Shire plc (NASDAQ:SHPG) reported second-quarter 2017 earnings of $3.73 per American Depositary Share (ADS), beating the Zacks Consensus Estimate of $3.53 and up 10.4% from the year-ago quarter figure of $3.38.

Revenues surged 54% to $3.75 billion and beat the Zacks Consensus Estimate of $3.73 billion.

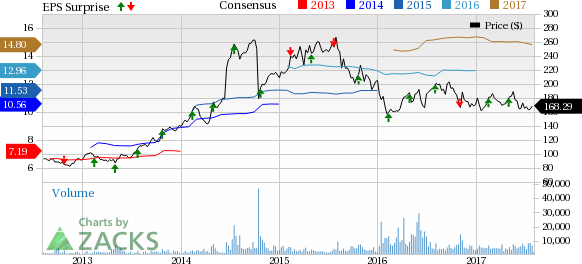

Shire’s shares have underperformed the industry so far this year. The stock fell 5.2% during this time against the industry’s 0.9% rise.

Quarter in Detail

Product sales soared 55% year over year to $3.6 billion primarily due to the inclusion of $1.7 billion of legacy Baxalta sales. Excluding Baxalta, product sales were up 7%, driven by strong performance of Internal Medicine (up 7%).

Royalties and other revenues were up 44% to $154 million primarily due to contract manufacturing revenues acquired as part of the Baxalta transaction.

The company’s Ophthalmology franchise contributed $57.4 million to total product sales and held 23% of the U.S. market (as of Jun 2017), following the launch of Xiidra in Aug 2016.

While Vyvanse sales remained flat at $518.2 million, sales of Lialda came in at $207.8 million, up 7%. However, sales of Adderall XR decreased 30% primarily due to additional generic competition.

The sales of Mydayis came in at $16 million since its approval on Jun 20, 2017.

While sales of Firazyr were up 1% to $137.4 million, Cinryze sales increased 2% to $175.9 million from the year-ago quarter. Moreover, Elaprase sales increased 5% to $161 million attributable to an increase in the number of patients on therapy. Also, Kalbitor sales increased 16% to $20.6 million.

Gattex and Natpara showed impressive performance with sales increasing 69% and 73% to $75.3 million and $83.4 million, respectively. Oncology sales added $62.5 million to total revenue.

Gross margin (adjusted) declined to 76.1% from 80.4% in the year-ago quarter. Research and development (R&D) costs were up 84% to $542.4 million primarily due to milestone and upfront payments and the inclusion of costs related to Baxalta. Selling, general & administrative (SG&A) expenses increased 33% to $899.1 million, primarily due to the inclusion of Baxalta related costs and XIIDRA marketing costs.

2017 Outlook Updated

Shire updated its earnings per ADS guidance in the range of $14.80–$15.20 (previous $14.60–$15.20). However, product sales projection was lowered to the range of $14.3 billion and $14.6 billion (previously $14.5-$14.8 billion) taking into account the anticipated sales erosion of ulcerative colitis drug, Lialda due to the launch of a generic version. The company maintained its forecast for royalties and other revenues of around $600–$700 million, including contract manufacturing revenues from Baxalta. Gross margin is estimated between 74.5% and 76.5%.

Pipeline Update

Shire continues to progress with its pipeline candidates. In Jun 2017, the FDA approved attention deficit hyperactivity disorder (ADHD) candidate, Mydayis, in patients aged 13 years and older. Moreover, another ADHD drug, Intuniv, was approved in Japan in children and adolescents from 6 to 17 years old in May. Veyvondi received approval in the EU in June for treating bleeding episodes and peri-operative bleeding in adult patients with Von Willebrand disease.

Subsequent to the quarter in July, Shire announced the submission of a new drug application for Firazyr to the Pharmaceutical and Medical Devices Agency in Japan for the treatment of hereditary angioedema.

Our Take

Shire’s second-quarter results were encouraging with the company beating both top- and bottom-line estimates driven by the sales of Baxalta. The approval of Intuniv in Japan is expected to boost sales. However, sales of Lialda continue to lag due to additional generic competition.

The approval of Xiidra boosted the company’s ophthalmology space. The uptake has been strong with 13% sequential growth in prescriptions and roughly 23% of the total market by the end of Jun 2017. The drug will also be filed for approval in Europe in third-quarter 2017. The label expansion of Cinryze in pediatrics and conditional approval of Natpara in Europe should continue to drive the top line going ahead.

Zacks Rank & Key Picks

Shire carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the pharma sector include Summit Therapeutics PLC (NASDAQ:SMMT) , Immune Design Corp. (NASDAQ:IMDZ) and Endocyte, Inc. (NASDAQ:ECYT) . All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Summit’s loss estimates narrowed from $2.36 to 32 cents for 2017 over the last 30 days. The company delivered positive earnings surprise in each of the four trailing quarters with an average beat of 25.55%. Its share price is up 66.4% so far this year.

Endocyte’s loss estimates narrowed from $1.20 to 88 cents for 2017 over the last 60 days. The company came up with a positive earnings surprise in three of the four trailing quarters with an average beat of 6.41%. The company is scheduled to release second quarter results on Aug 8.

Immune Design’s loss per share estimates narrowed from $2.44 to $2.37 for 2017 over the last 60 days. The company delivered positive surprise in three of the four trailing quarters with an average beat of 12.94%. The stock is up 90% so far this year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Endocyte, Inc. (ECYT): Free Stock Analysis Report

Shire PLC (SHPG): Free Stock Analysis Report

Immune Design Corp. (IMDZ): Free Stock Analysis Report

Summit Therapeutics PLC (SMMT): Free Stock Analysis Report

Original post

Zacks Investment Research