Sherwin-Williams Company (NYSE:SHW) will always be a Cleveland company to me despite its move to Ireland for tax purposes. My in-laws knew the founder’s family. And they still have their World Wide Automotive Finishes business only 3 miles down the road from my house in Warrensville, Ohio.

The stock has been a juggernaut since lifting out of the dust of the 2009 low. Running higher to the peak at the start of 2015 it was up over over 450%. But since that peak around 295 it has floundered. Veteran investors know that stocks don’t just go straight up forever, they take pauses and retrace along the way. It would make perfect sense if this was happening in Sherwin Williams over the last year.

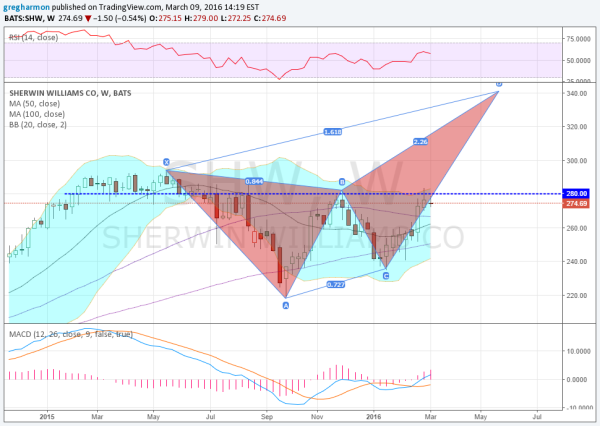

The chart above shows the price action in Sherwin Williams over that time period using weekly data. And it tells an interesting story. The consolidation with a pullback to point A and bounce then pullback to a higher low at C is tracing out a bearish Deep Crab harmonic. Reading the word bearish you might think this a stock set up to fail. But this pattern suggest that a move over point B has no real reason to stop going higher until at least $340. At that point you can start to look for a Potential Reversal.

But getting over point B is not a given. Point B at $280 has been an important level for this stock since the start of 2015. First it acted as support, until May and then resistance. This is the third time at that resistance. The momentum indicators are positive and support more upside, but just turning bullish. The Bollinger Bands® are turning higher too. So there is support for a move higher. Keep a watch for that break to be able to paint your account green.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.