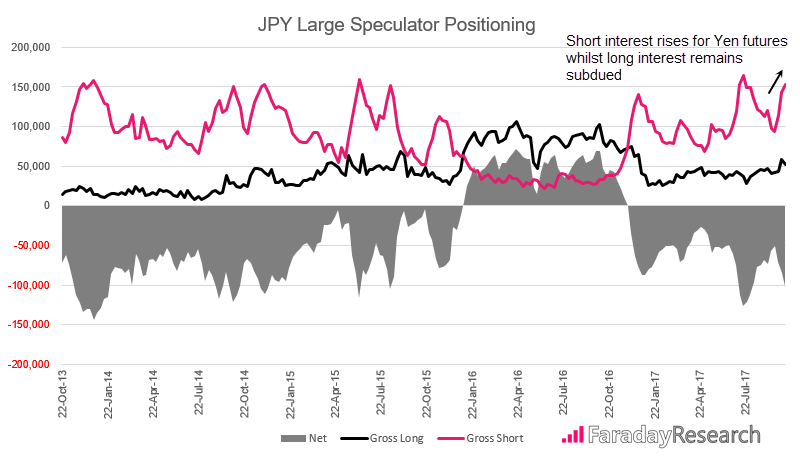

Short interest for the Japanese yen has picked up in recent weeks for two primary reasons: economic data is rising and Prime Minister Abe appears to be back in the driver's seat ahead of this weekend’s election.

Rising Yen Shorts

As large-scale quantative easing is one of the pillars to Abenomics, traders have even less reason to expect any sudden policy changes from the Bank of Japan (such as tapering) if the PM is re-elected. Because Japan is one of the few economies to weaken — even as positive data and quantative easing undercuts the currency — gross short positioning has now risen to three-month highs.

The speculative positioning data is provided by CFTC on a weekly basis, which better serves as a guide to general sentiment for higher time frames. But today we note that price action on the daily yen futures chart is of particular interest due to its shallow pullback following a directional move lower. If we are to see prices break lower, we can assume broad yen weakness, which would then be supportive of crosses such as USD/JPY, AUD/JPY, EUR/JPY etc.

Fall From Grace

On September 7, JPY broke to a five-month high. Yet the sharp reversal lower on the following session quickly saw sentiment shift in favor of the bears, who remained in firm control for the best part of September. While support has since been found at 0.8828, it's important to note that the shallow retracement from that low could be part of a bear flag. A break lower of the flag would be of technical interest as it assumes a continuation of the bearish trend, although we also note nearby support.

Pivotal Rising Support

Support has since been found at 0.8828, which marked the September low while also confirming a third touch of a rising support level from March. We do not consider its trajectory bullish enough to label it a trendline, but while it remains unbroken, it's considered a worthy level of support. And that makes the area pivotal over the coming week/s as it could mark celebration or embarrassment for bears — depending on how prices react around it.

Of course, elections can and do throw surprises where results are concerned, which leaves the yen vulnerable to a bounce higher if Abe were to lose or economic data soured. Which is why we will steer clear of JPY crosses leading up to the elections and then assess the technical landscape from Monday onward.

We should add that we are using yen futures as a proxy of broad yen strength or weakness, which is not to say that individual JPY crosses cannot break to new highs or lows without the Futures breaking its relevant swing. But if we are to see yen futures break support, it adds further weight to the moves of individual crosses as part of our overall analysis.