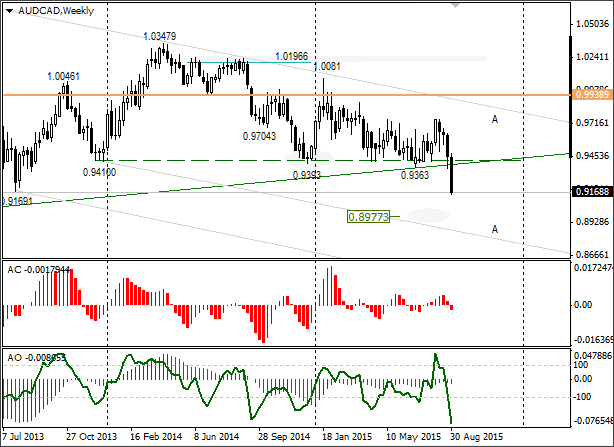

Trading opportunities for currency pair: The important levels have been passed. Weak statistics from Australia and a lack of risk taking are keeping the pressure piled on the Aussie. Most likely, the 0.8977 target will be broken by the end of the week. If oil quotes rise and the speed of the AUD/CAD fall doesn’t slow up, the target could shift along the A channel from 0.8977 to 0.8802.

On 6th April, I was waiting for a break in the support and a fall in the rate to 0.8977 due to further expectations of the Australians relaxing their monetary policy and a fall in the price of iron ore. For eight months the sellers have been trying to strengthen below 0.9390. In the end, they’ve broken through.

In a week the AUD/USD fell 250 points to 0.6907. The AUD/CAD fell 278 points to 0.9168. The Australian dollar has fallen under pressure after the publication of disappointing retail sales data for the country. Retail sales in July fell unexpectedly.

On Tuesday the Australian Reserve Bank left their base rate unchanged at 2%. The regulator made note of the fact that the Australian dollar is falling due to the fall in commodity prices. Due to the slowdown in growth for the mining industry, the RBA is trying to support the economy with low interest rates. RBA Governor Glenn Stevens announced that keeping the rates as they are sits in keeping with the current economic conditions.

As for the Canadian dollar, at the moment it’s looking better than the Australian dollar since the oil price has rebounded from 42.20. In addition, Canadian data is coming out better than Australian. Participants staying clear of risks is a reason the Australian dollar remains under pressure.

On Friday Brent attempted to increase in price after a Baker Hughes report came out. According to the data, the number of drilling rigs in the US for the week beginning 28th August fell by 13 to 864. In terms for the year, it is a 1061 fall. The number of oil drilling rigs fell by 13 to 665. The number of gas drilling rigs remained unchanged at 202. There has been a significant fall in operating oil drilling rigs over the last three months.

The dollar is strengthening throughout the market after the NFP came out flying and held back a rise in oil quotes. Monday was a holiday in Canada and the US, so the markets were closed. Due to this, Brent nearly reached 51 USD per barrel. A growth in oil prices will offer support to the Canadian dollar. Due to this, the AUD/CAD fall will hasten.

The important levels have been passed. More than likely, the 0.8977 target will be reached by the end of the week. If oil quotes rise and the speed of the AUD/CAD fall doesn’t slow up, the target could shift along the A channel to 0.8802.