I believe taxes are a punishment for doing something wrong. The USA does not tax money flows it wants to occur by creating tax loopholes.

Follow up:

The Modern Monetary Theory (MMT) folks believe that a sovereign currency issuer (such as the USA) does not need to tax as taxes remove money from the economy - and a sovereign government is able to issue money at will. Most main-stream economists believe printing money would cause inflation and devaluation of the dollar. I believe that Legislative and the Executive Branches of the Federal Government are so undisciplined that giving them a blank check to print money is insane. But the concept that a sovereign currency issuer does not necessary have to tax is logical provided government spending is properly managed and controlled (removed from a political process).

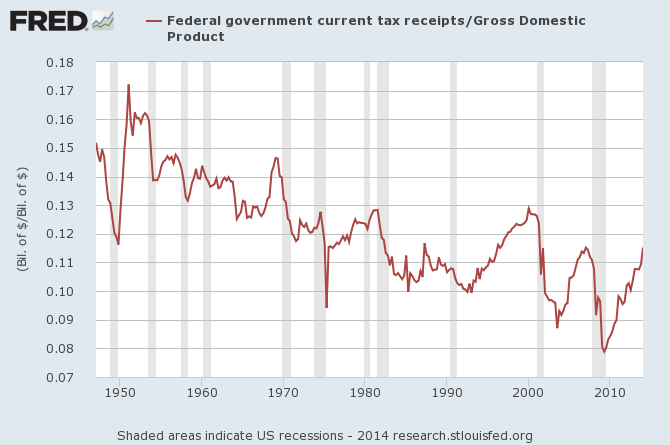

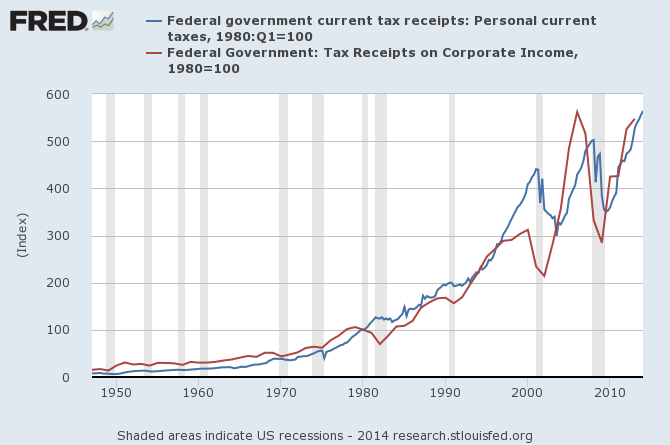

Whether one agrees with the MMT logic or not, most economists believe that taxes removes money from the economy - and as the graph below shows, the amount of money the Federal government is removing from the economy is on a long term down trend.

Now an alarm is being raised because corporations may be leaving to escape taxes. From the White House:

What's an inversion, and what's it costing you?

Last week, President Obama called attention to one kind of corporate tax loophole in particular -- called an "inversion" -- a word you might be seeing in a lot of news headlines lately.

It's not the most intuitive name for a corporate tax loophole, so we're breaking it down for you.

To begin - if one believes that corporations are people - then the rate of corporate tax growth should be similar to that for people. And it looks like it has been for the most part. Before 1980 tax receipts from corporations were a little greater than from individuals and after 1980 there have been times when individuals provided more tax revenues (all relative to the assumption of equality for 1980). But, in general the differences appear to be relatively minor.

There seems to be a concerted effort from the left wing to paint corporations as tax dodgers. Their mouth piece Nobel Laureate Paul Krugman opined:

Which brings us to the tax-avoidance strategy du jour: “inversion.” This refers to a legal maneuver in which a company declares that its U.S. operations are owned by its foreign subsidiary, not the other way around, and uses this role reversal to shift reported profits out of American jurisdiction to someplace with a lower tax rate.

The most important thing to understand about inversion is that it does not in any meaningful sense involve American business “moving overseas.” Consider the case of Walgreen, the giant drugstore chain that, according to multiple reports, is on the verge of making itself legally Swiss. If the plan goes through, nothing about the business will change; your local pharmacy won’t close and reopen in Zurich. It will be a purely paper transaction — but it will deprive the U.S. government of several billion dollars in revenue that you, the taxpayer, will have to make up one way or another.

Does this mean President Obama is wrong to describe companies engaging in inversion as “corporate deserters”? Not really — they’re shirking their civic duty, and it doesn’t matter whether they literally move abroad or not. But apologists for inversion, who tend to claim that high taxes are driving businesses out of America, are indeed talking nonsense. These businesses aren’t moving production or jobs overseas — and they’re still earning their profits right here in the U.S.A. All they’re doing is dodging taxes on those profits.

To be sure, corporations have no soul or loyalties. The capitalistic role of corporations is to make money for their owners. It seems funny and contradictory to me that a government wants a global marketplace allowing foreign corporations to operate freely within the USA - and yet denies home grown corporations to be globalized.

I reverse the question - Why is the USA allowing foreign entities to escape the full brunt of the USA tax system? Why would there be an advantage to being a foreign corporation UNLESS foreign corporations were already exploiting this advantage?

Corporations are taxed twice in the USA - once at corporate level, and once to the owners with profit distributions. The whole concept of taxes is misguided as currently applied:

- Why tax income? Is income bad? Without income, there can be no spending unless one believes that you need only to borrow to spend.

- Why allow a foreign made product which has paid no USA taxes to be sold against a USA product which has paid in all sorts of taxes (income, property, FICA, Social Security, ....)?

Like most issues, arguments on corporate taxation are complex. The error we continue to make is believing the issue is black or white - or believing the slanted arguments of those with an agenda.

Other Economic News this Week:

The Econintersect Economic Index for August 2014 is showing our index at a 3 year high. Outside of our economic forecast - we are worried about the consumers' ability to expand consumption although data is now showing consumer income and expenditures growth are similar. The GDP expansion of 4% in 2Q2014 is overstated as 2.1% of the growth would be making up for the contraction in 1Q2014, and 1.7% of the growth is due to an inventory build.

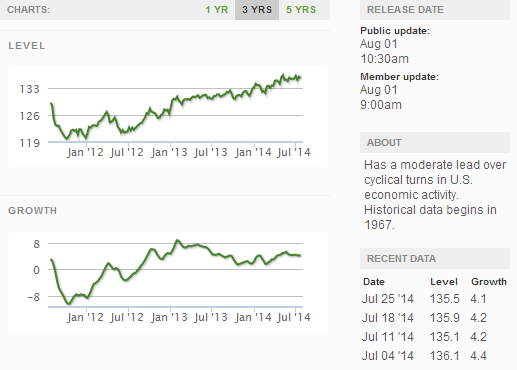

The ECRI WLI growth index value has been weakly in positive territory for many months - but now in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

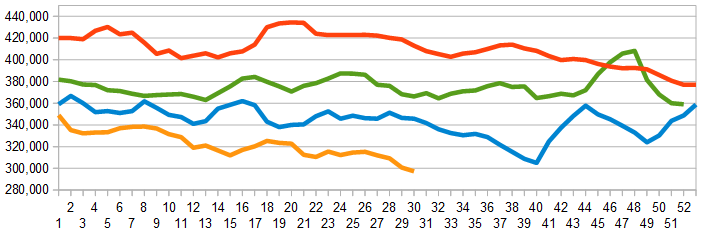

The market was expecting the weekly initial unemployment claims at 295,000 to 320,000 (consensus 305,000) vs the 302,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 300,750 (reported last week as 302,000) to 297,250.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: Ambient, United Kingdom-based New World Resources, United Kingdom-based Zodiac Pool Solutions

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks