EUR/USD

Sharp recovery following positive news.

EUR/USD extended sharply higher, as six central banks, reduced their USD funding costs to ease the debt crisis. The impact was very positive for investors around the world and has encouraged traditional “risk appetite” markets, such as EUR/USD, AUD/USD and S&P500 to turn back higher.

Expect the recovery to be limited into 1.3610, then 1.3730 and perhaps even 1.3850-90. Probability still favours a bearish reversal at these levels.

Meantime, support can be found at 1.3380 and 1.3146. A sustained close beneath 1.3146 (Oct swing low) will re-establish the larger downtrend from April and target 1.3000 (psychological level), then 1.2870 (2011 major low). Inversely, the USD Index is maintaining its recovery higher and still targets its recent 9-month highs near 80, (a move worth almost 10%).

Speculative (net long) liquidity flows have unwound from recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

GBP/USD

Break out from short-term range required.

GBP/USD saw a minor break under 1.5577 yesterday in the hourly timeframe. However, the lack of momentum that followed warns of little downside interest at current levels, suggesting a return to the 50% retrace level at 1.5795. A push back over 1.5726 will warn of a fresh leg higher in the recovery from 1.5423.

We remain alert to the fact that we are nearing the base of the year long range which, given the short-term relief seen in the Euro-Zone, may offer opportunities to enter long positions. This may also be advantageous if rising yields return to the Euro-Zone and Sterling attains a safe haven status once again.

Taking this approach will need to see levels closer to 1.5400 for a well placed stop. The range bound trade of the last few days is best avoided.

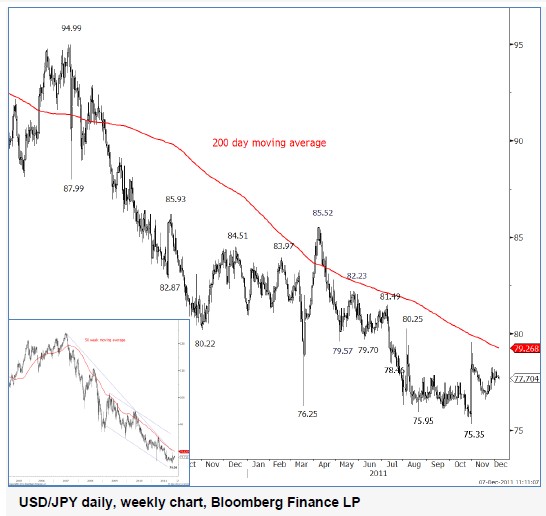

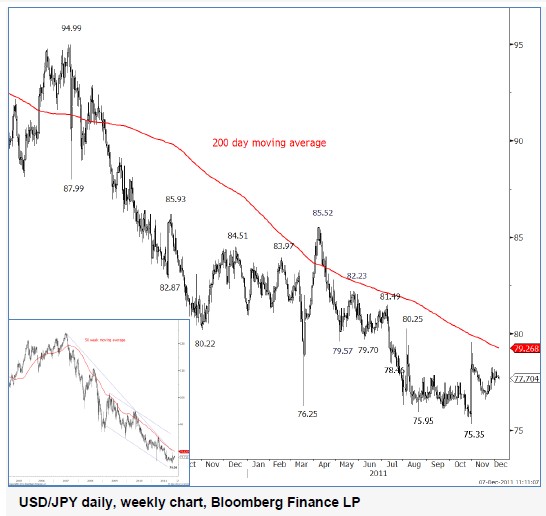

USD/JPY

Minor rebound capped at 78.24 (DeMark™ Level).

USD/JPY’s minor rebound is still being capped at 78.24 (DeMark™ Level). Moreover, downside risks remain, with the growing probability of a third price retracement back to pre-intervention levels (PIR III) and potentially even a new post world war record low beneath 75.35 (PINL).

Sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40-year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

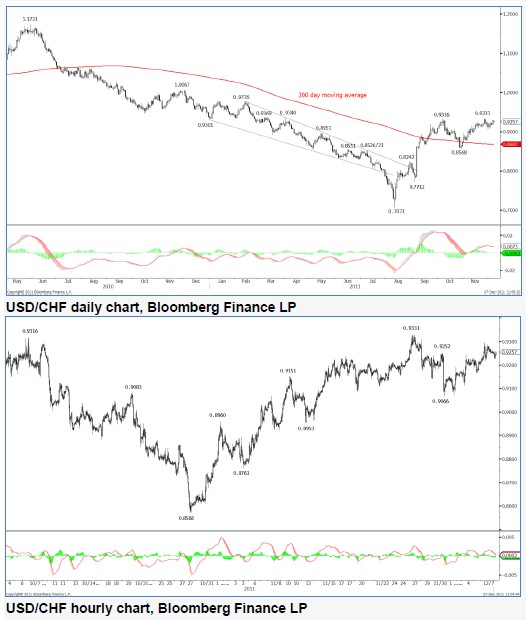

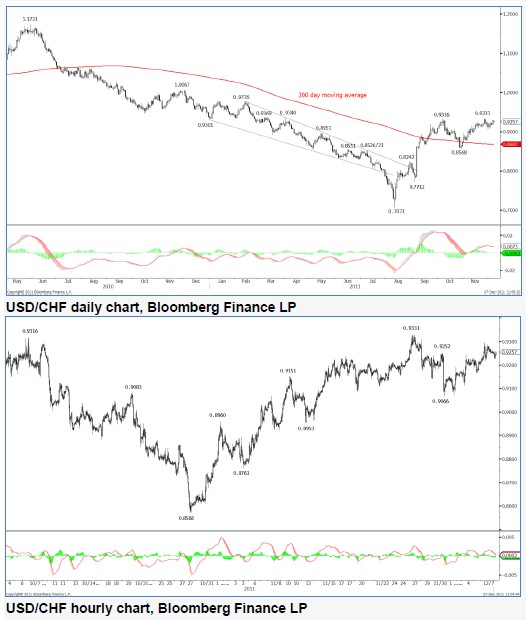

USD/CHF

Sustained over 0.9331 to target 0.9776.

USD/CHF Continues to edge higher back towards 0.9331. A sustained break over this level will warn of a much larger push higher. Instead, we favour a return to 0.9066 and potentially lower, forming a larger corrective phase.

The respite that was offered to 10 year Italian government bond yields following the USD based swap rate cut is likely nearing completion. The current trading zone near 5.750% is expected to see strong support, with the potential of a return back towards 7.00% over coming weeks. If upside pressure were to return to Italian and Spanish yields then USD/CHF will likely experience a degree of downside pressure too.

Spanish and Italian government bonds have seen a reasonable sized pullback over the last week, currently trading at 5.187% and 5.777% versus 6.478% and 7.355%, before the six party central bank agreement. The improvement that we had seen in the German sovereign curve has now slowed, when compared to yields one week ago.

USD/CAD

Sharp Setbacks hold steady.

USD/CAD’s sharp setbacks are holding steady, following the recent shortterm DeMark™ exhaustion sell signal.

A directional confirmation above 1.0658 is still needed to unlock the recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott wave cycle.

Only a sustained close beneath 1.0120 and parity unlocks bearish setbacks into the long-term 200-day MA at 0.9852 and 0.9726 (31st Aug low).

EUR/CAD remains beneath its 200-day MA, still within a large multi-month trading range. The strong multi-month distribution pattern is likely to breakdown further into support levels at 1.3570 and 1.3380.

CHF/CAD has also broken back beneath its 200-day MA at 1.1375, while breaching a multi-week trading range. This follows the dramatic price slide lower (which was triggered by the SNB intervention). The cross-rate has retraced more than half of its 2011 gains.

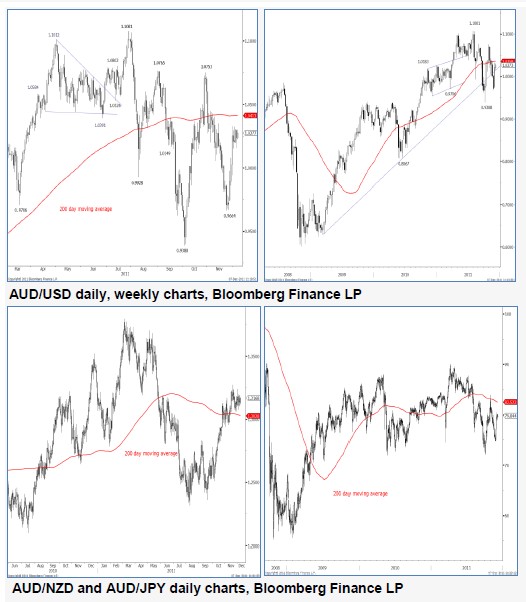

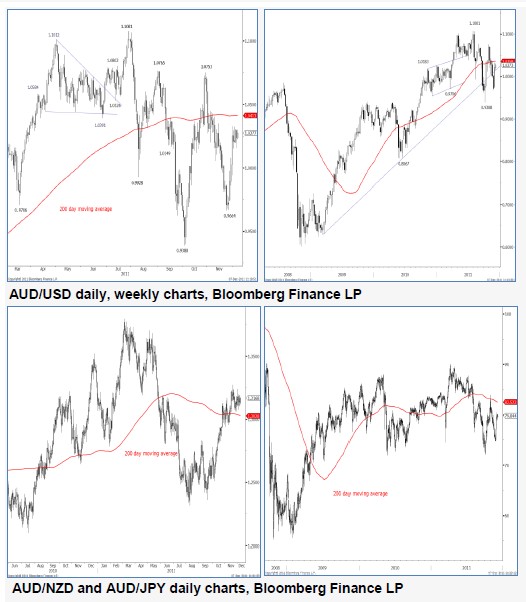

AUD/USD

Extended recovery beneath 200-day MA.

AUD/USD has extended its recovery into key resistance at 1.0340 (61.8% Fib-Oct 28th decline) and 200-day MA which is currently holding at 1.0412.

The bears must sustain below 1.0000 to further compound downside pressure on the rate’s multi-year uptrend and push back towards 0.9611.

Elsewhere, the Aussie dollar remains strong against the New Zealand dollar. However, near-term price activity is mean reverting back into the 200- day MA. Expect a sharp setback to ensue over the multi-day horizon.

The Aussie dollar has triggered a mild recovery against the Japanese yen and is now trading back above the neck-line of its two-year distribution pattern. Watch for further downside scope into support at 72.00 which would signal further unwinding of risk appetite.

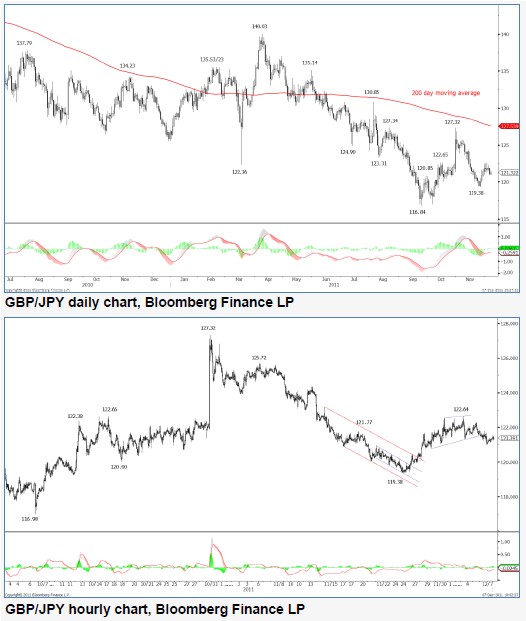

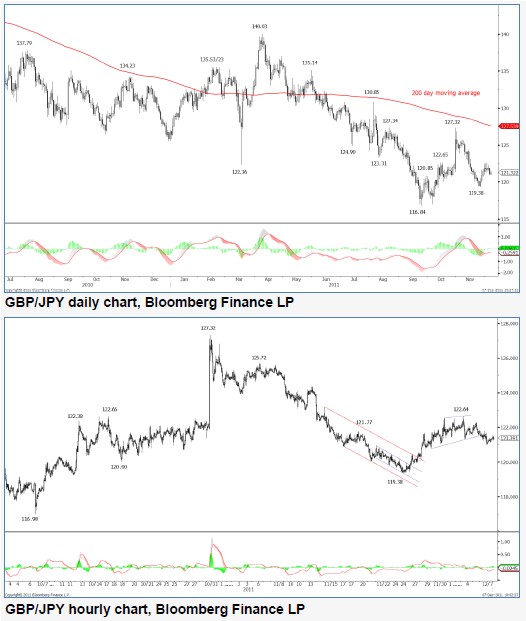

GBP/JPY

Possible short-term reversal pattern in place.

GBP/JPY continues to exhibit price action warning of a loss of momentum. The rising wedge that we had noted in recent reports has seen its support broken in recent trade. This now warns of a possible topping formation, with scope for a return to the 120.00 region in the short-term.

If 120.00 is met, a degree of support would be anticipated there. An earlier push back over 122.64 would be expected to meet resistance at 123.00.

A failure to hold over 119.38 will warn of a return to 116.84.

Over a longer period of time a substantial recovery higher is favoured, initially towards 163.09.

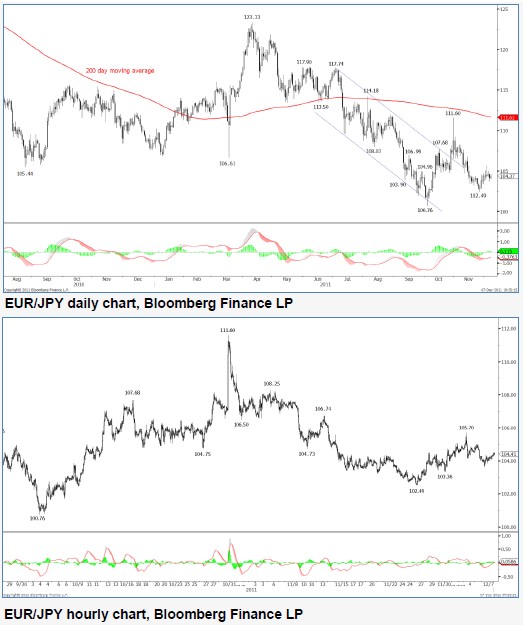

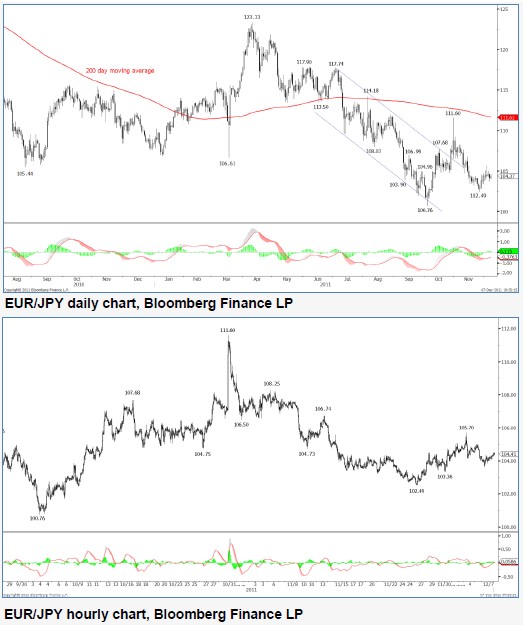

EUR/JPY

Rangebound short-term.

EUR/JPY is exhibiting many of the same characteristics as a host of currency pairs in the approach to the Christmas holidays. Most importantly the recent bout of intervention by various central banks warns of a period of coordinated intervention, which acts as a manipulation of the market, making technical analytics harder, due to the assumption of free market movement.

We view the fall that has taken place since 111.60 as being corrective in nature, suggesting potential for a return to this same level. However, in the shorter-term timeframe a corrective phase appears to have completed at 105.70. Thus we have a directional clash in two timeframes.

The EUR component of this pair is clearly affected by the movement in EUR/USD. A break under 1.3146 in EUR/USD will end the rising phase seen since 2010. This would likely be associated with a fall back down to 100.76 and potentially lower.

Given the above clash between the structure and events in the Euro-Zone, we prefer to wait on the side lines.

A sustained hold over the 200 day moving average will turn the mediumterm outlook more bullish.

EUR/GBP

Return to 0.8665 and then higher anticipated.

EUR/GBP failed to gain momentum again, this time in the hourly timeframe, after breaking under 0.8528, reaching 0.8520 on 30 November. This now warns of a larger rise higher, back towards the 0.8700 region. This price behaviour has been repeated in multiple timeframes and has been a hallmark of this currency pair over recent weeks and months. Thus the strategy remains to sell, but at higher levels.

We continue to expect a return to rising yields within the Euro-Zone and it is within this environment that we see the potential for Sterling to be perceived as a safe haven. Core government bond yields have eased back somewhat after the coordinated cut in USD based swap lines amongst selected central banks. However, a lasting solution still appears a long way off.

Our bias remains mildly bearish with trade continuing under both the 200 day and 50 week moving averages. We keep an eye on the 1.3146 level in EUR/USD. A push under this level will mark a clear breakdown of confidence in the EUR, which would then likely have a knock on effect in all EUR crosses.

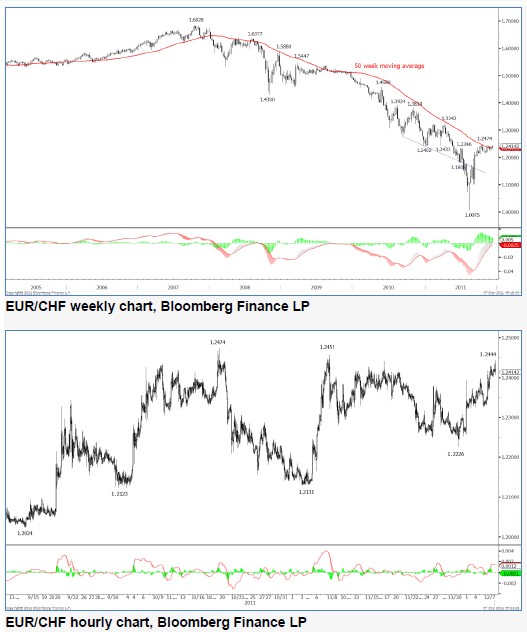

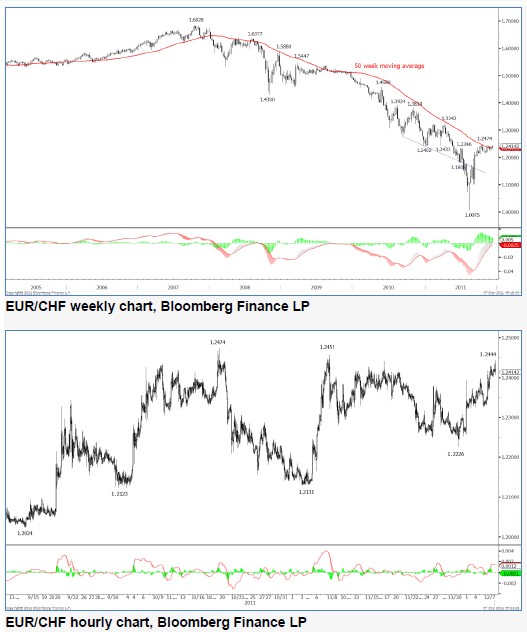

EUR/CHF

Resistance expected again close to 1.2474.

Short strategy altered to a sell limit order at the top of the hourly range. EUR/CHF continues to trade in a tight range, failing to meet the 1.2500 level thus far. However, a fresh attempt appears to have been initiated to re-test the 1.2400/2500 region. This return to the upper end of the recent trading range has been assisted somewhat by the six bank dollar swap rate coordination. An eventual return to rising yields is anticipated and with this downside pressure should return to EUR/CHF.

The short-term structure that is forming is also suggestive of exhaustion, with scope for a final push to re-test the old high at 1.2474. However, we would anticipate a degree of resistance near this level and would then favour a return to range bound trade.

The chance of collusion of central banks has made the current environment difficult to trade from a technical perspective as free market movement is one of the main assumptions of this analytic technique.

The failure of this pair to break over the 50 week moving average over recent weeks is also an initial warning that the prior downtrend may not be over. The large cluster of stops that is likely to be placed around the 1.2000 level is also anticipated to aid any short positioning, questioning the ability of the SNB to hold back the possible flow of funds into Swiss Francs.

Sharp recovery following positive news.

EUR/USD extended sharply higher, as six central banks, reduced their USD funding costs to ease the debt crisis. The impact was very positive for investors around the world and has encouraged traditional “risk appetite” markets, such as EUR/USD, AUD/USD and S&P500 to turn back higher.

Expect the recovery to be limited into 1.3610, then 1.3730 and perhaps even 1.3850-90. Probability still favours a bearish reversal at these levels.

Meantime, support can be found at 1.3380 and 1.3146. A sustained close beneath 1.3146 (Oct swing low) will re-establish the larger downtrend from April and target 1.3000 (psychological level), then 1.2870 (2011 major low). Inversely, the USD Index is maintaining its recovery higher and still targets its recent 9-month highs near 80, (a move worth almost 10%).

Speculative (net long) liquidity flows have unwound from recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

GBP/USD

Break out from short-term range required.

GBP/USD saw a minor break under 1.5577 yesterday in the hourly timeframe. However, the lack of momentum that followed warns of little downside interest at current levels, suggesting a return to the 50% retrace level at 1.5795. A push back over 1.5726 will warn of a fresh leg higher in the recovery from 1.5423.

We remain alert to the fact that we are nearing the base of the year long range which, given the short-term relief seen in the Euro-Zone, may offer opportunities to enter long positions. This may also be advantageous if rising yields return to the Euro-Zone and Sterling attains a safe haven status once again.

Taking this approach will need to see levels closer to 1.5400 for a well placed stop. The range bound trade of the last few days is best avoided.

USD/JPY

Minor rebound capped at 78.24 (DeMark™ Level).

USD/JPY’s minor rebound is still being capped at 78.24 (DeMark™ Level). Moreover, downside risks remain, with the growing probability of a third price retracement back to pre-intervention levels (PIR III) and potentially even a new post world war record low beneath 75.35 (PINL).

Sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40-year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

USD/CHF

Sustained over 0.9331 to target 0.9776.

USD/CHF Continues to edge higher back towards 0.9331. A sustained break over this level will warn of a much larger push higher. Instead, we favour a return to 0.9066 and potentially lower, forming a larger corrective phase.

The respite that was offered to 10 year Italian government bond yields following the USD based swap rate cut is likely nearing completion. The current trading zone near 5.750% is expected to see strong support, with the potential of a return back towards 7.00% over coming weeks. If upside pressure were to return to Italian and Spanish yields then USD/CHF will likely experience a degree of downside pressure too.

Spanish and Italian government bonds have seen a reasonable sized pullback over the last week, currently trading at 5.187% and 5.777% versus 6.478% and 7.355%, before the six party central bank agreement. The improvement that we had seen in the German sovereign curve has now slowed, when compared to yields one week ago.

USD/CAD

Sharp Setbacks hold steady.

USD/CAD’s sharp setbacks are holding steady, following the recent shortterm DeMark™ exhaustion sell signal.

A directional confirmation above 1.0658 is still needed to unlock the recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott wave cycle.

Only a sustained close beneath 1.0120 and parity unlocks bearish setbacks into the long-term 200-day MA at 0.9852 and 0.9726 (31st Aug low).

EUR/CAD remains beneath its 200-day MA, still within a large multi-month trading range. The strong multi-month distribution pattern is likely to breakdown further into support levels at 1.3570 and 1.3380.

CHF/CAD has also broken back beneath its 200-day MA at 1.1375, while breaching a multi-week trading range. This follows the dramatic price slide lower (which was triggered by the SNB intervention). The cross-rate has retraced more than half of its 2011 gains.

AUD/USD

Extended recovery beneath 200-day MA.

AUD/USD has extended its recovery into key resistance at 1.0340 (61.8% Fib-Oct 28th decline) and 200-day MA which is currently holding at 1.0412.

The bears must sustain below 1.0000 to further compound downside pressure on the rate’s multi-year uptrend and push back towards 0.9611.

Elsewhere, the Aussie dollar remains strong against the New Zealand dollar. However, near-term price activity is mean reverting back into the 200- day MA. Expect a sharp setback to ensue over the multi-day horizon.

The Aussie dollar has triggered a mild recovery against the Japanese yen and is now trading back above the neck-line of its two-year distribution pattern. Watch for further downside scope into support at 72.00 which would signal further unwinding of risk appetite.

GBP/JPY

Possible short-term reversal pattern in place.

GBP/JPY continues to exhibit price action warning of a loss of momentum. The rising wedge that we had noted in recent reports has seen its support broken in recent trade. This now warns of a possible topping formation, with scope for a return to the 120.00 region in the short-term.

If 120.00 is met, a degree of support would be anticipated there. An earlier push back over 122.64 would be expected to meet resistance at 123.00.

A failure to hold over 119.38 will warn of a return to 116.84.

Over a longer period of time a substantial recovery higher is favoured, initially towards 163.09.

EUR/JPY

Rangebound short-term.

EUR/JPY is exhibiting many of the same characteristics as a host of currency pairs in the approach to the Christmas holidays. Most importantly the recent bout of intervention by various central banks warns of a period of coordinated intervention, which acts as a manipulation of the market, making technical analytics harder, due to the assumption of free market movement.

We view the fall that has taken place since 111.60 as being corrective in nature, suggesting potential for a return to this same level. However, in the shorter-term timeframe a corrective phase appears to have completed at 105.70. Thus we have a directional clash in two timeframes.

The EUR component of this pair is clearly affected by the movement in EUR/USD. A break under 1.3146 in EUR/USD will end the rising phase seen since 2010. This would likely be associated with a fall back down to 100.76 and potentially lower.

Given the above clash between the structure and events in the Euro-Zone, we prefer to wait on the side lines.

A sustained hold over the 200 day moving average will turn the mediumterm outlook more bullish.

EUR/GBP

Return to 0.8665 and then higher anticipated.

EUR/GBP failed to gain momentum again, this time in the hourly timeframe, after breaking under 0.8528, reaching 0.8520 on 30 November. This now warns of a larger rise higher, back towards the 0.8700 region. This price behaviour has been repeated in multiple timeframes and has been a hallmark of this currency pair over recent weeks and months. Thus the strategy remains to sell, but at higher levels.

We continue to expect a return to rising yields within the Euro-Zone and it is within this environment that we see the potential for Sterling to be perceived as a safe haven. Core government bond yields have eased back somewhat after the coordinated cut in USD based swap lines amongst selected central banks. However, a lasting solution still appears a long way off.

Our bias remains mildly bearish with trade continuing under both the 200 day and 50 week moving averages. We keep an eye on the 1.3146 level in EUR/USD. A push under this level will mark a clear breakdown of confidence in the EUR, which would then likely have a knock on effect in all EUR crosses.

EUR/CHF

Resistance expected again close to 1.2474.

Short strategy altered to a sell limit order at the top of the hourly range. EUR/CHF continues to trade in a tight range, failing to meet the 1.2500 level thus far. However, a fresh attempt appears to have been initiated to re-test the 1.2400/2500 region. This return to the upper end of the recent trading range has been assisted somewhat by the six bank dollar swap rate coordination. An eventual return to rising yields is anticipated and with this downside pressure should return to EUR/CHF.

The short-term structure that is forming is also suggestive of exhaustion, with scope for a final push to re-test the old high at 1.2474. However, we would anticipate a degree of resistance near this level and would then favour a return to range bound trade.

The chance of collusion of central banks has made the current environment difficult to trade from a technical perspective as free market movement is one of the main assumptions of this analytic technique.

The failure of this pair to break over the 50 week moving average over recent weeks is also an initial warning that the prior downtrend may not be over. The large cluster of stops that is likely to be placed around the 1.2000 level is also anticipated to aid any short positioning, questioning the ability of the SNB to hold back the possible flow of funds into Swiss Francs.