The Bulls have had a good run, but I believe their time is up now when it comes to the Silver market.

Currently the rebel faction in Iraq (ISIS) is starting to take a lot of pressure from Iraq’s and Iran’s armed forces, both of which are out to crush them and stop the current movement. This in turn has led to a drop off in the speculation in precious metals.

Secondly, FOMC is tonight and is expected to carry home the usual message of “steady as she goes” when it comes to tapering. I would also anticipate Yellen talking up those eventual rate rises, especially with inflation beating expectations yesterday for the previous month. As a lot of Americans want to see a return to normal monetary policy, especially the hawks.

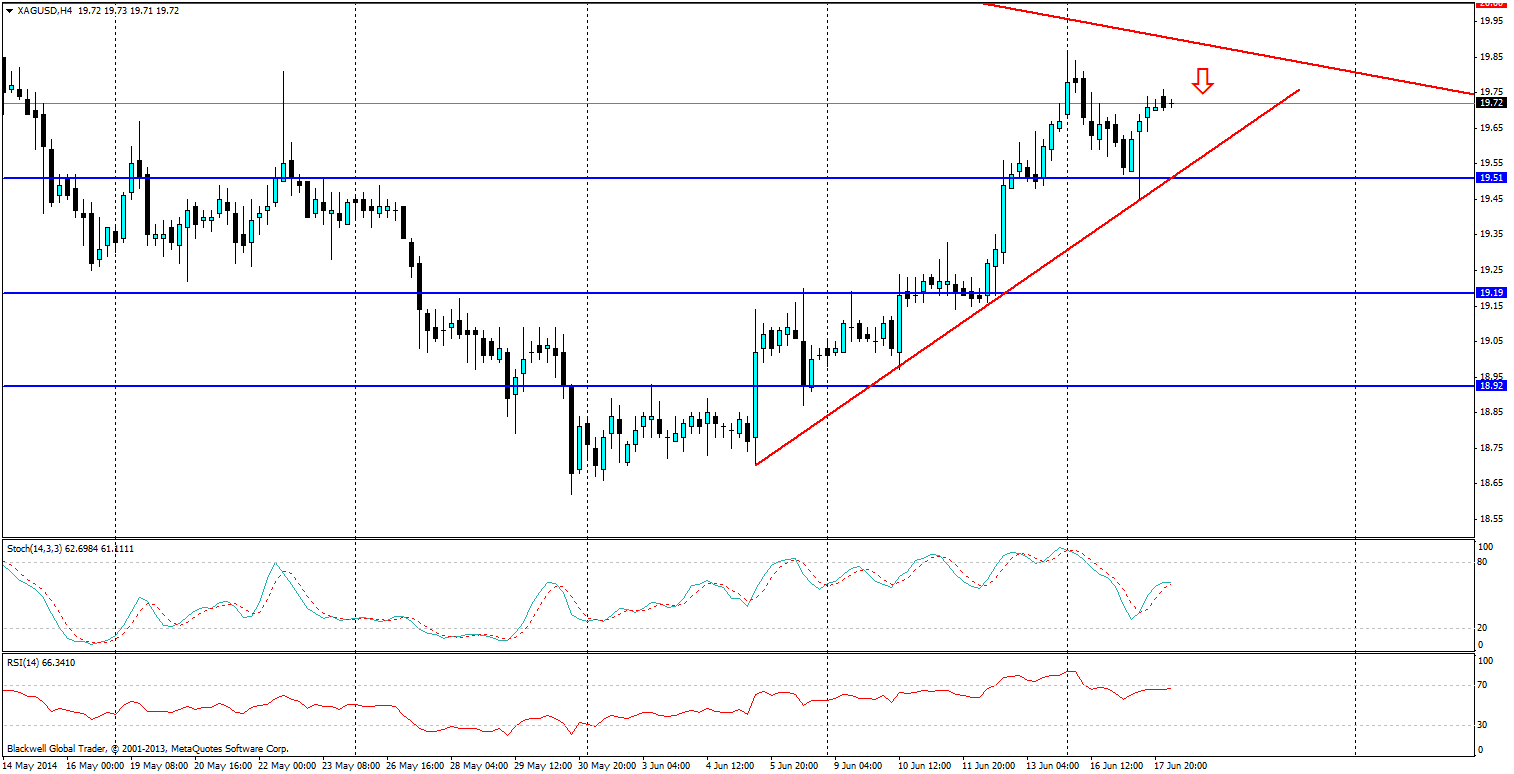

Source: Blackwell Trader (XAG/USD, D1)

When looking at the chart its quite clear the silver short term bullish run we have seen, is starting to lose a fair bit of momentum, as the pressure in Iraq starts to taper off. Markets will now be looking to shift lower to test the short term trend line, and even breakthrough if they can get enough momentum; something that FOMC tonight could easily provide.

Indicators are starting to show a turning of the market; RSI pressure is starting to taper off, and stoch is also showing markets starting to trend lower, as momentum starts to lack heavily.

Current support levels can be found at 19.51, 19.19 and 18.92; but it’s more than likely that the short term trend line will initially act as dynamic support. When a breakdown does occur though, market participants should look for support levels to help exit from positions.

Overall, silver is one to watch. The short term bulls are running out of steam and markets will likely look to catch movements lower on FOMC tonight. The question will be how far it can drop in a short amount of time.