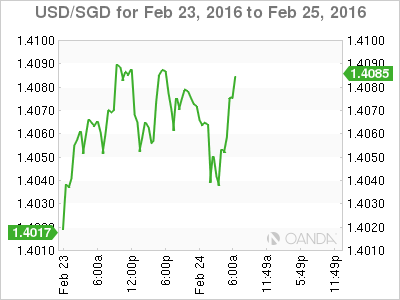

USD/SGD is choppy on Wednesday, as the pair trades at 1.4090 in the European session. In economic news, Singapore GDP posted a gain of 1.8% in the fourth quarter. In the US, today’s key release is New Home Sales. On Thursday, the US releases two key events – Core Durable Goods Orders and Unemployment Claims.

Growth and inflation, the most important factors affecting the economy, are pointing downwards in Singapore. GDP dipped lower in the fourth quarter, with a gain of 1.8%, shy of the estimate of 2.0%. This figure was slightly lower than the third quarter gain of 1.9%. On an annual basis, GDP dropped in 2015 to 2.0%, down sharply from 3.3% in 2014. Meanwhile, CPI the primary gauge of consumer inflation, dropped to .6%, a repeat of the previous release. CPI has now dropped for 15 straight months, prompting the Monetary Authority of Singapore to lower its inflation forecast for 2016. Like developed economies across the globe, Singapore is grappling with weak inflation levels, and the inflation picture has worsened with the collapse in oil prices. Weaker Chinese demand has resulted in softer growth for the tiny island-state, as the Asian giant is Singapore’s largest export market.

The US economy has softened in the early part of 2016, and the American consumer has become less optimistic about the economy as a result. This was underscored by CB Consumer Confidence, which slid to 92.2 points in January, well off the forecast of 97.4 points. This marked a three-month low for the key indicator. Weaker consumer confidence could well translate into a decrease in consumer spending, a key driver of economic growth. Meanwhile, the US manufacturing sector continues to struggle. Recent manufacturing reports have pointed to contraction in the sector, and this was again the case with the Richmond Manufacturing report, which slipped to -4 points in February, short of the forecast of +2 points. This was the indicator’s worst reading since September 2015. On Thursday, we’ll get a look at Core Durable Goods Orders, a key manufacturing indicator. The markets are braced for a small gain of 0.2%, and a reading that misses the estimate could have a sharp impact on the currency markets.

USD/SGD Fundamentals

Wednesday (Feb. 24)

- 9:45 US Flash Services PMI. Estimate 53.4 points

- 10:00 US New Home Sales. Estimate 522K

- 10:00 Singapore GDP. Estimate 2.0%. Actual 1.8%

- 10:30 US Crude Oil Inventories. Estimate 2.0M

- 19:00 US FOMC James Bullard Speaks

Upcoming Key Events

Thursday (Feb. 25)

- 8:30 US Core Durable Goods Orders. Estimate 0.2%

- 8:30 US Unemployment Claims. 271K

*Key events are in bold

*All release times are EST

USD/SGD for Wednesday, February 24, 2016

USD/SGD February 24 at 6:15 EST

Open: 1.4071 Low: 1.4025 High: 1.4090 Close: 1.4084

USD/SGD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3810 | 1.3927 | 1.4016 | 1.4139 | 1.4248 | 1.4368 |

- USD/SGD has been choppy in the Asian and European sessions

- 1.4016 is providing support

- There is resistance at 1.4139

- Current range: 1.4016 to 1.4139

Further levels in both directions:

- Below: 1.4016, 1.3927, 1.3810 and 1.3721

- Above: 1.4139, 1.4248 and 1.4368