When I previously wrote about gold, prices were around $1,316 an ounce and subject to a bearish head and shoulders formation on the charts, as you can see below. (Read “Why Gold Might Only Be Good for Traders Right Now.”) I was bearish on the precious metal then and continue to be so, at least when considering it as a buy-and-hold investment rather than a speculative trading opportunity.

Spot gold has fallen below $1,225 and appears to be set to take a run at the key support level of $1,200, according to my technical analysis. The reality is that even with the 7.5% decline from early October, I would still not be a buyer at the current price, unless I wanted to trade the yellow ore and hope for a possible oversold technical bounce back above $1,250.

Instead, given the attractive buying opportunities in the stock market, I’d advise more conservative investors to invest their dollars in stocks, rather than gold bullion at this time.

Some of the underlying fundamentals that have traditionally supported the metal are not evident. Yes, China is continuing to accumulate physical gold, but buying by India, which is the world’s largest buyer of the precious metal, has been stalling.

In addition, the yellow metal usually receives a lift from a weaker U.S. dollar. With the greenback showing some recent strength against other world currencies, especially in the emerging markets, the precious metal isn’t seeing any support from a weak dollar.

Inflation, a historically supportive variable for the precious metal, has also been largely benign across the world economies (with some exceptions). Without inflation rising higher (in spite of the exorbitant amount of easy money being pumped into the global economy), I just don’t see why anyone, aside from speculative traders, would buy the precious metal at this point.

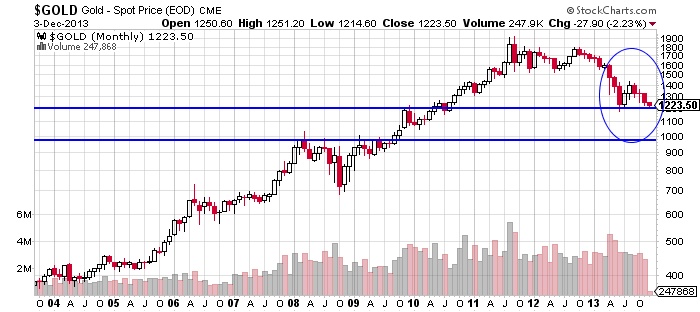

Traders may begin to look at gold as a speculative trade if prices head down toward $1,200 and below, as shown on the long-term chart below, which dates back to 2004. There is some decent support around $1,200, but the problem is that a failure to hold could see the metal fall towards $1,100 and $1,000, as shown by the lower blue horizontal support line on the following chart.

So unless you are a persistent gold bug that has remained loyal to the yellow ore since the $1,800 level in 2011, I would be hesitant to add gold as a buy-and-hold investment; instead, I continue to look for opportunities in equities. If gold prices do bounce back toward $1,300, I might consider entering the market on the short side and sell gold, as the fundamentals, at this time, don’t appear to be there. In the current market, gold investments are most beneficial to speculative traders.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Should Investors Hold Out For $1,300-An-Ounce Gold ?

Published 12/06/2013, 02:34 PM

Updated 07/09/2023, 06:31 AM

Should Investors Hold Out For $1,300-An-Ounce Gold ?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.