Integrated oil and gas company, Royal Dutch Shell (LON:RDSa) plc RDS.A recently announced that it is planning to resume normal operations at the Pernis refinery in Rotterdam by the end of August 2017. Operations at the largest refinery in Europe were halted in late July due to a fire at a power unit and a hydrogen fluoride leak.

Impact of the Closure

The 404,000 barrel per day Pernis refinery in Netherlands was inoperative for 10 days. This created a fuel shortage in the Amsterdam-Rotterdam-Antwerp area, which hit diesel and gasoil inventories, dragging them to the lowest in the last two months. Jet fuel inventory of the Amsterdam-Rotterdam-Antwerp area declined in the last one week to its five-year seasonal average.

The suspension of operations at Pernis at a time of high demand for diesel in the region triggered further shortage. The regional diesel benchmark, ICE gasoil futures, has trended down since then, depicting short-term lack of supply. It can increase the price of distillates that includes gasoil, diesel and jet fuel. The situation led to increased flow of fuels from the US.

Shell’s Attempt at Restart

The production units were unharmed by the fire, although the same cannot be said for some of the catalysts that are used for upgrading units. The damaged catalysts will be replaced by Shell.

Resuming operations at the facility will ease the supply of fuels in the region’s oil-trading hub. It will take the pressure off fuel prices in the area. Shell will restart the process by starting two units in the facility and then gradually the other parts will become operational. Shell will not start all the units simultaneously as it might hamper the overall process. The process is coming online before the company’s expected time frame of two weeks. The maintenance work of the facility due in autumn will further help the company to increase production in the facility.

About Pernis Refinery

Shell’s Pernis refinery is the integrated complex in Europe that is a part of a value chain, which converts crudes into high-value products and are sold around the globe. The facility employs 1,900 staff and 1,000 contractors on average. The company has its other such integrated facilities in Canada, Singapore and the US Gulf Coast.

About the Company

Headquartered in The Hague, Netherlands, Shell explores for and extracts crude oil, natural gas, and natural gas liquids. The company transports oil and gas, converts natural gas to liquids to produce and market fuels and other products. It also extracts bitumen from mined oil sands and turns it into synthetic crude oil. Shell also generates electricity from the wind. The company divides its operations into four major segments: Upstream, Downstream, Corporate and Integrated Gas.

In terms of assets, Royal Dutch Shell owns a strong and diversified portfolio of global energy businesses that offer attractive long-term growth opportunities. The group’s strong inventory of development projects should help volume growth in the long run.

Shell’s revenues, earnings and cash flow have been significantly hurt by the 3-year commodity bear market, while attacks on its local establishments by the Nigerian militants have created another major problem.

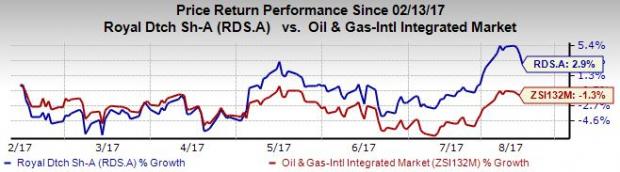

Price Performance

Shell’s stock has gained 2.9% in the last six months, substantially outperforming the 1.3% fall of the industry it belongs to.

Zacks Rank and Stocks to Consider

Shell presently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the oil and energy sector include Braskem S.A. (NYSE:BAK) , TransCanada Corporation (TO:TRP) and Range Resources Corporation (NYSE:RRC) . These sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Braskem’s sales for 2017 are expected to increase 11% year over year. The company delivered an average positive earnings surprise of 107.8% in the last four quarters.

TransCanada’s sales for the year 2017 are expected to increase 0.3% year over year. The company delivered an average positive earnings surprise of 4.1% in the last four quarters.

Range Resources’ sales for 2017 are expected to increase 124.6% year over year. The company delivered a positive earnings surprise of 250% in the second quarter of 2017.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Royal Dutch Shell PLC (RDS.A): Free Stock Analysis Report

Braskem S.A. (BAK): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Original post

Zacks Investment Research