The recent slide in the bond market has been granted a reprieve over the last two months. Interest rates have retreated in recent weeks, which has lifted bond prices. The challenge is deciding if this is noise or the start of an extended run higher for fixed-income securities.

The key factor: inflation expectations. Specifically, is the recent surge in pricing pressure transitory? If not, the Federal Reserve may be forced to raise interest rates sooner than expected.

Such a policy change will nip any bond-market rebound in the bud. Alas, the final word on inflation’s trajectory is months away at the earliest. That leaves investors with the usual challenge: deciding how to act in real time with sketchy insight on ex ante macro data.

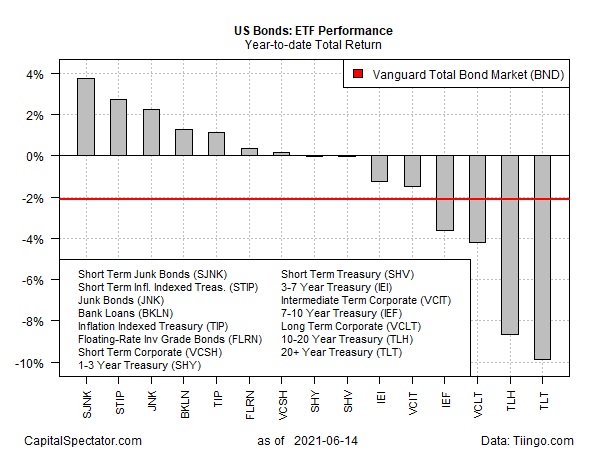

What is clear is that short-dated junk bonds and inflation-indexed Treasuries continue to lead the US bond market year-to-date through yesterday’s close (June 14), based on a set of ETFs.

SPDR® Bloomberg Barclays Short Term High Yield Bond ETF (NYSE:SJNK) is up 3.8% so far in 2021. Nipping at SJNK’s heels: iShares 0-5 Year TIPS Bond ETF (NYSE:STIP), which is higher by 2.7% this year.

By some accounts, attempting to divine the future on matters relevant to the future path of inflation and interest rates is unusually challenging at the moment, and so a reasonable response is to favor cash and wait for clearer signals. That’s the message from JPMorgan Chase (NYSE:JPM) Chief Executive Jamie Dimon, who says:

“We’ve actually been effectively stockpiling more and more cash, waiting for opportunities to invest at higher rates. So our balance sheet is positioned (to) benefit from rising rates.”

Favoring short-term bonds is a close cousin to Dimon’s preference, which may explain the performance leadership in the funds referenced above.

Meanwhile, making mistakes in the current environment comes with stiff penalties. Holding long-term bonds has certainly been a painful trade this year. The worst year-to-date performer in the chart above: iShares 20+ Year Treasury Bond (NASDAQ:TLT) has shed 9.9% so far in 2021.

The loss is a bit lighter relative to fund’s previous low, reached in late-March, but that’s weak tea for anyone nursing a roughly 10% loss this year via a so-called “safe” investment.

This week’s Federal Reserve meeting, which starts today and concludes on Wednesday with a policy statement and press conference, may drop new clues on the central bank’s plans for the rest of the year.

Economists are expecting that the current 0%-to-0.25% range for the Fed funds target rate will remain unchanged. Nonetheless, the market will be closely analyzing the central bank’s comments for hints about where we go from here.

Tim Duy, an economist at SGH Macro Advisers, expects the Fed will signal that it will maintain its current policy track in tomorrow’s announcement and press conference. “The Fed in general, and the Federal Reserve Chair Jerome Powell and his Board colleagues in particular, are very much committed to the Fed’s current implementation of its new framework,” he writes in a note to clients.

"The overarching goal of the current policy stance is to avoid making the perceived mistakes of the last cycle. Those mistakes were the taper tantrum and the premature withdrawal of monetary accommodation. In response, the Fed has placed a new emphasis on its employment mandate with a focus on achieving the pre-pandemic labor market conditions as a lower bound on what might be considered full employment."

At the same time, Duy adds that “the Fed cannot delay tapering forever” and “the arguments in favor of tapering have grown stronger in recent months.”

Accordingly, markets will be keenly focused on how, or if, the Fed attempts to thread this needle. As The Wall Street Journal reminds, “Federal Reserve officials could signal this week that they anticipate raising interest rates sooner than previously expected following a spate of high inflation readings.”

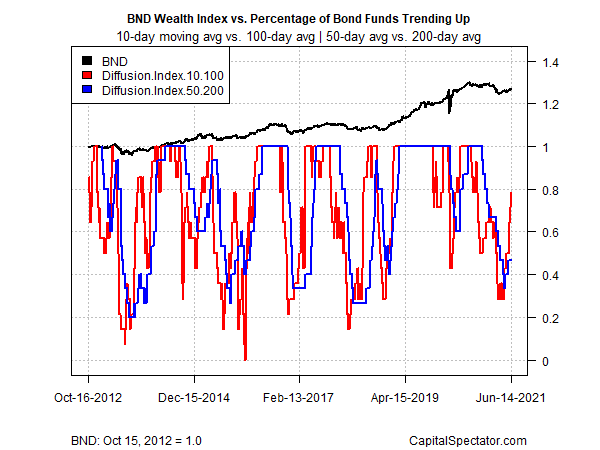

Meanwhile, short-term momentum for bonds generally has made a sharp bullish U-turn lately, based on a set of moving averages (see chart below). Uncertainty, however, remains high for deciding if this is more signal than noise. The hope, however thin, is that tomorrow’s Fed announcement will offer fresh clarity on how the rest of the year unfolds.

Don’t hold your breath.