Retail giant Guess? Inc (NYSE:GES) is down 1.5% at $22.50 at last check, moving lower as investors gear up for the company's fourth-quarter report, which is slated for after the close tomorrow, March 20. Below we will dive into the options market's outlook on the stock's post-earnings move, and take a look at how the retailer has been faring on the charts.

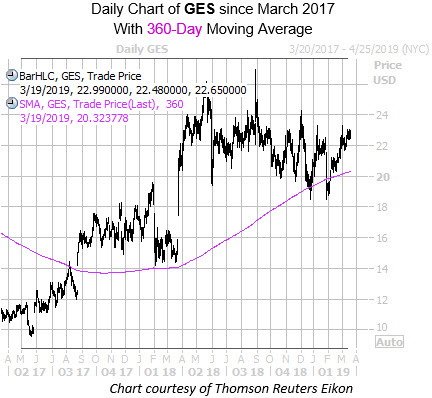

Long-term, GES has enjoyed the help of its 360-day moving average, a trendline supportive of the shares since their 2017 late-August bull gap. The moving average contained Guess stock's late-December and January pullbacks, and recently pushed the shares back above $22, and to a 53% year-over-year lead.

Diving into GES' earnings history, the clothing retailer has traded higher the day after its quarterly report in five of the past eight quarters, including the last two in a row. Over the past two years, the shares have swung an average of 14.2% the day after earnings, regardless of direction. This time around, the options market is pricing in a smaller-than-usual 13.9% move for Thursday's trading.

Digging deeper, the stock's 30-day at-the-money (ATM) implied volatility (IV) was last seen at a lofty 59.5% earlier, ranking in the 87th percentile of its annual range. This indicates short-term GES options are pricing in extremely elevated volatility expectations at the moment.

Lastly, Guess? stock's Schaeffer's put/call open interest ratio (SOIR) comes in at 0.50, ranking in the low 3rd annual percentile. In other words, near-term options traders have rarely been more call-biased in the past year.