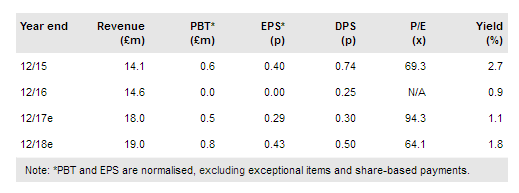

Share Plc's (LON:SHRE) H117 figures announced in August were ahead of management expectations, reflecting robust trading volumes and the benefit of partnership agreements feeding into volumes and revenue. This has prompted us to increase estimates for this year and next. For the moment profitability is still muted because of the investment the company is making in IT in order to deliver a better customer experience. Assuming continued growth in the number of customers and assets under administration (AUA), operational leverage could provide further positive surprises.

H117 results

Share’s AUA increased by 14% to £4.3bn from end 2016 compared with an increase of 3.3% in the FTSE All-Share. Total revenues increased by 23% from H116, within which dealing revenues increased by 45% and fee income 8%. Operating costs increased by 15%, partly reflecting spending arising from the digital transformation programme. This left the operating loss lower at £0.2m versus £0.7m, while underlying pre-tax profit increased from £0.11m to £0.31m. Shortly after the results, a supplementary trading update reported that a potential partnership agreement Share announced it was working towards last year will not proceed. It will receive £0.9m in compensation for the costs already incurred, which will augment the cash position of £7.8m at the half-year end.

To read the entire report Please click on the pdf File Below: