Target Corporation (NYSE:TGT) stock is down 0.3% at $83.04 in afternoon trading, as investors gear up for the company's impending earnings report. The retail giant is slated to release its second-quarter earnings before the market opens tomorrow, Aug. 22. Below we will dive into Target's earnings history, as well as how TGT stock has been faring on the charts, and what options traders are expecting.

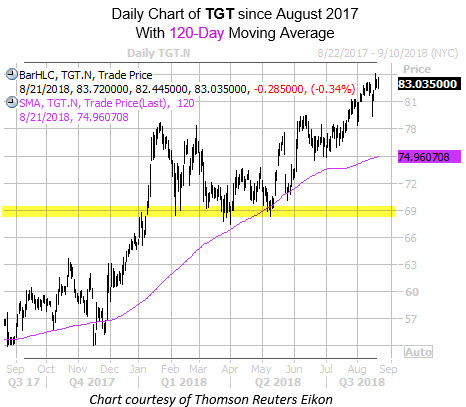

TGT has been in a long-term uptrend, gaining 47% in the past year. Pullbacks earlier this year were contained by a floor of support near $69 and the 120-day moving average. Since its latest bounce off support, Target stock touched a two-year high of $84.13 on Aug. 17.

Looking at TGT's earnings history, the stock has closed lower the day after the company reported in five of the last eight quarters, including the last three in a row. Looking back all eight quarters, the shares have moved 6.2% the day after earnings, on average, regardless of direction. This time around, the options market is pricing in a slightly larger-than-usual 8.8% move for Wednesday's trading.

Digging deeper, short-term traders are more call-skewed than usual, with its Schaeffer's put/call open interest ratio (SOIR) of 0.34 ranking in the lowest percentile of its annual range. This indicates that near-term call open interest outweighs put open interest by a wider-than-usual margin right now.

Today, however, put options are flying off the shelves at three times the average intraday pace, with 13,000 traded so far. Most of the action appears attributable to spread activity in the weekly 8/24 series. It appears the speculator may have initiated a long straddle at the 82.50-strike put and 88.50-strike call, and helped fund the position by selling to open 77.50-strike puts. If so, the trade was established for $2.25 per trio of options, and will profit if TGT moves above $90.75 (call strike plus net debit) or below $80.25 (bought put strike minus net debit). However, profit potential on a move south of $77.50 is limited, due to the sold put.

Analysts remain uneasy toward Target stock, despite the equity's quest for new highs. Of the 15 firms following the retailer, 11 sport tepid "hold" or worse ratings. Plus, the stock's average 12-month price target of $79.87 represents a 4% discount to current trading levels.