Sell ‘em if you got ‘em.

And c’mon, we all have ‘em.

Let’s think back a few months. Which stocks are we still holding now that we wish we had sold then?

I’m talking about the dividend dogs that, if we’re being honest, are not deserving of long-term positions in our retirement portfolios.

These mutts have had a fun summer—good for them (and us). Now let’s find them a nice home in another portfolio.

Why the deadline? September swoons are common. The Wall Street guys return from their Hampton homes and sell everything that rallied in August.

The summer rally (recently ended?) had a bit of a frat party feel to it. It started calmly enough and evolved into quite the rager. Even meme stocks came back, bro!

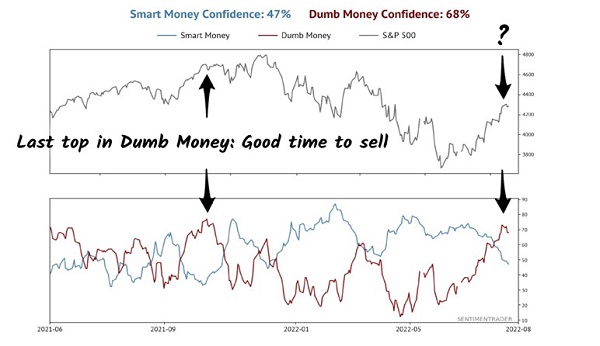

SentimenTrader’s “Dumb Money” index—republished with permission—is as high as it’s been since late 2021, just weeks before the ultimate market top:

Dumb Money Confidence: Too Confident?

Source: SentimenTrader

The Dumb Money is, well, the individual traders who come late to the party. They buy meme stocks and virtual coins with dogs on them, just in time for the cliff fall.

When they are piling back in, we contrarians should be cautious. They helped us out by running shares higher. We can now “sell the rip” they created.

Before we get into the stocks to dump, let me highlight one more reason for caution: the dollar bulldozer. A strong greenback “bulldozes” corporate profits and stock prices. A weak dollar, meanwhile, buoys asset prices (in nominal terms, at least) and the economy at large.

The buck took a breather in mid-July. Stocks took off while the bulldozer idled. But the dollar is quietly ticking higher again, and the market, sensing this, is beginning to stumble.

In case you haven’t heard, the next Federal Reserve meeting is in September. Officials have insisted that they will keep raising rates as long as inflation data is high. Well, the numbers aren’t going to look much better by the next meeting. Another decent Fed hike could send the dollar to new highs—and chop a quick 5% off the S&P 500!

Long-term positions? Fine. We’ll hang onto them. Paper payout tigers? Sell before September.

In my house, my kids know we have two rules for 2022:

- We don’t talk about Bruno (no, no, no).

- We don’t buy mortgage REITs.

Rithm Capital (RITM)—the artist formerly known as NRZ—is our lone exception in the mREIT space. RITM owns a boatload of mortgage service rights (MSRs), which increase in value as rates rise. RITM was ready for 2022.

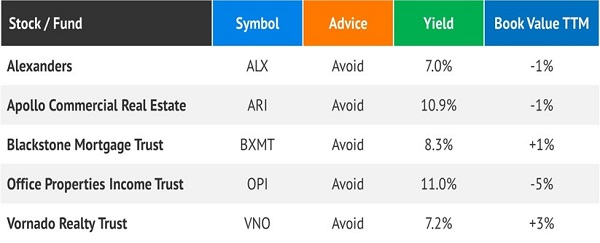

Other mREITs? Not so much. Their book values have plummeted over the past year and the worst may be to come.

Book value for these firms is the market price of the mortgages they own. All they have is their portfolios. And, other than RITM, these portfolios have declined by 13% or worse during the trailing twelve months (TTM).

We’ve written about RITM/NRZ over and over again. CEO Michael Nierenberg really saved the day when he “backed up the truck” on MSRs. Thanks to him, RITM is the largest non-bank owner of these assets in the world.

As for Michael’s competitors? Let’s not be fooled by their high stated yields. Dividend cuts are likely, kicking their stock prices downstairs. We’re giving them the Bruno treatment.

Moving from residential to commercial real estate, the latter mREITs’ book values are holding up “better” on paper. But really, they are probably outdated.

Here in Sacramento, most State of California employees are still working from home. They’re not coming back to the office.

The state has buildings it leases, and buildings it owns. Leases are an easy decision—they are being broken early or, at minimum, not renewed.

It’s a terrible time to be a commercial landlord. Let’s not be fooled by these placid-on-paper book values. The book is stale. These stocks are sicker than they look. We are going to avoid all of these office space peddlers.

Sometimes income investing is this simple. Vanilla dividend buyers get blinded by big yields. We discussed a dozen, and eleven should be sidestepped. Or sold if owned.

There’s a time and a place to own mortgage and commercial REITs. September 2022 is not that time. No, no, no.

Know another “loser” quality about these dividend dogs? They only pay quarterly, not monthly.

Lame!

I’m not sure about you, but my expenses hit my credit card once a month. This is why they are called monthly bills.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."