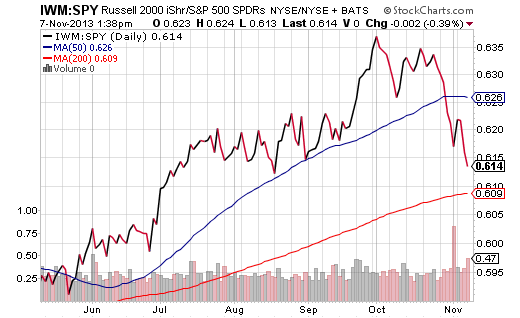

For the better part of 6 months, small company stocks have outperformed large company stocks. That’s not unusual for an unapologetic bull rally. Indeed, if investors are embracing risk, then they are typically willing to pay a higher price to own faster growing corporations.

Since the beginning of October, however, riskier holdings have been losing momentum to the large-cap bellwethers. The iShares Russell 2000 (IWM):SPDR S&P 500 Trust (SPY) price ratio demonstrates the relative weakness in smaller company stock shares.

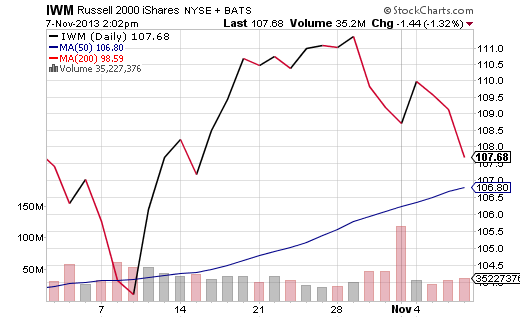

Granted, the major news outlets tend to focus on the Dow, the NASDAQ and the S&P 500. Moreover, many programs enjoy enhanced ratings by covering sexy topics like the Twitter IPO. Still, it may be a disservice to viewers when talking heads celebrate factoids like, “the market has been up for 17 of the last 20 trading days.” Expressing enthusiasm for the Dow in this manner may ignore other facts, like the iShares Russell 2000 (IWM) trading at the same price that it did at the start of October.

Is it possible that investors are beginning to grow squeamish about small company valuation? Are trailing P/Es of 85 and forward 12-month P/Es of 25 a little too rich for some people’s blood? Hard to say. Yet a continuation of Federal Reserve interest rate manipulation alone does not seem to be reason enough to overweight IWM.

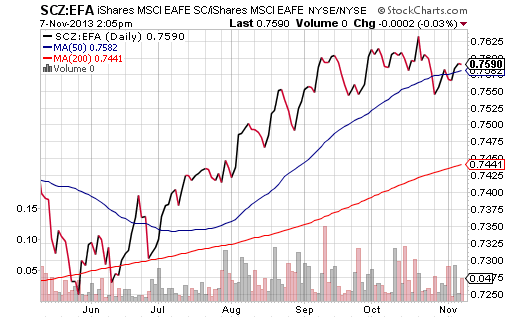

Interestingly enough, the valuation concern is not present in Europe, Australia (Australasia) and the Far East. Consequently, small cap outperformance has not waned; the iShares MSCI EAFE Small Cap (SCZ):iShares MSCI EAFE (EFA) price ratio shows that SCZ is maintaining its relative strength.

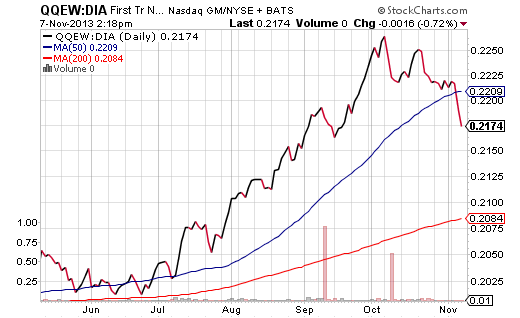

The under-achievement of small caps is not the only sign that investors may be turning defensive. The First Trust Equal Weighted NASDAO 100 (QQEW) has been giving ground to the SPDR Dow Jones Industrials Fund (DIA). Ostensibly, investors appear to be backing away from tech-heavy growers and favoring “old school” favorites in the Dow Industrials. The QQEW:DIA price ratio looks ominously similar to the IWM:SPY price ratio.

While few people believe that the Federal Reserve would enact a surprise tapering in December, some folks may be charting a more defensive course in light of an eventual tapering in 2014. Of course, a lot may come down to the October jobs report released on Friday (11/08) as well as the November jobs report released in early December. Job growth and wage growth will be the Fed’s main justification for backing away from buying U.S. debt at the same pace. Weak jobs reports would likely keep the Fed on hold much longer… and the markets rising with all the complacency that 2013 has represented.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Should Changing Market Dynamics Concern Small Cap ETF Owners?

Published 11/08/2013, 02:03 AM

Updated 03/09/2019, 08:30 AM

Should Changing Market Dynamics Concern Small Cap ETF Owners?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.