Market share gains continue

Share plc (SHRE.L) has reported a record benchmark market share of 6.88% in Q312 up from 6.69% in Q212 and 5.77% in Q311. Market conditions have been challenging and total revenue was down 4% on Q311 (peers down nearly 20%). Structurally Share plc is less dependent on trading commissions, but even in this weak area its revenue fell at just two-thirds of the rate of peers. The group also revealed that trail commission accounts for just 4% of revenue and that regulatory changes provide net growth opportunities. Our net profit estimates are unchanged, but we have modestly trimmed revenue and costs.

Revenue trends

The greatest weakness in Q312 was commissions (down 16% on Q311, H1 down 13%, Edison previous 2012e down 12%). Given the market uncertainties and noting market volumes reported by the LSE this should not have been a surprise. Share plc did better than retail peers (peers down 28% in Q312) in this weak market. Account fees rose 1% Q312 on Q311 (H1 down 3%, Edison previous 2012e flat, peers down 24%) and interest income and other income was up 15% (H1 up 22%, Edison previous 2012e 26%, peers up 10%).

Market share

While somewhat volatile quarter-on-quarter, Share plc is maintaining its multi-year gain in market share. In Q312 it outperformed peers in each revenue line, as well as benefitting from a lower-than-peer dependence on rapidly falling trading commissions.

Minimal changes in net estimates

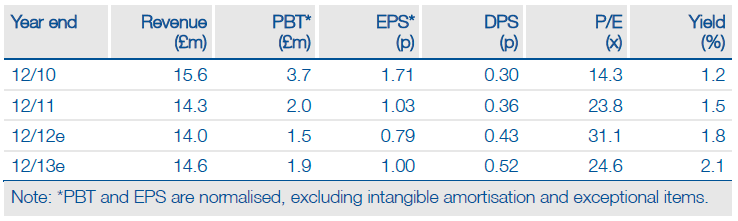

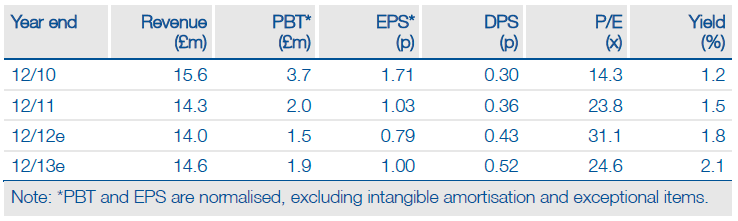

We had conservatively cut our estimates with the interim results and market conditions have been only slightly worse than expected subsequently. We have trimmed revenues (offset in 2012 by the gain on disposal of Sharemark). While market conditions remain challenging, Share plc has made a small acquisition and participated in the Direct Line IPO, helping H212 revenues.

Valuation: Upside over a third

Our absolute valuation approaches indicate a value of c 34p, an upside of over a third from the current price. We note that stripping out excess cash reduces the 2013 P/E to c 17x. We also note the high operational gearing means that the DCF valuation can move quickly with a 10% increase in 2014 revenues, raising it by over 10p.

To Read the Entire Report Please Click on the pdf File Below.

Share plc (SHRE.L) has reported a record benchmark market share of 6.88% in Q312 up from 6.69% in Q212 and 5.77% in Q311. Market conditions have been challenging and total revenue was down 4% on Q311 (peers down nearly 20%). Structurally Share plc is less dependent on trading commissions, but even in this weak area its revenue fell at just two-thirds of the rate of peers. The group also revealed that trail commission accounts for just 4% of revenue and that regulatory changes provide net growth opportunities. Our net profit estimates are unchanged, but we have modestly trimmed revenue and costs.

Revenue trends

The greatest weakness in Q312 was commissions (down 16% on Q311, H1 down 13%, Edison previous 2012e down 12%). Given the market uncertainties and noting market volumes reported by the LSE this should not have been a surprise. Share plc did better than retail peers (peers down 28% in Q312) in this weak market. Account fees rose 1% Q312 on Q311 (H1 down 3%, Edison previous 2012e flat, peers down 24%) and interest income and other income was up 15% (H1 up 22%, Edison previous 2012e 26%, peers up 10%).

Market share

While somewhat volatile quarter-on-quarter, Share plc is maintaining its multi-year gain in market share. In Q312 it outperformed peers in each revenue line, as well as benefitting from a lower-than-peer dependence on rapidly falling trading commissions.

Minimal changes in net estimates

We had conservatively cut our estimates with the interim results and market conditions have been only slightly worse than expected subsequently. We have trimmed revenues (offset in 2012 by the gain on disposal of Sharemark). While market conditions remain challenging, Share plc has made a small acquisition and participated in the Direct Line IPO, helping H212 revenues.

Valuation: Upside over a third

Our absolute valuation approaches indicate a value of c 34p, an upside of over a third from the current price. We note that stripping out excess cash reduces the 2013 P/E to c 17x. We also note the high operational gearing means that the DCF valuation can move quickly with a 10% increase in 2014 revenues, raising it by over 10p.

To Read the Entire Report Please Click on the pdf File Below.