Shield Therapeutics (LON:STXS)’ interim results highlight a momentous year to date, with the FDA approval of primary asset Feraccru/Accrufer, for the treatment of iron deficiency (ID) in adults with any underlying cause. Royalties received from early sales of the product in the UK and Germany by partner Norgine are encouraging. The AEGIS-H2H study reported positive data, strengthening the product’s profile and leading to a €2.5m development milestone from Norgine. We expect a further ramp up in sales in 2020/2021 as pricing and reimbursement conclude in some European countries, leading to ongoing rollouts. A key inflection point is a US partnering deal, which management guides could be concluded by end-2019; an upfront licensing payment would extend Shield’s cash reach beyond our forecast of H220. We value Shield at £273m.

Norgine execution key to EU opportunity

Feraccru is available in Germany and the UK for the treatment of ID in adults, through partner Norgine; sales in H119 led to £0.3m in royalties. Feraccru is initially benefiting from Norgine’s footprint in gastroenterology offices. Sales uplift will depend on pricing and reimbursement during the rollout through Europe (2020 onwards) and the presentation of positive AEGIS-H2H data (non-inferiority to IV iron), which should strengthen Feraccru’s appeal to prescribers. Other near-term inflection points include a US partnering deal, which we assume will occur in the next 12 months and currently forecast deal terms of a £15m upfront and a flat 20% royalty rate. Negotiations for out-licensing the rights to Feraccru in China are also underway and could present further upside to our base-case assumptions.

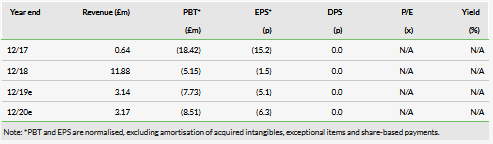

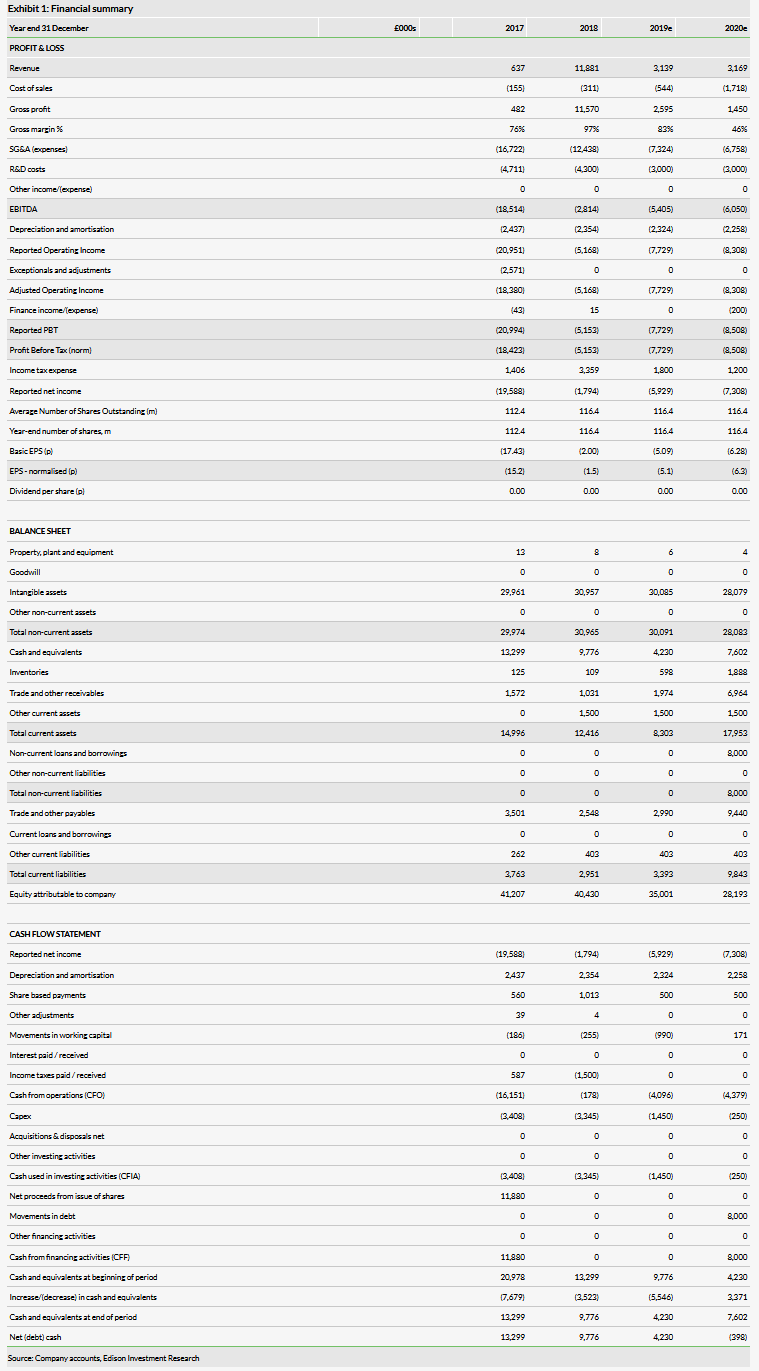

Financials: Cash runway into 2020

Shield reported revenues of £2.6m and a net loss of £2.0m in H119 (H118: £8.0m), benefiting from the €2.5m milestone payment and a significant reduction in SG&A as it is no longer directly marketing the drug itself. We have adjusted our forecast R&D cost down (paediatric study), in line with company guidance. The H119 cash position of £6.6m implies a runway into H220. A US partnering deal should enable an upfront licensing payment to extend the cash runway. We now forecast a 2019 cash burn of £5.5m and sustainable profitability from 2022.

Valuation: £273m or 233p/share

We have rolled forward our model and updated for net cash of £6.6m, which coupled with the lower R&D maintains our valuation at £273m. It is based on an NPV of Feraccru for ID related anaemia in Europe and the US, with conservative peak sales of €133m and $420m, respectively. Should partners be able to utilise the full breadth of the ID labels attained, there might be significant upside potential.

Business description

Shield Therapeutics is a commercial-stage pharmaceutical company. Its proprietary product, Feraccru, is approved by the EMA and FDA for the treatment of iron deficiency. Feraccru is marketed through partners Norgine, AOP Orphan and Ewopharma.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI