We are about to embark on a family vacation to the beach. I grew up going to the beach every year. It was an extended family event. We would head to Ocean Isle Beach in North Carolina and get 4 beach houses for my Mom’s mother, 5 siblings, spouses and all us kids. It was great. We would rent rafts and the Dads would pull us out to the break line for a ride in. Many times we saw hammer head sharks in the water when we were out there. No one ever panicked. The Dads just gave us one more ride to shore and we got out.

Thinking of that now has my wife thinking we need to buy our own shark cage to go to the beach. I understand. She grew up in Ohio (where we live now) so trips to the ‘beach’ meant the shores of Lake Erie. No sharks there. But it got me thinking. As we plan to gather supplies from my favorite store, Costco (NASDAQ:COST), I wondered if they sell shark cages. I mean you can buy everything else there.

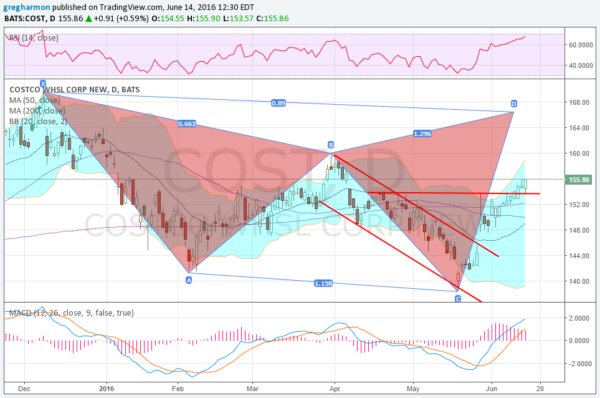

I also wondered how the stock of my favorite store was doing. The chart below tells the story. Since making a bottom in May it rose back to the April resistance level. Last week saw it peek above that on Friday, and continue this week. By Tuesday it had closed the gap from early April. h and there is one more thing about the chart.

It seems there are Sharks circling at Costco. A harmonic Shark pattern that is. It will confirm with a move in price over $160. From there it creates 2 potential Reversal Zones (PRZ’s). The first is shown at about 166.50. The second would be further above at 173.25. There is momentum behind the current run. The RSI is in the bullish zone and rising, and the MACD is moving higher. Even the Bollinger Bands® are shifting and opening higher.

You can use that resistance break line as a stop loss and ride it higher risking about $2.50. Or consider using July 155 Calls for about $3.50 to limit your risk absolutely to the premium paid and add leverage. A move in your favor and you will be the shark.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.