Next week we will see the final employment report before the November elections. Will the Bureau of Labor Statistics (BLS) have their fingers on the scales to make the Democratic party look good going into the election?

Follow up:

This suspicion is the result of the perception of a massive dose of political spin coming from all political parties. And the BLS is housed under the political purview of the Executive branch. Americans do not trust the government to tell them the truth.

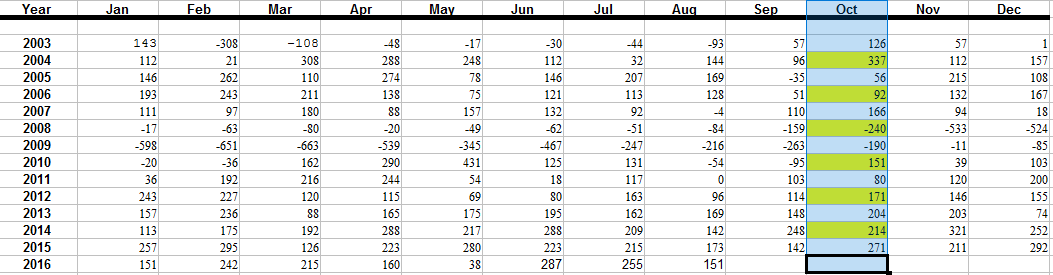

Well, here is my take: I have found no compelling evidence of political bias in the BLS jobs report. Taking a look at original headline jobs growth (total non-farm from the establishment survey) for Octobers of election years:

Source: BLS

There is little consistency in growth between September and November. Out of the last 13 years (6 being election years), September had the best growth only once (and that was an election year), October seven times (three times during election years), and November five times (twice during election years). On the surface, it appears the seasonal adjustment model is defective for the month of September as it generally reads low. The opposite seems true for Octobers. You could spin a case that there was election bias - but it is far from convincing.

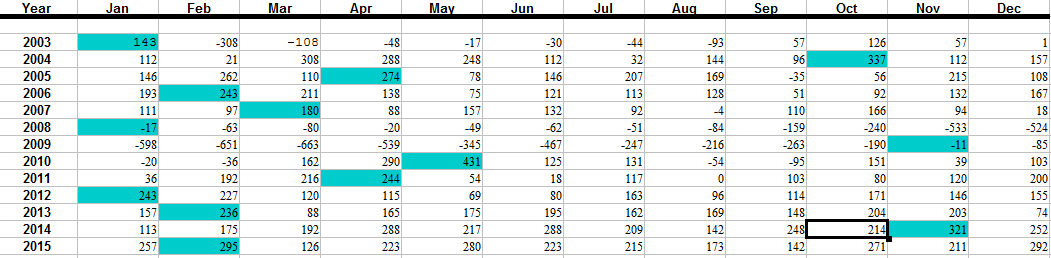

If I were devious, I would put the best jobs growth of the year right before elections:

Source: BLS

Notice the skew of top jobs growth to the first part of the year? This suggests the way the BLS seasonally adjusts is flawed - and no case can be spun for political bias. If there was bias, you would expect the top jobs growth to be in the second half of the year leading up to the elections. In a perfect world where employment growth was constant - the seasonally adjusted jobs growth would all be the same.

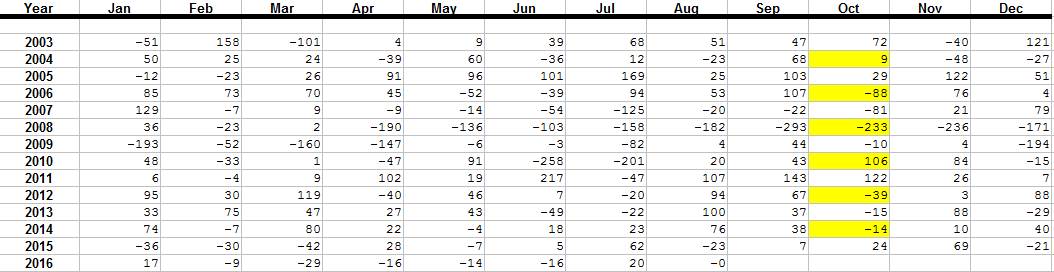

One can also look at how the October estimates have been revised after the initial estimate. There is no pattern of revision where numbers were revised significantly lower (except during the Great Recession where the pattern is that almost every month that year was overstated). Note a negative number in the table below is a reduction in jobs growth from the initial estimate.

Source: BLS

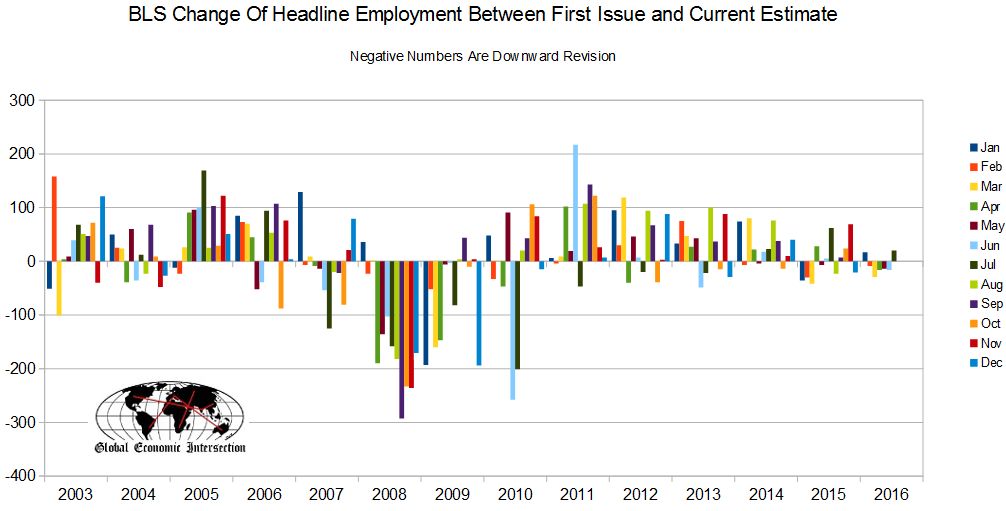

The bar chart below uses the data in the above table.

Source: BLS

To summarize: If there is any issue with the BLS - it is that their seasonal adjustment methodology is flawed. There is little evidence demonstrating political bias.

Other Economic News this Week:

The Econintersection Economic Index for October 2016 insignificantly declined with the economic outlook remaining weak. The index remains near the lowest value since the end of the Great Recession. Some sectors of the economy continue to give recession warning flags. Employment growth forecast indicates little change in the rate of growth.

Bankruptcies this Week: Key Energy Services, Basic Energy Services, American Gilsonite Company

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: