The US dollar got a shot in the arm with the Brexit vote last week. A sharp two day move higher took the US Dollar Index back towards the top of the long consolidation range between 92 and 100. But since then it has stalled and pulled back. What is next for the greenback?

Despite the pullback the prognosis for the Dollar Index in the short term is still positive. This may not be what Equity bulls want to heat as the pair have held a negative correlation the past week. But the chart is telling a story.

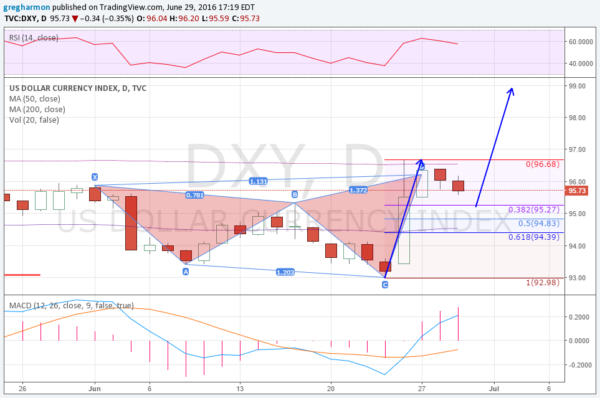

The movement in the Dollar Index since the beginning of June has traced out a bearish Shark harmonic. The pattern reached its Potential Reversal Zone (PRZ) Monday as it touched the 200 day SMA. Now the pullback has retraced about 23.6% of the pattern, and it would have a target of either 95.27 (38.2%) or 94.39 (61.8%), also the 50 day SMA.

So long as either holds a reversal higher would look for a move to another higher high. A Measured Move would look for a run up to 99 if the 38.2% level holds. Not out of the long consolidation, but back to the top of the range.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.