicated a spike of 63% from a similar period a year earlier.

On segmental basis, Genesis Energy reported Segment Margin, which reflects revenue less certain expenses for each of its major divisions:

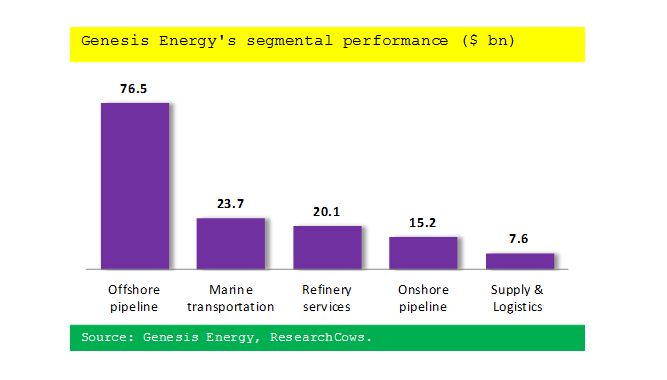

Offshore pipeline contributed $76.5 million, Onshore pipeline brought $15.2 million and Refinery services contributed $20.1 million. Other segments Marine transportation and Supply and Logistics generated $23.7 million and $7.6 million, respectively.

The chart below captures segmental contributions in Q4 2015 :

What’s exciting about Genesis Energy?

- Diversified business model

Genesis Energy, L.P. (NYSE:GEL) originally started out providing refinery services and gradually but steadily expanded into onshore pipeline segment. The business continued to diversify further, mainly through strategic acquisitions that Genesis Energy has been able to expand into offshore pipeline segment. Moreover, Genesis Energy has a solid footprint in marine transportation segment.

Genesis Energy’s well-diversified operation is great for mitigating operating risks.

- Strategic acquisitions

Genesis Energy has a practice of buying growth and diversification, especially if it needs to expand quickly into a promising area that it doesn’t already have meaningful presence. These acquisitions unlock opportunities quickly and allow the company to sidestep the risks of having to launch into a new area from scratch.

To enhance its play in offshore pipeline segment, Genesis Energy acquired offshore pipeline system for $1.5 billion from Enterprise Products Partners LP (NYSE:EPD). The deal both increased Genesis Energy’s scale and asset base.

Through bolt-on acquisitions and crisp execution in the integrating the acquired assets, Genesis Energy has been able to rapidly enhance its position in new segments such as marine transportation and offshore pipeline.

Over the past decade, the company has turned over $5 billion to strategic acquisitions as well as growth oriented projects. The bulk of that amount was spent in the last three years where $3 billion was poured into strategic acquisition and growth deals.

- Stable business model

Not only is Genesis Energy, L.P. (NYSE:GEL)’s business model diversified to spread risks, the business model is stable. The company’s financial performance is less sensitive to the shifts in the commodity market as does other oil and gas industry players. The stability in Genesis Energy’s business stems from the fact that a large part of its income is fee-based, which doesn’t swing as much with swings in crude oil prices. About 85% of Genesis Energy’s operating margin is drawn from fee-based businesses.

The other reason for stability in Genesis Energy’s business is that fact that the majority of its customers large integrated oil companies that are also well-capitalized. They include Royal Dutch Shell A (NYSE:RDSa)

- Growth projects

Genesis Energy continues to invest in growth is it seeks to position itself for long-term growth in and out of season. Towards achieving that target, the company has continued to allocate substantial amounts for capex. In 2015, capex was $450 million, but this year it will be only $300 million, which can be viewed as a cautious capital allocation measure in times of tough economic conditions.

Among other things, Genesis Energy’s capex go to programs aimed at improving the connection between its onshore and offshore infrastructure to allow more efficient and smooth operations in the midstream business.

- Disciplined capital deployment

As much as Genesis Energy, L.P. (NYSE:GEL) maintains a healthy capex program, it also makes it a point to return value to its investors. The management has consistently hiked cash distribution to shareholders over the past several quarters. For example, the management has sweetened distribution by over 8% in the past 42 quarters. Genesis Energy typically sweetens cash distribution in the range of 8% to 10%.

What’s worrying about Genesis Energy?

- Adverse price/demand shifts

Genesis Energy, L.P. (NYSE:GEL) benefits more when it is moving large volumes of crude oil and refined products through its systems. However, when crude prices shoot, production of refined products tends to fall, thus leading to a rise in the prices of refined products. When that happens, demand for refined products tends to cool and less volume passes through GEL’s system.

- Risk of excess capacity

Recent years have seen Genesis Energy diversifying, expanding and adding capacity. Such measures are great when demand for midstream services is high. But when demand is low, Genesis Energy is left with excess capacity, which can adversely impact financial returns.

- Macroeconomic pressures

MLPs tend to be sensitive to the health of the broader economy. A slowdown in GDP growth that triggers a decline in energy demand can adversely shake MLP players and Genesis Energy, L.P. (NYSE:GEL) is not immune.

- Regulation risks

MLPs operate in a more dynamic environment. Congress tends to shift policies relating to taxation of MLP and those shifts are mostly adverse. Genesis Energy and its investors have to constantly keep an eye on what is unfolding in Washington in relation to MLP regulation and taxation.

- Capital access risks

Investors love MLPs because they return a significant portion of their operating cash flow to shareholders. However, there is also risk in that because MLPs have to return to the capital market all the time to raise the funds they need to finance operations. If economic shifts cause investors to lose appetite for oil stocks or interest rates hike, accessing capital can become a serious challenge for Genesis Energy, L.P. (NYSE:GEL) and fellow MLPs.

Takeaway

Despite the typical volatility in oil and gas industry, Genesis Energy, L.P. (NYSE:GEL) has succeeded in building a more stable and diversified business. That enables the company to weather serious storms in its industry.