Burger chain Shake Shack Inc (NYSE:SHAK) is down 1.5% at $52.51 in early afternoon trading, with traders bracing for the company's impending fourth-quarter report. With earnings slated for after the market closes on Monday, Feb. 25, below we will dive into what the options market has priced in for SHAK shares' post-earnings moves.

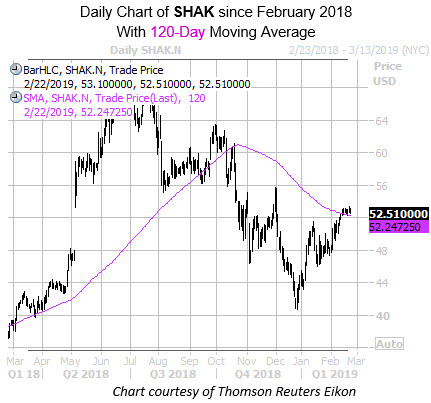

Shake Shack stock has managed to add 41% since hitting its late-December bottom and recently retook its 120-day moving average. The equity is now staring up at the $56 region, which capped its rebound attempt in early December, and prior to that acted as a floor for SHAK.

Looking at the food chain's earnings history, the stock has closed lower the day after six of the last eight reports, including a 13.9% drop in November. Overall, the shares have averaged a 9% swing the day after reporting, regardless of direction. This time around, SHAK options are pricing in a higher 11.6% swing for Tuesday's trading.

Moving on, it appears option buyers are bracing for another earnings disappointment. Shake Shack's 10-day put/call volume ratio at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) stands at 2.46, and ranks in the 91st annual percentile. This suggests puts have been bought to open over calls at a faster-than-usual clip of late. Over this same time frame, the March 50 put has seen a notable increase in open interest -- suggesting buyers expect the stock to travel below $50 by the contract's March 15 expiration.

Meanwhile, short sellers have been piling on, as short interest grew 8.3% during the two most recent reporting periods, and now accounts for 18% of the stock's total available float. At SHAK's average pace of trading, it would take shorts just over one week to buy back their bearish bets.