Asian and Pacific Rim markets are mostly higher today with shares on the Shanghai Composite outperforming thanks to easing credit crunch fears.

Overnight Wall Street was a bit mixed as corporate earnings are showing some yellow flags. We are seeing more cost cutting and not enough revenue numbers. This is leading some to believe the business environment might not be as robust as we have been led to believe.

The Bank of Japan left monetary policy and rats the same as we had expected. We are now looking at the bank of Thailand’s policy decision which comes out today at 3:30 pm HK. We are expecting them to cut rates even though there is a state of emergency in that country. Rioting against the current regime has brought parts of that country to a halt.

Yesterday, the PBOC injected $42 billion into the markers. This was the first injection since December 2013 and the biggest amount in over a year. This has eased fears of a credit crunch in the world’s second largest economy.

STOCKS

The Dow Jones lost 44.12 points to close the day at 16,414.44 Verizon (NYSE: VZ) lost ground after Q4 results showed a 3.4 percent rise in revenue slightly beating analyst estimates. The S&P 500 gained a little over 5 points to 1,843.84. We are within sight of its record at 1,850.84. The material sector led gains on the day. The Nasdaq Composite rose 28.18 points to end at 4,225.76. This move comes after the tech heavy composite hit a better than 13 year high.

Volume on the NYSE was at 753 million and the composite volume was close to 3.8 billion. For every share that fell 2 rose on the NYSE.

So far in Asia this morning the Shanghai Composite has rallied 1.6 percent. We are now at a two week high above 2,035 as it is extending gains from yesterday. The seven day repo rate has fallen to near 5 percent. This is well off Monday’s 6.3 percent and easing credit crunch concerns. The Nikkei is seeing some profit taking after a one percent rally yesterday. The yen rose after hitting a one week low on Monday. The USD/JPY is trading near 104.74.

The ASX 200 in Sydney continued to fall on disappointing CPI numbers. The chances of the RBA interest rate cut have diminished. The AUD/USD fell even further toward 0.8856 overnight. We are retreating even further from the three and half year low set on Monday.

CURRENCIES

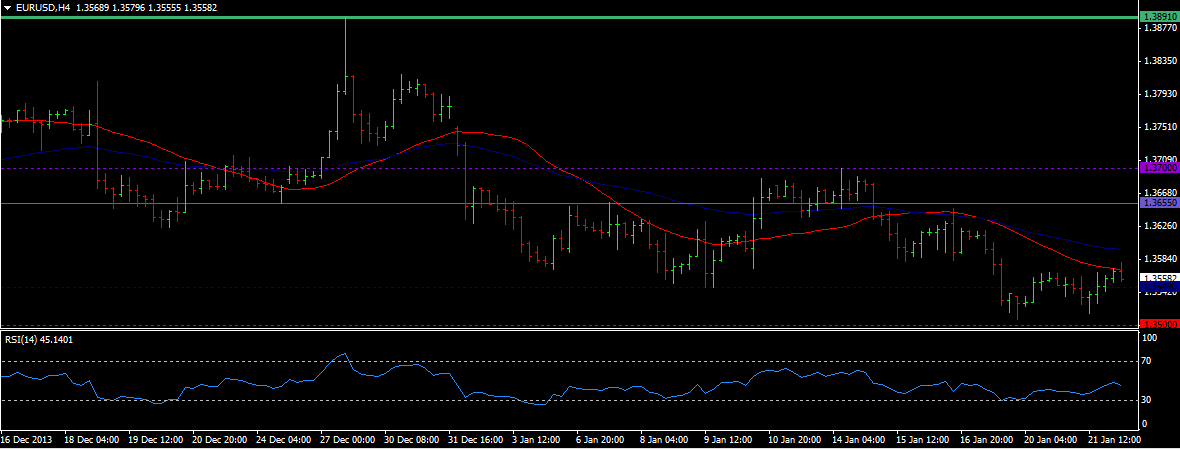

EUR/USD (1.3557) is weakly bouncing from 1.35 and butting heads with resistance at its current level. There is a chance we could touch 1.3620 before falling back. A move move below 1.35 targets 1.3350.

USD/JPY (104.101) has moved higher from 103.66 and could be in the middle of another uptrend. We are now targeting 107 but must go above 105.50 for this to happen. AUD/USD (0.88602) bounced back from support at 0.87 and can stay above 0.89 we can rally to 0.9050.

COMMODITIES

WTI Crude (95.35) has moved up from 94.05 and is testing resistance at its current levels. We are gaining steam from the 91 now and could target 98 then 101 in the medium term. Gold (1242.70) failed at 1258 and is back below 1250. We are still falling from 1750 and need to break above 1280 to bring out the buyers. For now, we can retest 1225 then target 1200. Silver (19.925) failed at 20.30 and retreated. We are range bound for now. A rise above 20.50 brings out the bulls. We have key support at 19 that we need to watch. If it holds, expect a rally.

TODAY’S OUTLOOK

Corporate earnings remain in focus today and will drive the financial markets worldwide. Data is soft today, expect mortgage application at 7:30 EST.