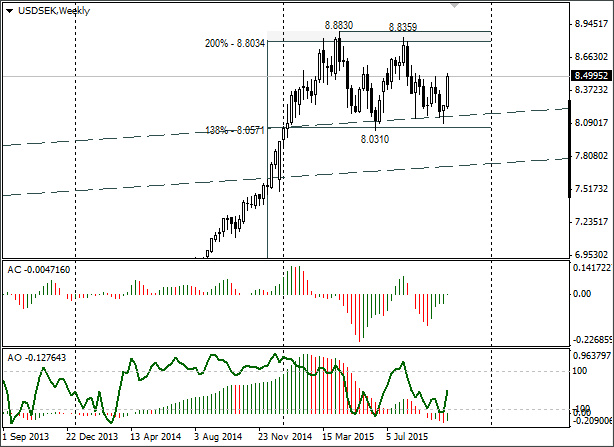

Trading opportunities for currency pair: the USD/SEK has broken away from the support. A double top didn’t quite form. I’ll risk saying that we’ll see a W form with an 8.8359 target. This idea for growth will become invalid if we see a close of the weekly candle below 8.5544.

Background

My last USD/SEK idea came out on 24th August, 2015. Back then the price was 8.3516 and a double top was beginning to form on the weekly. I expected to see an initial fall to 8.0571 and then to 7.7231. The USD/SEK fell to 8.0924. At 2592 points the position went into the positive. It missed the first target by a whisker. The idea became invalid and we came out evens.

Current situation

At first a hammer formed. Then Draghi let us know his thoughts and market participants began to buy USD throughout the market. On 28th October, the US Fed will make a decision on its base rate. Buyers are currently pushing the dollar rate towards the 8.8359 resistance.

What’s interesting at the moment?

After the pinbar, the USD/SEK rose to 8.4995. With the current price pattern, there’s reason to believe that the USD/SEK will return to 8.8359. The triangle to crisis is a rare pattern, so I’m going for a W shaped pattern forming.