The VanEck Vectors Oil Services (NYSE:OIH) is failing to capitalize on an up day for oil prices. After bottoming at a record low of $16 earlier, the fund -- whose main holdings include Schlumberger (NYSE:SLB) and Halliburton (NYSE:HAL) -- was last seen trading down 2.7% at $16.18, pacing for a fifth straight loss. This follows downwardly revised 2018 and 2019 oil price forecasts from the U.S. Energy Information Administration (EIA).

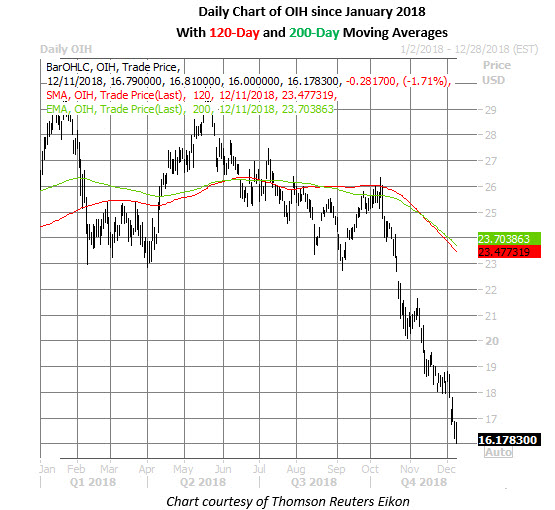

The fund has been locked in a long-term downtrend, with its most recent leg lower sparked by unsuccessful tests of its 120-day and 200-day moving averages back in early October. Since its Oct. 9 peak at $26.33, the exchange-traded fund (ETF) has shed more than 39%, putting OIH on track for its worst quarter ever.

Options traders, meanwhile, have been actively accumulating calls on OIH in recent weeks. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the fund's 10-day call/put volume ratio of 13.14 ranks in the 97th annual percentile, meaning puts have been bought to open over calls at a faster-than-usual clip.

While the bulk of this activity has centered at the weekly 12/28 20-strike call, today's options traders are targeting the January 2019 18-strike call. With call volume running at six times the average intraday pace, Trade-Alert pegs buy-to-open activity at the back-month strike, suggesting speculative players are targeting a short-term bounce for the oil ETF.

It's possible short oil traders are contributing to this call-heavy activity, using options to hedge against any upside risk. Whatever the reason, short-term OIH options are pricing in sky-high volatility expectations at the moment, per the fund's 30-day at-the-money implied volatility (IV) of 44.1% -- an annual high. Plus, the ETF's 30-day IV skew of 4.7% registers in the 15th percentile of its 12-month range, indicating call options are near parity with their put counterparts.