It is no secret that the minimum wage is too low. It puts literally all families below the poverty level if one works less than 40 hours per week.

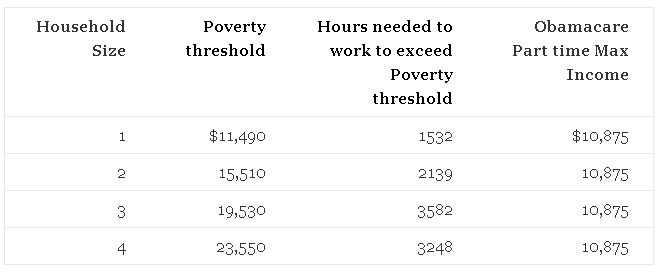

The US government poverty guidelines of the government follows – although depending on the interpretation of the specific agency and state – these numbers could be pretax or post-tax because the government guidelines do not specify:

Consider that 2000 hours are equal to a year working, and except for a single person on their own, this is not even close to a living wage for a family if there is only one bread winner. Now consider that most non-full time employment at retailers will likely fall to 1500 hours per year due to Obamacare.

Houston – we have a problem …. The law of unintended consequences over health care have made the existing minimum wage which was already too low problematic even with subsidies. The political wheels are turning – bringing the attention of the pundits and dumbed down masses to a few major retailers who help their employees get government assistance.

Even the big gun – Nobel Laureat Paul Krugman opined this week:

Still, even if international competition isn’t an issue, can we really help workers simply by legislating a higher wage? Doesn’t that violate the law of supply and demand? Won’t the market gods smite us with their invisible hand? The answer is that we have a lot of evidence on what happens when you raise the minimum wage. And the evidence is overwhelmingly positive: hiking the minimum wage has little or no adverse effect on employment, while significantly increasing workers’ earnings.

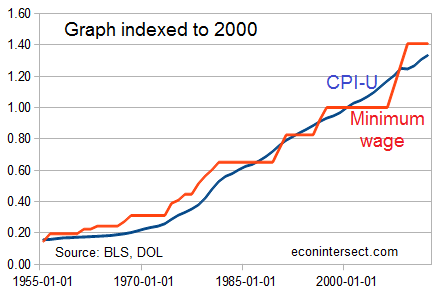

If you have the time, you can scan the “lot of evidence” – and if you are not already too biased, you will realize the empirical evidence is fairly weak – but that does not diminish that families cannot live on minimum wage. One of the primary arguments is that minimum wage has not kept up to inflation – the answer depends on how you index minimum wage, and how you view the CPI – but this argument is weak also.

It seems like the minimum wage has kept up with inflation for most periods since 1955. If the minimum wage was okay in 1955, should it not be okay today? Could the inflation index be flawed? Or is the current poverty level calculation flawed (too high)?

Note: If we picked a reference year between 1975 and 1980, minimum wage would have lagged inflation for much if the intervening time since.

Will increasing the minimum wage help? Like everything – there will be winners and losers. The losers will be the lower income families who are not benefited by the raise in the minimum wage – but will have to bear the higher costs which likely will be passed along.

Does this mean politicians should do nothing? Is it acceptable that income disparity continues to grow? Has the government shown they can manage the unintended consequences of their growing involvement in a languishing economy?

My concern about screwing with the minimum wage is with the laws of supply and demand – it is telling us that there are too many workers and not enough jobs. There is not a chance that increasing the minimum wage even begins to address this issue. Minimum wage is not a problem if there are more than one household worker. The real problem is not enough jobs being created in an economy which has been mismanaged for over ten years.

Do not take this post as suggesting that the minimum wage should not be studied and/or adjusted, but it is an argument that the minimum wage is not the core problem – and that any solution limited to simply adjusted minimum wage could lead further unintended consequences.

Other Economic News this Week:

The Econintersect economic forecast for December 2013 again improved. What this forecast cannot see is the real effect of austerity and Obamacare – but it does see that business is betting the effects on the economy will be minimal.

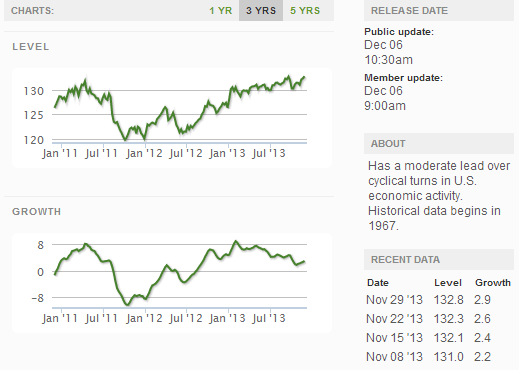

The ECRI WLI growth index value has been weakly in positive territory for over four months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today. .

Current ECRI WLI Growth Index

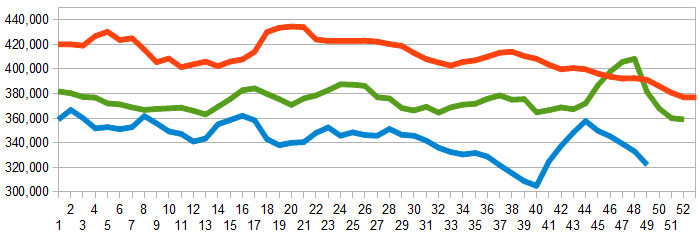

Initial unemployment claims went from 316,000 (reported last week) to 298,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate. The real gauge – the 4 week moving average – improved from 331,750 (reported last week) to 322,250. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line)

Bankruptcies this Week: OCZ Technology Group

Data released this week which contained economically intuitive components(forward looking) were:

- Rail movements growth trend is continuing to accelerate.

All other data released this week either does not have enough historical correlation to the economy to be considered intuitive, or is simply a coincident indicator to the economy.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks