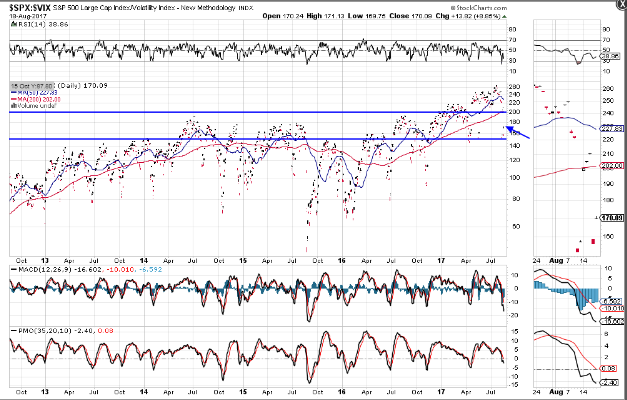

Further to all the UPDATES noted on my original post of August 15th, I would note that, as of Friday's close, the SPX:VIX Ratio managed to stay above the critical 150 Bull/Bear Line-in-the-Sand major support level, but remains well below the 200 New Bull Market resistance level...as shown on the following Daily and Monthly ratio charts.

Next week, we could very well see a re-test of the 200 level (which happens to intersect with the 200-day moving average), in anticipation of any favourable news from global Central Bankers, policy makers, economists and academics attending the upcoming annual Jackson Hole Economic Policy Symposium (August 25 & 26), before traders make a final commitment, one way or the other, as to longer-term direction...Fed Chair, Janet Yellen was scheduled to speak on August 25 at 10:00 am ET and ECB President, Mario Draghi is also expected to speak at some point.

For further details on what to watch for on a variety of timeframes, I'd direct your attention to my recent post on this ratio here.