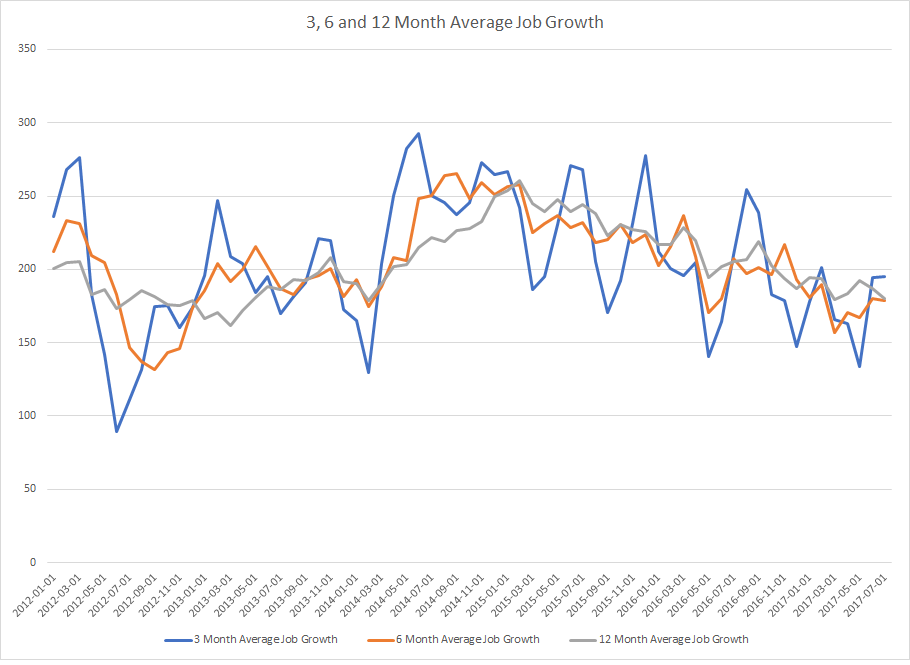

The employment report was this week’s most notable economic release. Total jobs increased 209,000 while the unemployment rate was unchanged. Most importantly, the 3, 6 and 12-month moving averages of monthly job growth are all between 150,000 and 200,000:

Y/Y wages were higher; there were slight modifications to the previous two months’ reports. This release will keep the Fed in a rate-hiking mood.

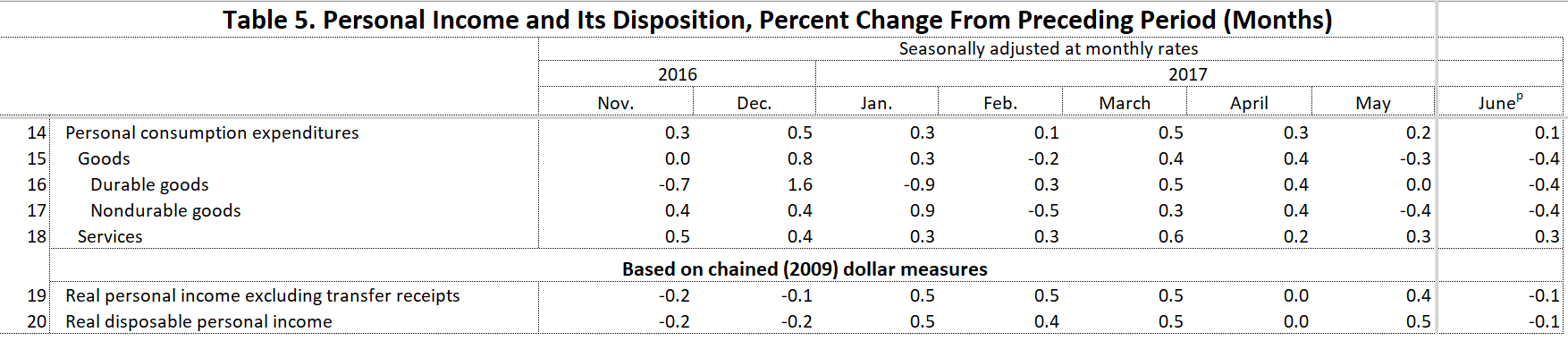

The BEA released the latest personal income and spending numbers, which were underwhelming. Personal income less transfer payments fell .1%; PCEs rose a paltry .1%; spending on durable and nondurable goods both decreased .4%. PCEs have been weak over the last eight months:

Durable and non-durable spending as well as person income less transfer payments all declined 3/8 of the time; each was unchanged in one month. While these numbers aren’t fatal, they have occurred with sufficient frequency to warrant modest concern going forward.

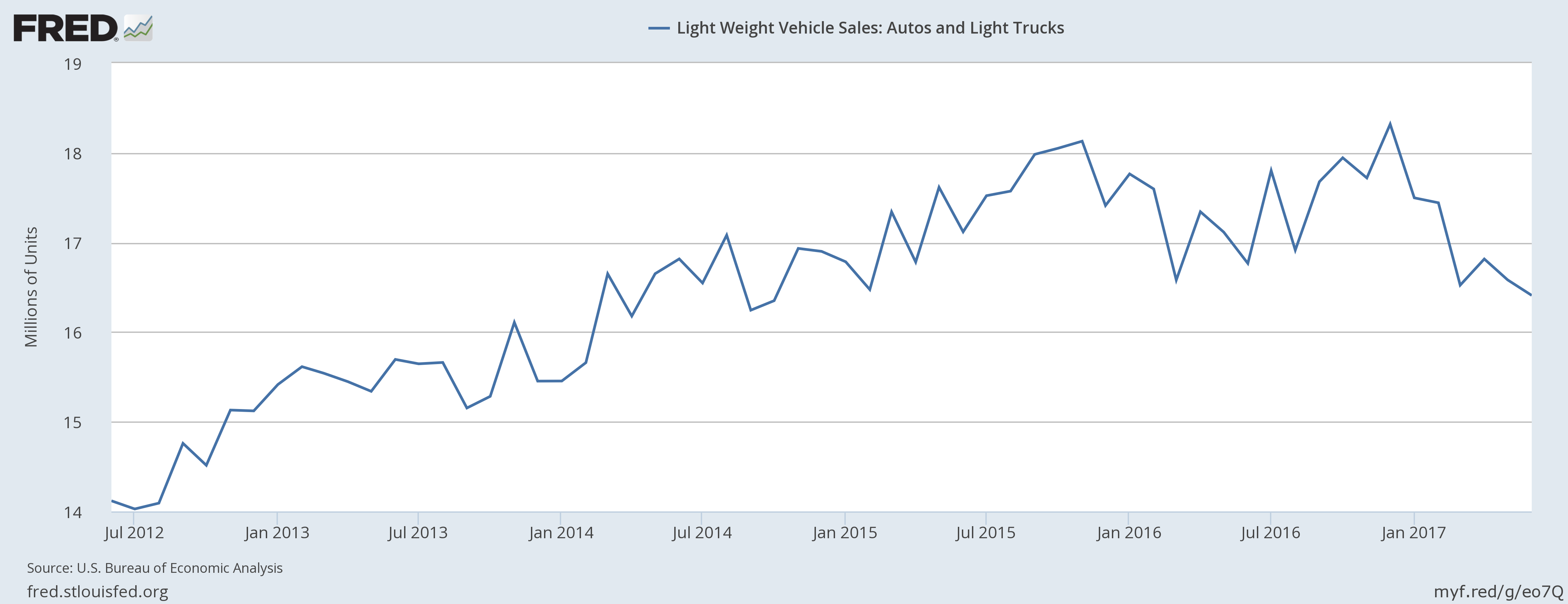

Auto sales have peaked for this expansion:

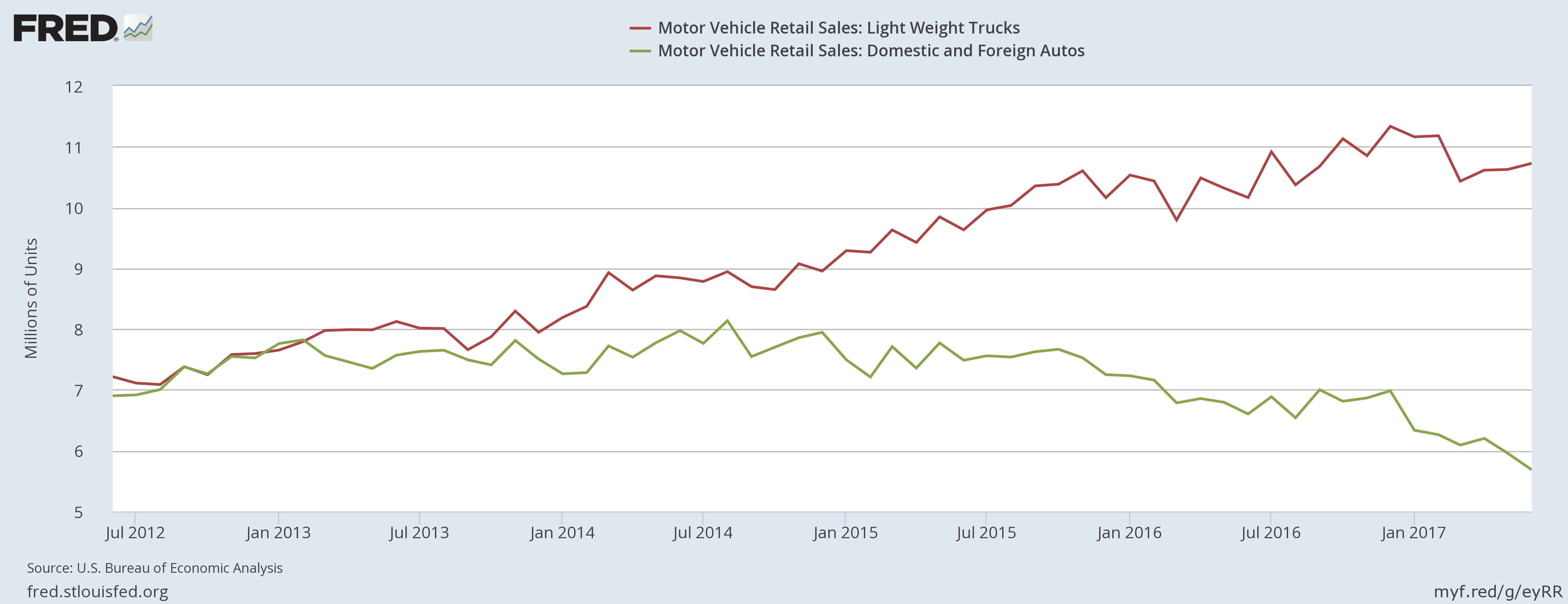

They increased steadily from 1H12 to the 3Q15, rising from a 14 million to 18 million annual pace. For the last 1 ½ years, total sales have been reported between a 17-18 million annual rate. The sales pace has declined since the end of last year. It’s possible to argue that we’re simply seeing a moderate decline like that which occurred in the 2H15. The granular data argues against that interpretation of that data:

Auto sales (in green above) have been trending lower since the first half of 2014, falling from an 8-million-unit annual pace to their current level below 6 million. Lightweight trucks – which have risen from an 8,000,000 to 11,000,000 annual pace -- have kept the market afloat.

Economic conclusion: this week’s news was mixed. The employment report was strong in the short-term. Unfortunately, in the intermediate term it also gives the Fed additional ammunition to continue raising rates, which, given the weak pace of inflation, may not be good policy. Additional news points to modest weakness. Auto sales – which are a fair gauge of medium-term consumer sentiment -- have modestly weakened. Despite very low unemployment, wage growth is still below levels seen at advanced stages of previous expansions. And personal income less transfer payments – a coincident indicator – are slowing. While none of these developments are fatal, they to raise the caution flag one of two notches.

Market overview: once again, this week’s market news highlights my utter disdain for the Dow as a market average. While it rose for the week, broader averages either moved sideways (the SPYs and QQQs) or lower (the IWMs). The IEFs and TLTs also advanced modestly, indicating a further level of caution to pronouncements of an ever-peaking market.

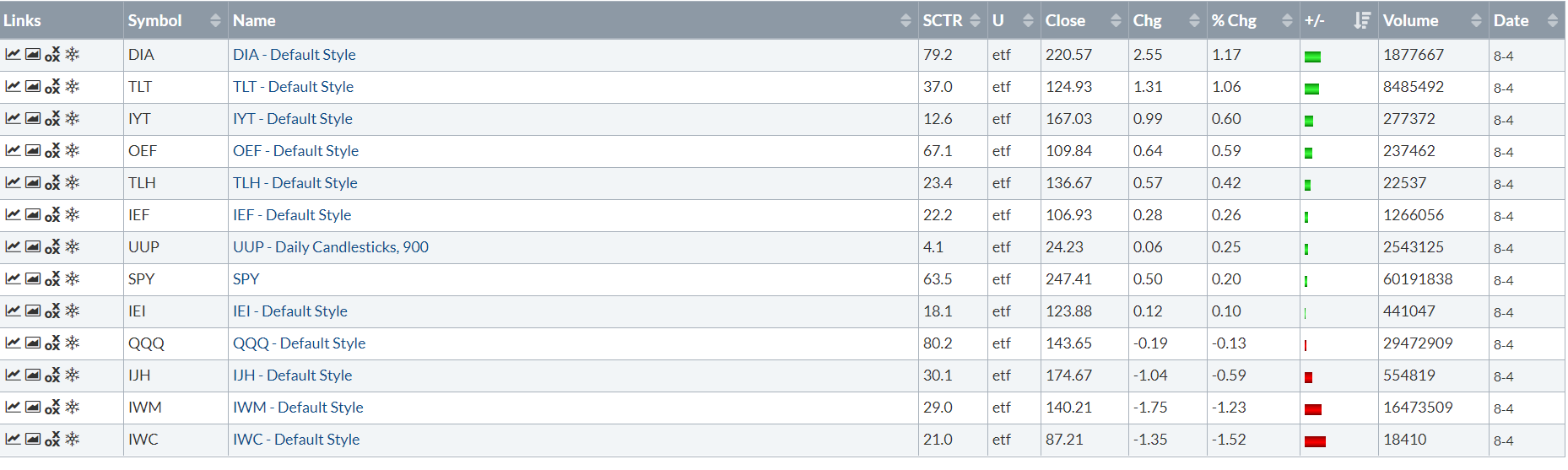

This table summarizes the weekly price moves:

The DIAs rose 1.17% and the transports gained .6. But the SPYs were up a far more modest .20% and the QQQs were down .13%. And the TLTs gained over 1% -- a fairly large move for a treasury bond.

While the financial press promoted the Dow’s gain, the underlying technical picture is a slightly cloudier.

The IWMs – which are a good proxy for risk based capital – have been moving sideways since the beginning of December. And while the Dow was rallying this week, this index was moving lower.

The QQQs chart is also a bit messier technically:

In July, the QQQ broke their trend line in to the downside. They have since moved back through it, but are currently entangled with it once again.

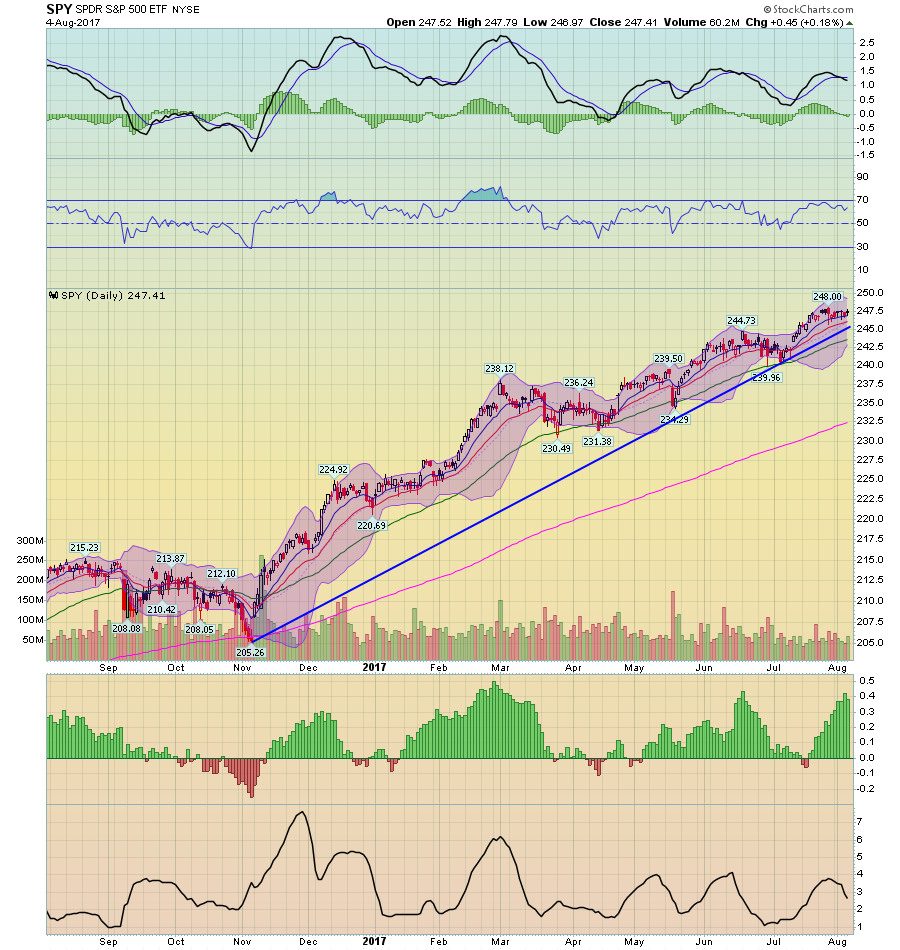

And then we have the SPYs …

Which simply moved sideways this week.

None of these charts is fatal to the Dow’s current rally. But they do indicate the market is not a jubilant as the Dow’s recent move suggests.