In a very short statement, after announcing there would be no change to its monetary policy, the Bank of Canada (BoC) delivered a message that some analysts called “more optimistic than expected.” The institution seemed to want to leave behind its negative rhetoric by underscoring growth in consumption and housing, but took care to note that the economy must still deal with excess capacity and disappointing exports.

It is interesting to note that the BoC commented on the real estate sector by indicating that macroprudential measures still have not had the desired effect of cooling down the market. Is this the sign that the BoC is ready to act? Will renegotiating NAFTA and upcoming economic indicators give the central bank sufficient leeway in this area?

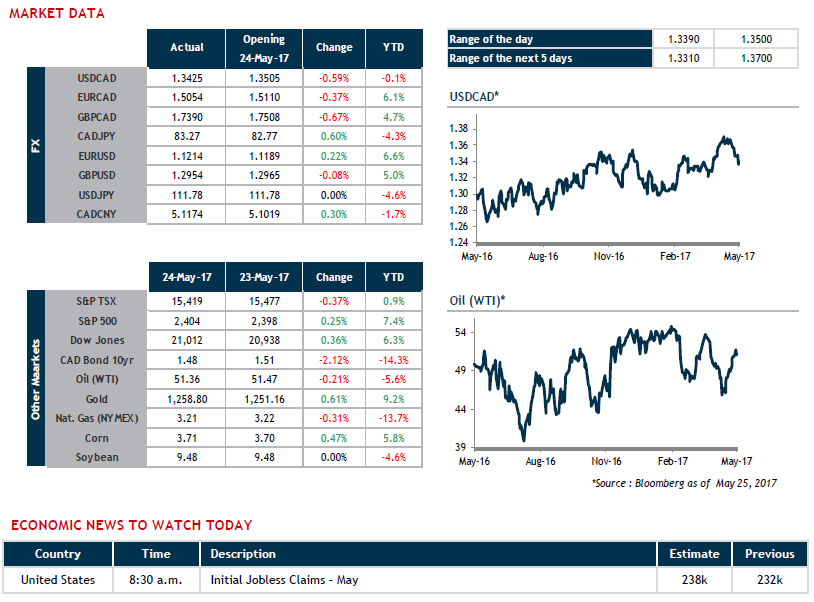

Since the announcement, the loonie has gained close to 100 points against the USD, showing the extent to which investors were taken by surprise.

Today, we’ll be keeping an eye on news related to the meeting of oil-producing nations. Early feedback is pointing to a renewal of the current agreement for nine months with output maintained at the same level. Crude oil is down this morning.