Yesterday, the Fed issued the statement from the FOMC meeting on June 9-10. The statement is little changed from the April edition. Nevertheless, there are two important differences.

First, the members of the committee have acknowledged the improvement in the economic situation since April, as they wrote that “financial conditions have improved, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.”

Moreover, according to new wording, the virus and the measures taken to protect public health “have induced” (instead of “are inducing” in April) sharp declines in economic activity and a surge in job losses.

Second, the Fed used a subtle forward guidance, reassuring the market participants that the quantitative easing will not end or even be tampered with any time soon. Perhaps to avoid taper tantrum, the FOMC wrote:

To support the flow of credit to households and businesses, over coming months the Federal Reserve will increase its holdings of Treasury securities and agency residential and

commercial mortgage-backed securities at least at the current pace to sustain smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions.

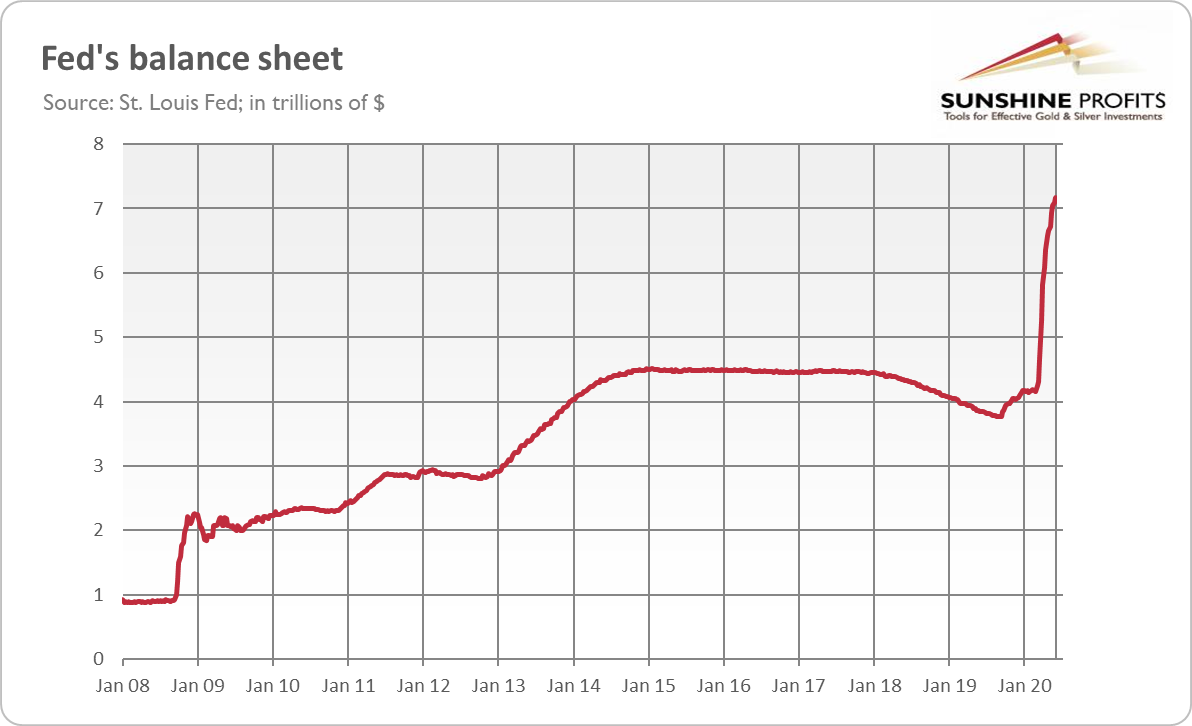

What does it mean for the gold market? On the one hand, the Fed’s balance sheet is already massive, as the chart below shows. Indeed, the U.S. central bank’s assets have surpassed $7 trillion in May and they are expected to rise even more to around $10 trillion because of the coronavirus crisis. So, the Fed’s intention to increase it at least at the current pace should raise it even more, spurring worries about the unconventional monetary policy and possibly support gold prices.

On the other hand, the Fed’s forward guidance and end of steady tapering of asset purchases could reassure Wall Street that the party of easy money and unlimited liquidity is going to last. The tap with cheap money will not be turned off any time soon, or it can be even unscrewed wider – so, the FOMC statement could support risk appetite and risky assets at the

expense of safe-haven assets such as gold. However, it seems that positive impact triumphed as gold prices rose yesterday amid the dovish FOMC statement, as the chart below shows.

June FOMC Projections and Gold

The FOMC issued yesterday not only the statement of its monetary policy, but also its fresh economic projections. Not surprisingly, all projections are much more pessimistic compared with December. The GDP growth and inflation will be lower, while the unemployment rate higher, as the table below shows.

What is important here, is that although the Fed sees recovery next year (which is normal, given the low base in 2020), the projections do not paint the V-shaped recovery, as the GDP will return to its pre-pandemic level only in 2022. As Fed Chairman Jerome Powell said during his press conference: “We all want to get back to normal, but a full recovery is unlikely to occur until people are confident that it is safe to reengage in a broad range of activities.”

This is rather good news for gold. The unemployment rate is expected to be 9.3% in 2020, 6.5% next year and 5.5% in 2021, versus 3.5%-3.7%range seen in December projections.

These are also quite positive projections for gold prices, as the unemployment rate is not expected to even return to its pre-pandemic level.

When it comes to PCE inflation, the FOMC sees muted inflation in 2020 (0.8% rate instead of 1.9% projected in December), and rebound in next years to 1.6 and 1.7% (versus 2% in both years forecasted in December). Lower inflation rates could reduce the demand for gold as an inflation hedge. However, the FOMC projects that inflation rates will be below its target, which will provide an excellent excuse for continuation of its dovish monetary policy, thus supporting gold prices.

Last but not least, the Fed sees its federal funds rate to remain near zero at least until 2022. As Powell said during the press conference: “We’re not even thinking about raising rates.”

This is also good news for gold from the fundamental point of view, which thrives under a zero interest rate policy and very low real interest rates.