Solar electric power was the poster child of green energy. The industry now faces a near collapse of investor support and a troubled outlook for the carbon financing that helped its soaring growth

Solar electric power was the poster child of green energy, with a cleaner, higher tech image than gaunt intrusive windfarm arrays drawing criticism even from environmentalists in favour of alternate energy, but the industry is now leading the way to green energy downsizing, industrial consolidation and restructuring. The industry was a classic example of mushroom growth driven by massive government subsidies, uncritical policy support and a wave of investor enthusiasm, but solar power companies in Europe and the United States are now hit hard by a toxic mix of oversupply, falling orders, and panel supply at cuthroat prices from low-cost Asian competitors who themselves also face troubled times.

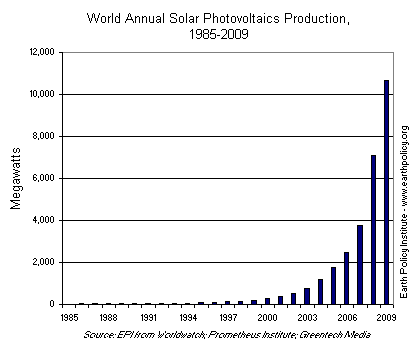

The industry now faces a near collapse of investor support and a troubled outlook for the carbon financing that helped its soaring growth, but in particular is being downsized by steep cuts in the massive government subsidies and financial aid which artificially boosted the industry until the past 18 months. Until 2010 and the start of 2011, industry growth rates were often running at over 20% p.a.

Company insolvencies have already swept away large numbers of the small start-ups which mushroomed in the 2006-2009 period, but the wave of company failures is now moving to the higher ground. Large company bankruptcies in the United States since late 2011 include solar cell panel makers Solyndra LLC and Evergreen Solar. In Germany, once home to the world's largest solar PV industry but now No. 2 to China, annual production capacity attained more than 12 000 MW (12 GW) in 2010 on the back of massive state subsidies and "first mover" advantage, but is set to sharply fall this year: German solar company failures have rapidly mounted since midyear 2011.

China, the "second mover" and now the world's dominant producer and exporter of solar power panels, is also facing sharp contraction of its solar industry but for several reasons German contraction may be more drastic. Initially poised to maintain its growth thrust and expand to more than 15 GW, perhaps 17.5 GW annual capacity in 2012 and employ at least 150 000 persons, German industry downsizing will transform these figures, on the downside. Analyst forecasts suggest that direct employment in the industry may shrink below 100 000 persons this year and production capacity in 2012 is unlikely to match 2010's 12 GW, and may fall far below this.

Annual installations of solar power capacity in Germany, according to industry group BSW-Solar, probably achieved a record 7.5 GW in 2011, compared with 7 GW in 2010 but this was a rush by buyers to profit from the 'last wave' of subsidies and grants. The outlook for 2012 is for much less than this. Government sources indicate that new solar power installations may fall as low as 3.5 GW-per-year by 2013-14. According to a 9 Jan 2012 report on Bloomberg.com, German economics minister Philipp Roesler is proposing a cap of 1 GW-per-year through further and deeper cuts in state subsidies to solar electricity. This would represent an 86% cut in national installations over 3 years.

German industry retrenchement is now accelerating: S2M AG and Solon AG both filed for insolvency, and Solon fired one-third of its employees in a single day in December 2011. Solarworld AG and Q-Cells SE, two of Germany’s other biggest and oldest solar cell and panel makers reported wider-than-expected losses, slowed demand growth both at home and in export markets, sharply weakened panel prices, and rising difficulty in extending their bank credit lines.

VICTIM OF ITS OWN SUCCESS

The world solar electric power industry was in many ways a victim of its own success. Like the dotcom-telecom boom and slump in the last years of the 20th century, and technologically related to the same IT, microcomputer and semiconductor industry origins, the solar industry was driven by investor enthusiasm and massive governments handouts of public cash, and simply locked on to an exponential growth track. In IT jargon this was 'high gain positive feedback', but the gravy train was doomed to hit the buffers. The present crisis was inevitable for reasons as basic as its unsustainable growth rate, and the industry is now falling back. World supply capacity - totally dominated by China and Germany - grew to levels that were unrelated to market potentials and needs: the only possible short-term outlook for the industry is therefore one of sharp contraction.

EXPLOSIVE GROWTH IN THE SOLAR CELL INDUSTRY TO 2010

China's copybook explosive growth of its solar cell industry was also a copybook example of state planned and state backed capture of a hoped-for leading industry. Driven by state initiatives to develop a world class solar PV cell industry and dominate an unrealistically projected, supposedly vast export market, China's solar industry grew at rates as high as 33% p.a. from the late 1990s, in a more successful play than similar strategies operated in Germany, the US, Japan, Korea, Taiwan, Spain, Norway and elsewhere - including India, where the Chinese solar industry's takeoff was tracked by similar state-backed action to lever a national industry. State "guidance" and targeted subsidies to producers rather than users of panels, which was the European path, was the chosen Chinese strategy.

The success of this action is shown by simple facts: Chinese solar-panel makers attained an annual capacity of around 35 GW, far more than one-half of world total production capacities, and supplied over one-half the world export market in 2011. Today, industry sector analysts suggest the "weeding out" of smaller producers could cut China's solar cell production capacity from as high as 70 GW per year in 2013 if company expansion had continued as in 2006-2010, to a vastly downsized 20 GW per year. This would represent a shrinkage of around 70% within 2 to 3 years.

Chinese and other newer-entrant producers, including India's nascent solar panel industry now face a critical mix of global supply glut, falling unit prices, falling subsidies, and competition from other sources of electric power generation - both fossil and renewable - in a context where global electricity demand growth rates are falling. Due to previous mushroom growth, and like the dotcom-telecom boom and bust at the start of the century, the solar power industry's downsizing may be huge.

AVOIDING ACTION

Current and initial Chinese and German corporate-level avoiding action features shutting factories, or even entire solar businesses rather than merging. Hefty cuts in production, as in Germany, are another short-term response, but longer-term shrinkage of production capacity is certain. For China, early reports suggest, this downsizing will at first be voluntary, but state coordinated action is will almost certainly soon take over: according to China’s Energy Research Institute at the national Development and Reform Commission, plans are being mulled to shrink the number of domestic manufacturers to 15-only within five years, representing a cut of more than two-thirds, or 66%.

As in Germany, but also in other countries with large solar PV production capacities, Chinese cell manufacturers will firstly resist mergers and acquisitions at home, that is "tough it out", and larger players like LDK Solar will buy troubles overseas producers, especially in Germany but the final result is simple. Overrapid growth of production capacity, even when state coordinated as in China and India, and state backed in all other countries, in a new context of slowed market growth and rising market absorbtion limits, has pushed down market prices by almost 50% in less than 12 months. At these price levels which are below-cost in most cases, only buyers are happy - as long as they go on receiving government subsidies and are able to integrate the intermittent solar electricity supply with their current or planned electricity production or utilisation.

Even at current loss-making panel prices however, which are down to almost $1 per peak Watt and below typical onshore wind turbine costs of around $1.4 per peak Watt ($1400 per kW), fully installed and power system integrated solar PV power systems still produce expensive electricity. In Europe, these 'levelized costs' were around 20 - 30 euro cents per kWh, in 2011. Compared with oil-fired electricity generation, oil prices would need to exceed $200 per barrel to produce electricity this expensive ! Solar electricity costs run from around two to four times the levelized cost for lignite and coal-fired plants, and up to three times the levelized cost of power from natural gas plants, even when they depend on high cost Russian, Algerian or Norwegian pipeline gas or Qatari LNG. Reasons for these high costs not only include the high first cost of solar PV power (only partly offset by low operating costs), and low year-round capacity utilization rarely above 25% in the mid-latitudes, but the power system integration costs for solar electricity. Although panel prices in the industry's current dire straits are down to $1 per peak Watt, replacement of a 1 GW fossil-fuelled power plant operating at 80% or 90% of capacity needs as much as 3.5 GW of solar capacity.

The bottom line is simple: solar electricity remains expensive.

Competing power supply options as expensive, or more expensive than solar power are few in number. Only nuclear power including full-lifecycle power costs (that is including decommissioning and Safestor), and certain non-hydro renewables including geothermal power and offshore windfarns, deliver electricity at anywhere near the cost of typical solar PV generating plants. For governments and energy agencies, the best avoiding action is to carefully plan the best utilisation of solar power and prevent the industry going into runaway and uncontrolled growth.

As with wind power, power transport system integration challenges and the unknown lifetimes of solar power plant - which may be considerably less than industry claims of "at least 30 years" - add to uncertainty on rational solar capacity growth, cause high infrastructure spending needs, and result in large investment risk premiums, making subsidies critical to continued development. The outlook is therefore that the facade of the solar industry "toughing it out" will crack in 2012, resulting in a wave of company mergers and acquisitions, as well as simple company shutdowns and retreat from the global solar PV industry. For governments, and various vested interests including "the ecology-environment lobby", the 10-year history of boom and then slump in the solar industry should be a cautionary tale, and is a story of extreme waste of scarce resources, bad planning and clumsy execution.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sharp Contraction Ahead For the Solar Industry

Published 01/11/2012, 01:46 AM

Updated 07/09/2023, 06:31 AM

Sharp Contraction Ahead For the Solar Industry

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.