Short term top coming with tomorrow's employment report?

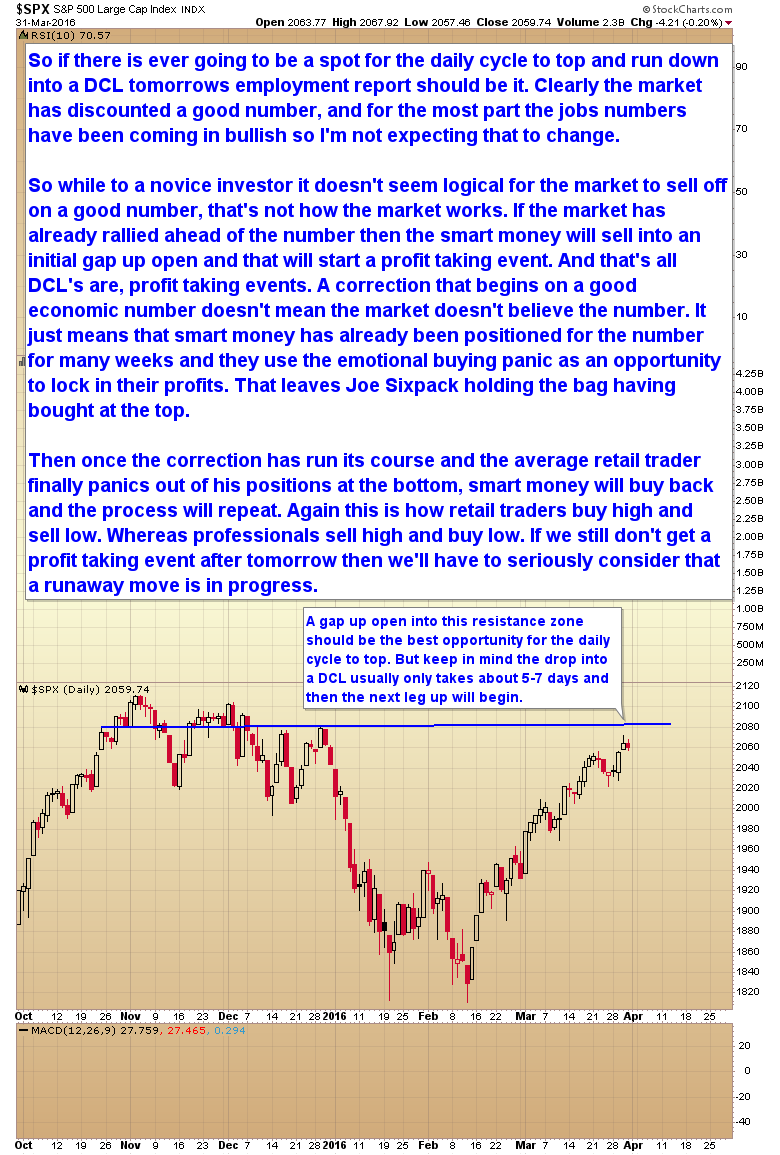

If there is ever going to be a spot for a short term top in this stock market, in this case a daily cycle top, today's employment report should be it.

Clearly, the market has been discounting a good number, and for the most part the jobs numbers have been coming in bullish for some time, so I’m not expecting that to change.

To a novice investor it probably doesn’t seem logical for the market to sell off on a good number, but that’s not how the market works. If the market has already rallied ahead of the number then the smart money will sell into an initial gap up open and that will start a profit taking event – thereby creating a short term top.

And really, that is how moves into a daily cycle lows are begun. Daily cycle tops and their ensuing correction are profit taking events. A correction that begins on a good economic number doesn’t mean the market doesn’t believe the number. It just means that smart money has already positioned for the good number of weeks in advance and then use the emotional buying panic as an opportunity to lock in their profits. This leaves Joe Sixpack holding the bag as he has once again bought at the top.

Then, once the correction has run its course and the average retail trader finally panics out of his positions at the bottom, smart money will buy back and the process will repeat.

Again, this is how retail traders buy high and sell low. Whereas professionals sell high and buy low.

If we still do not get a profit taking event after today then we’ll have to seriously consider that a runaway move is in progress.