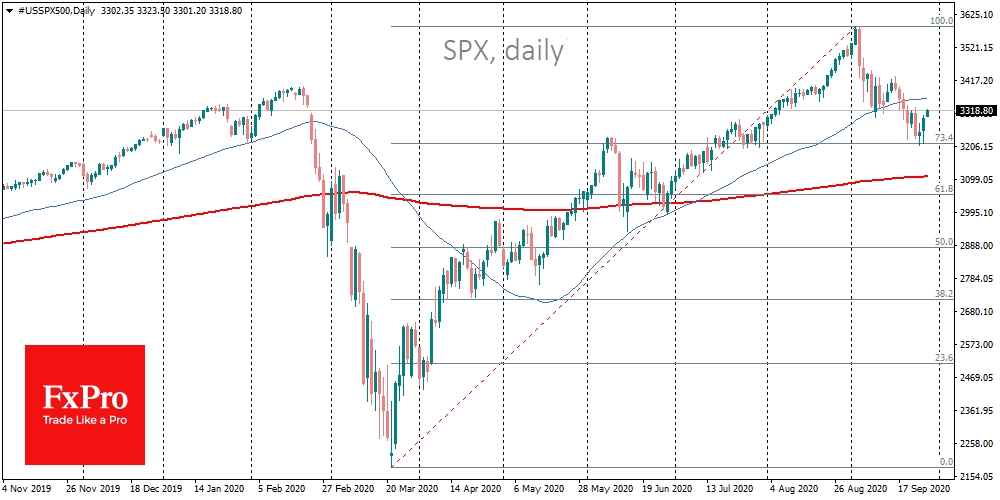

The markets on Monday morning are supported by hopes for fiscal support in the US and progress in Brexit negotiations. Interestingly, the markets have managed to put aside the fear of the risks of an economic slowdown amid a near-record number of infections at the end of last week.

Market dynamics once again shows us that investors will be too quick to focus only on the number of new daily infections. We can already see that record infections do not lead to record mortality rates, which are noticeably lower than they were in April.

What is even more important is that the reaction of the authorities is not as strong as it was in March and April. Clearly, officials have raised the bar for imposing economic restrictions and this is good for the markets as companies that are not directly affected by the coronavirus crisis do not suffer. We saw in previous weeks that the demand for protective assets had increased very moderately, along with a worsening of the epidemiological situation.

Perhaps this common misfortune has spurred politicians to be more accommodating, once again overcoming their political differences. At the end of last week, negotiations between Democrats and Republicans shifted from a deadlock to the possibility of a deal and discussions became more substantial.

In the short term, this was a turning point for the US indices and spread positive waves to other indices.

At the same time, the currency market has not yet seen an equally sharp reversal in demand for yielding currencies. The dollar index just suspended its upward correction at the end of the day on Friday, remaining close to its highs of 2 months, but shied away from resuming decline.

In addition to the major currencies, the less popular ones are also experiencing specific growth difficulties. The Swiss franc falls for its seventh consecutive trading session. AUD/USD remains within reach of 0.7000, after collapsing from 0.7320 last week. The Chinese yuan continues to give up positions.

Thus, the currency market is still not optimistic, preferring to take a waiting position. In spring, when we saw this kind of divergence between currencies and stocks, the foreign exchange market was right. And this time it may be more appropriate to watch the debate of politicians and their reaction to rising infections. This may help avoid false optimism in a still tense epidemiological and political environment.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Shares Bounce, But Currencies Are Wary

Published 09/28/2020, 03:54 AM

Updated 03/21/2024, 07:45 AM

Shares Bounce, But Currencies Are Wary

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.