Integrated oil company Royal Dutch Shell (LON:RDSa) plc RDS.A recently lifted force majeure on Nigeria's Forcados crude oil export. This is the first time since Feb 2016 that Nigeria’s oil exports have come fully online.

Forcados exports ceased as the company declared force majeure on Feb 2016, following a militant attack on Trans Forcados Pipeline, the main export route, by Niger Delta Avengers.

Forcados, in general, has the capacity to export 200,000-240,000 barrels per day (BPD). Following the start of operations at the terminal, Nigeria's export level is expected to reach approximately 1.8 million BPD. The government of Nigeria is looking to achieve this export level before the next Organization of the Petroleum Exporting Countries (OPEC) meeting. The force majeure delayed Nigeria’s participation in the OPEC output cut.

Oil average shipment in June from the terminal is expected to be 250,000 BPD.

Shell's loading program for June that came out last week raised planned exports from the country to a 15-month high of 1.75 million BPD. It will add 10% more to the country’s output.

Shell operates in eight kilometers of the Forcados terminal through a subsidiary, Shell Petroleum Development Company of Nigeria Limited. The company is operating in the country for more than 50 years.

About the Company

The original Royal Dutch Shell Group was formed from the 1907 alliance between U.K.-based Shell Transport and Trading Company and the Netherlands-based Royal Dutch Petroleum Company, with 40% and 60% stake in the group, respectively. However, both companies maintained their separate and distinct identities. The unification plan proposed in 2005 by the boards of both the companies was completed in 2006, resulting in one parent company, Royal Dutch Shell plc. Royal Dutch Shell divides its operations into four major segments: Upstream, Downstream, Corporate and Integrated Gas. The company is headquartered in The Hague, Netherlands.

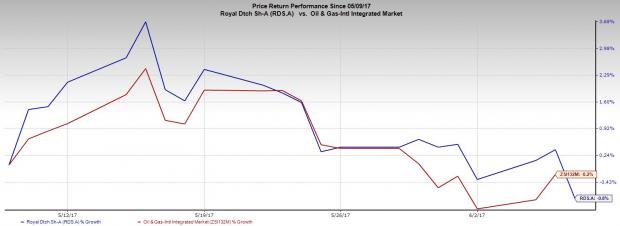

Price Performance

Shell’s stock underperformed the Zacks categorized Oil and Gas, International Integrated industry in the last one month. While the stock fell 0.85%, the industry registered a decrease of 0.25% during this time.

Zacks Rank and Stocks to Consider

Shell presently has a Zacks Rank #5 (Strong Sell). Some better-ranked stocks in the oil and energy sector are Delek US Holdings, Inc. (NYSE:DK) , Enbridge Energy, L.P. (NYSE:EEP) and Canadian Natural Resources Limited (TO:CNQ) . All of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Delek US Holdings’ sales for 2017 are expected to increase 71.35% year over year. The company came up with a positive average earnings surprise of 60.68% in the last four quarters.

Enbridge Energy’s sales for the second quarter of 2017 are expected to increase 13.17% year over year. The partnership delivered an average positive earnings surprise of 38.22% in the last four quarters.

Canadian Natural Resources’ sales for 2017 are expected to increase 49.38% year over year. The company delivered a positive earnings surprise of 30.77% in the first quarter of 2017.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Enbridge Energy, L.P. (EEP): Free Stock Analysis Report

Delek US Holdings, Inc. (DK): Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A): Free Stock Analysis Report

Original post

Zacks Investment Research