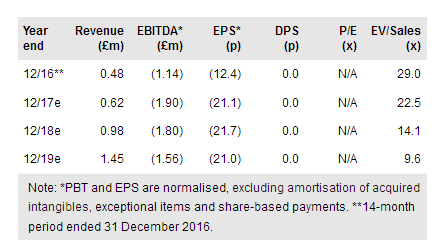

Osirium Technologies PLC (LON:OSIO) is making good progress in renewing contracts and signing new customers. We are initiating forecasts based on the assumption that the company will grow bookings at a rate of 63% in FY17, 50% in FY18 and 40% in FY19. We forecast that this will result in an EBITDA loss of £1.9m in FY17 reducing to £1.6m by FY19. We estimate that the current share price is factoring in longer-term bookings growth of 29% (average FY20-26) which, based on the company’s ‘land and expand’ strategy and focus on selling to the mid-market via distributors, appears achievable in our view.

Making good progress with renewals

Osirium has recently received a variety of contract renewals across its customer base. This highlights the wide-ranging verticals that the company serves as well as the range of company sizes, from a global aerospace and defence company to a UK-based company taking a licence for the minimum number of devices. The company continues to sign up new customers, recently announcing that a global insurance group had signed a 12-month contract.