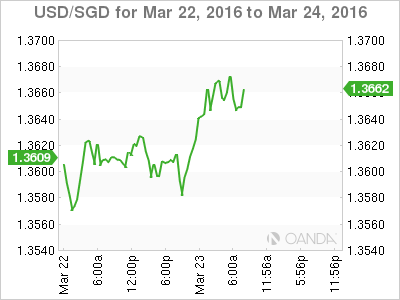

USD/SGD has posted considerable gains on Wednesday, as the pair trades at 1.3650 in the European session. In economic news, the Singapore Consumer Price Index posted a decline of 0.8%. In the US, today’s major event is New Home Sales. We’ll also get a look at the weekly Crude Oil Inventories.

Singapore CPI, the primary gauge of consumer inflation, continues to struggle. The index posted a weak reading of -0.8%, compared to -0.6% in the previous release. The Singapore economy has taken a hit from the Chinese slowdown, as the Asian giant is a major export market for Singapore. In December, a Monetary Authority of Singapore survey projected growth in 2016 of 2.2 percent. However, a poll conducted by economists, which was released last week, downgraded that estimate to 1.9 percent.

The US manufacturing sector has struggled, hurt by the global slowdown which has meant less demand for US-produced goods. Recent manufacturing readings have reflected a sector in deep trouble, so the markets were surprised as the Richmond Manufacturing Index surged in March. The indicator, which measures activity in the US Atlantic region, jumped to 22 points, its highest level since June 2010. The next manufacturing release is the ISM Manufacturing PMI, which will be published on April 1. The index has pointed to contraction for four straight readings, but the markets will be hoping that the superb Richmond Manufacturing Index reading is a harbinger of better news to come from the manufacturing sector.

USD/SGD Fundamentals

Wednesday (March 23)

- 00:00 Singapore Consumer Price Index. Actual -0.8%

- 10:00 US FOMC Member James Bullard Speaks

- 10:00 US New Home Sales. Estimate 512K

- 15:30 US Crude Oil Inventories. Estimate 2.5M

Thursday (March 23)

- 13:30 US Core Durable Goods Orders. Estimate -0.2%

- 13:30 US Unemployment Claims. Estimate 267K

*Key events are in bold

*All release times are DST

USD/SGD for Wednesday, March 23, 2016

USD/SGD March 23 at 7:20 DST

Open: 1.3603 Low: 1.3587 High: 1.3682 Close: 1.3656

USD/SGD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3401 | 1.3535 | 1.3639 | 1.3721 | 1.3810 | 1.3939 |

- 1.3639 has switched to support following gains by USD/SGD on Wednesday. It is a weak line

- There is resistance at 1.3721

- Current range: 1.3639 to 1.3721

Further levels in both directions:

- Below: 1.3639, 1.3535, 1.3401 and 1.3279

- Above: 1.3721, 1.3810 and 1.3939